One of the hazards of small cap investing is that smaller companies are often more at risk of disruption from single events than larger businesses.

We saw this on Friday when the Character Group share price closed down by 19%. The trigger for this slide appears to have been a £3.3bn bid from US toy giant Hasbro for Peppa Pig brand owner Entertainment One.

I’ll explain why this could be bad news for Character Group later in this report.

As it happens, I was due to take a look at Character anyway this week. It’s the end of the month, which means that companies that have been in SIF for at least nine months are due for review and possible sale. On the list this week are three firms:

Character Group (LON:CCT) - should Character stay in the SIF folio? I’ll explain each side of the argument and take a look at the numbers.

Anglo Pacific (LON:APF) - this mining royalty group has impressed me although I remain concerned by its dependency on one key asset. After a strong set of H1 figures last week, does it still pass my screening tests?

Total SA (LON:TTA) - my bet on French oil and gas giant Total hasn’t paid off (yet). But does this firm still qualify as a hold?

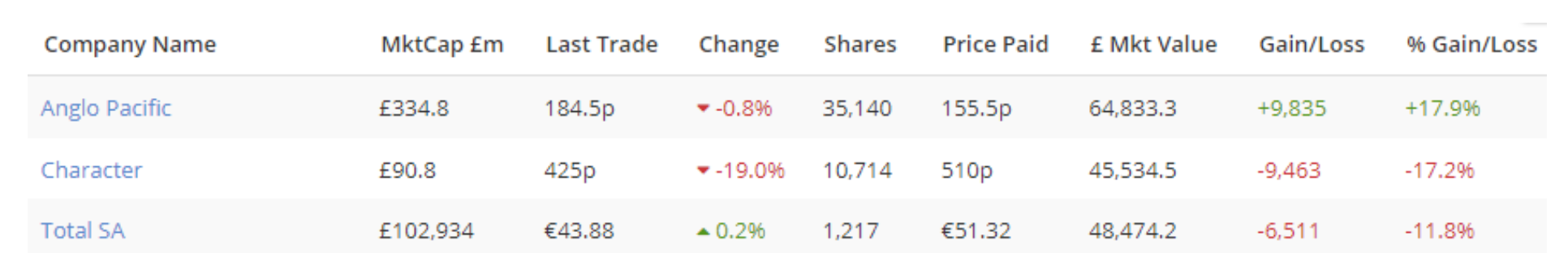

Here’s how these three firms have performed so far during their time in the portfolio:

As you can see, Friday’s fall has wiped out what would have been a modest profit on the Character position.

Let’s take a closer look at each company.

Character Group (LON:CCT)

(Original coverage 13/11/2018)

Entertainment One is the owner of the Peppa Pig brand. For the last fifteen years, Character Group has held the exclusive licence to produce Peppa Pig toys. As you’ll know if you’ve watched children’s television in the last decade, Peppa is massive. Character’s toy ranges have performed very well.

I suspect it’s fair to say that Peppa has given this toy firm a greater scale, profitability and credibility than it might otherwise have enjoyed.

Until Friday, the market had not seriously considered the risk that Character could lose the Peppa contract. After such a long run of good performance, licence renewals had become a foregone conclusion.

But…