'Shorting the Christmas Retailers'

What a bold headline to make during the season of goodwill to all everyone. I am sure that I will get some thumbs down for just the miserable subject title alone! However my timing is probably perfect. Since it is boxing day I doubt many people will actually bother to read this post. So I may be safe from the howls of the bullish retailer investors who at this time are probably thinking of buying the Christmas/New Year sales; rather than reading this.

But despite being the season of goodwill we must stick to our unemotional plans when investing no matter what the time of the year is. So today I read a very interesting article in The Times Newspaper Business Section. It too had a happy headline called 'Short-sellers betting retailers will disappoint' It seemed quite disappointing to read considering that this is meant to be the best part of the cyclical year for many retailers. So what on earth is the Times doing giving us all this doom and gloom.

Well this shouldn't have come as a big surprise. Even before The Times article I was aware of the profit warning from Game Digital (LON:GMD) (how could anyone miss it), and also Bonmarche Holdings (LON:BON) . In my opinion I wasn't surprised at £GMD as I believe in the digital age of practically buying instant download games, then stores are kinda well old fashioned. Bonmarche Holdings (LON:BON) I am not so sure. I felt the market was over reacted, and the business model is still sound.

But as mentioned in the article, Black Friday, warmer Christmas, slowdown in China the hedge funds have taken notice and in most cases increasing shorting opportunities in all the retailers.

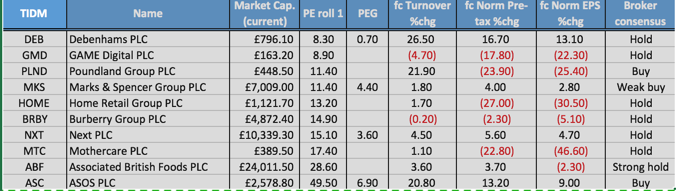

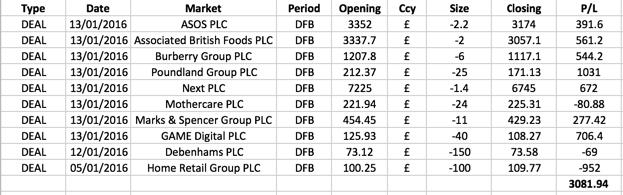

So I wonder how I could jump on the bandwagon and try to make money short selling some of the retailers. But the question that I asked myself was 'Which Ones?' I took the time to build lists and filters checking retailers for High forecasted PE's, low forecasted earnings growth and anything else that would for me anyway knock the price down should the speculated profit warnings become fact.

I decided on this occasion to look at it from a…