Well, what a few weeks we’ve had with Britain choosing to exit from just about everything European. Maybe the one major positive we can take is that England were kicked out of the European Championships by Iceland - a non-EU European country. It’s a spurious relationship but if our team spirit improves Icelandically outside of the EU then perhaps we can look forwards to our football team winning again, even if we can’t afford the tickets. Regardless, Brexit negativity has hammered our savings, and we’re all feeling worse off as a result. As we’ll see the New Year NAPS portfolio has not been immune with a considerably worse showing in H1 2016 versus H1 2015.

Before we assess the NAPS, let’s consider the wider market result. Unless you’ve been on another planet in the last few weeks you’ll probably have heard the following, even from the mainstream news outlets:

- Large caps have risen above the level they were at pre-Brexit (FTSE 100)

- Mid and Small Caps have slumped (FTSE 250, FTSE Small Cap)

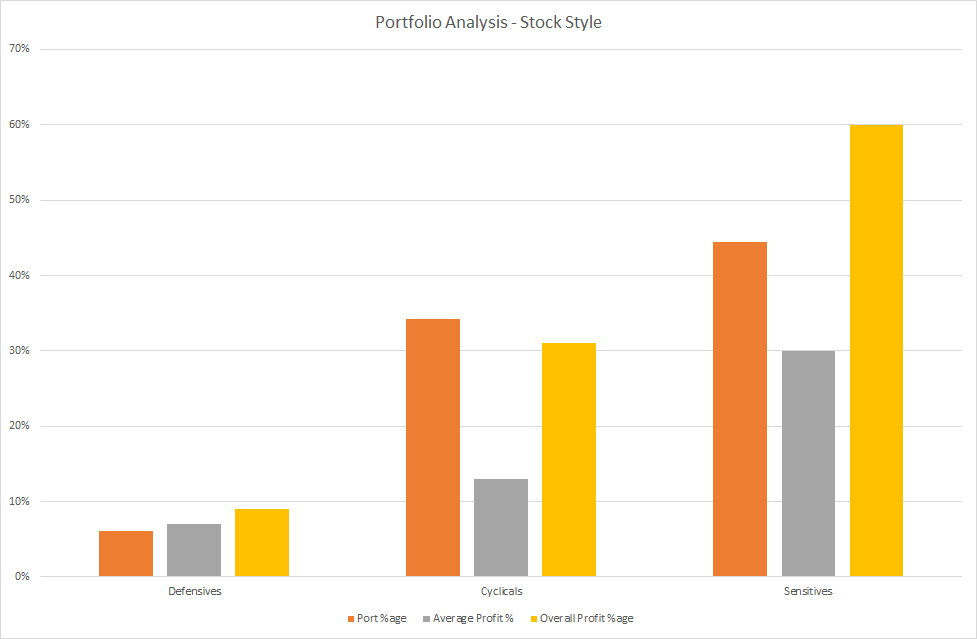

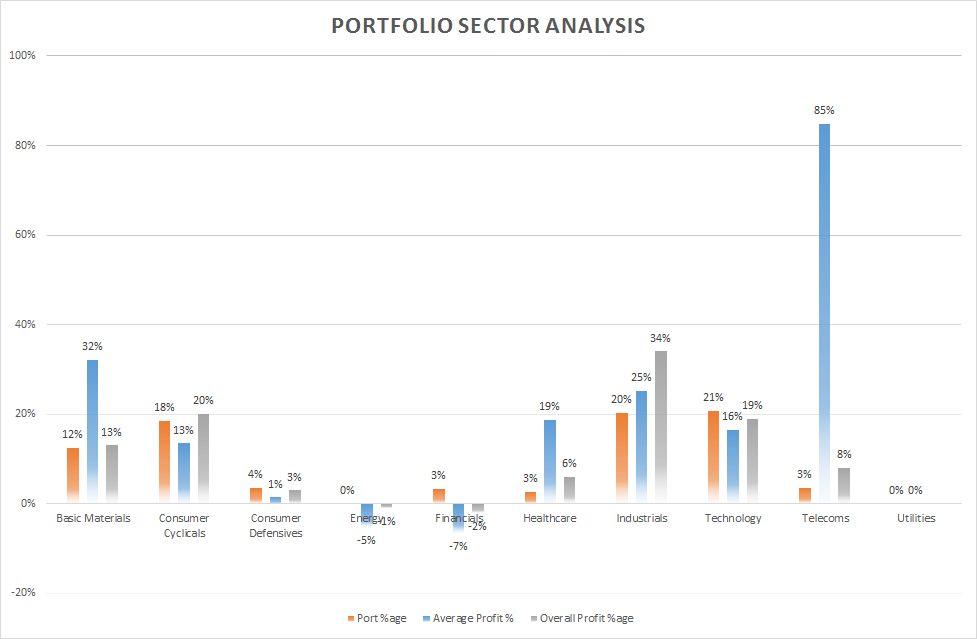

- Cyclical, domestic stocks have been hammered - banks, housebuilders, airlines

- Defensive, foreign earning stocks have risen - e.g. Glaxo, Unilever, Miner

In economic upswings, savvy investors know you want to own small cap cyclical stocks, but in a downswing they underperform which is why the recent cull has been so brutal for many. Markets tend to climb a wall of worry, in a calm fashion, lulling investors into a false sense of security. Novice investors who haven’t lived through downward or bear markets can sometimes be shocked at how fast things move in the other direction when conditions change.

Good diversification always helps soften the blow of these sector and size specific reversals. The plans we’d put in place have helped the NAPS portfolio minimise its losses in a tough environment, but broader market selection and timing ideas could have put the returns year to date in the black. As we’ll be exploring these ideas, this will be a lengthy post - you’ve been warned!

A NAP Refresher

For those that are newbies to the NAPS portfolio, it’s worth a quick refresher. It was designed as a portfolio selection process to avoid discretionary stock picking. Just as pilots and surgeons improve their success rate and reduce catastrophic risk using checklist driven processes, we hoped to do the same. The NAPS put their faith in a rule-based process based around an…