I’d like to start thanking the many readers who completed my International SIF survey last week, or left comments sharing their views. I really appreciate your feedback.

Happily, 75% of you were keen for me to continue experimenting with rules-based investing in foreign stocks. However, only 51% thought I should include stocks from all of the markets available on Stockopedia.

About one quarter of you said you’d prefer me to focus only on European and/or US stocks.

The final 25% said they were only interested in UK stocks.

Many of you also took the time to make thoughtful suggestions about how I could make the International SIF folio more relevant. There were several recurring themes, especially around changing the mix of geographic coverage.

I’m now planning some changes as a result of your feedback, and will reveal these with my next portfolio update in September.

Shares Awards: Before I get back to my main UK SIF fund, I’d just like to remind you that there are only a few days left to vote for Stockopedia in this year’s Shares Awards. We’re in categories 15 and 17 -- you can vote here.

Two stocks up for eviction

It’s the end of another month. That means it’s time to review any stocks that have spent nine months or more in the SIF folio, to see if they still qualify for my screen.

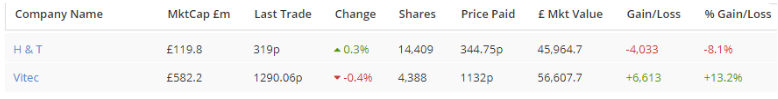

There are two stocks up for review this month:

Vitec Group - this photography and videography equipment firm has had a good run but has slipped back recently. Does this High Flyer still pass all of my tests?

H&T Group - pawnbroker and personal loan group H&T is expanding steadily and delivering a solid 10% return on equity. But the market is out of love with the group, perhaps because of regulatory risks. Should I hold on for a turnaround, or sell at a loss?

Here’s how the two companies have fared during their time in the SIF fantasy fund:

Not exactly record breaking. But not disastrous either. Let’s find out more.

Vitec Group

Original coverage - 01/11/2017

Vitec Group joined the SIF folio in November 2017. This firm makes products such as autocues, tripods, portable power packs and baggage for carrying camera…