I want to become a better seller. I’m sure many of you will agree that choosing the right time to sell a share often seems harder than knowing when to buy it.

Indeed, I’d suggest that having a good strategy for buying but no clear process for selling is a common weakness among investors.

At a portfolio or fund level, there are two ways of making money from stocks. Firstly, you need to buy some winners. But equally importantly, you need to minimise the impact on your portfolio return from the inevitable losers.

Over the last year, I’ve tried to address the second of these requirements by introducing two new rules to the SIF folio:

These rules have already been put to the test, with good effect. After Centamin’s gold mining plans went awry recently, I sold the shares from SIF for a -27.5% loss. At the time of writing, CEY shares are down by more than 50% from my original purchase price.

Note: If you’re interested in understanding more about the statistical evidence supporting my profit warning rule, I’d strongly recommend Stockopedia’s The Profit Warning Survival Guide ebook. This provides excellent statistical evidence on the benefits of getting out quickly when trouble appears.

These new rules mean that my approach to selling losers has evolved considerably from my original approach of only selling after nine months, regardless of any running losses.

However, when it comes to selling profitable holdings, I haven’t really made any changes to my system since I launched SIF in April 2016.

What I do now: At present I sell shares after nine months if they no longer qualify for my SIF screen. This is the screen I use to select shares to buy. If stocks do still qualify for the SIF screen after nine months, then I keep them in the portfolio on a rolling one-month review.

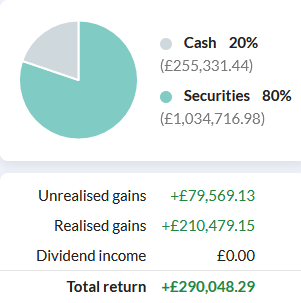

This approach has certainly helped me to lock in some gains in the 4.5 years I’ve been running the portfolio. SIF is currently up by almost 30% (excluding dividends) since its inception in April 2016.

SIF virtual fund at 16 November 2020 (Value at inception: £1m)

Including dividends, SIF is up by more than 40% since inception.

However, using my buying criteria…

.JPG)

.JPG)