African telecoms and mobile money operator Airtel Africa is a stock I’ve been watching as a possible income play for much of the last year. So I’m interested to see this stock now qualifies for my SIF buying screen. In this week’s piece, I plan to take a closer look at this business.

SIF does not currently have any exposure to the telecoms sector. Although this sector has a history of capital destruction, I think the African market in particular is attractive due to the parallel growth of mobile money services.

Airtel Africa (LON:AAF)

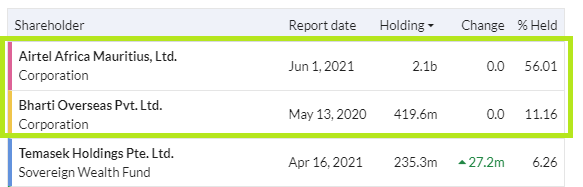

Airtel Africa floated on the London market in June 2019, when it was spun out of Indian group Bharti Airtel. Only 19% of the company’s stock was sold in the IPO and the former parent remains a controlling shareholder, via (I assume) the top two holdings listed in Stockopedia’s shareholder data:

The group operates in 14 countries in Africa, mainly East, Central and West Africa. It’s the second-largest mobile operator in Africa and is first or second by market share in 12 of the countries in which it operates. Nigeria is by far the largest market and generated 40% of revenue and 45% of EBITDA last year.

Customer numbers across the group rose by 6.9% to 118.2m during the year to 31 March, while the number of data customers rose by 14.5% to 40.6m. The number of active mobile money users rose by 18.5% to 21.7m.

These metrics translated into a pre-tax profit of $697m, 16.7% higher than in FY20.

I think that the big stories here are the growth potential of the African market and the value of the mobile money business. The other attraction, in my view, is that the company isn’t burdened with legacy assets and regulatory obligations (BT) or sluggish mature markets (BT and Vodafone).

In the short term, my main concerns are corporate governance and political stability in Africa, especially Nigeria. Longer term, what worries me is that Airtel could become too much like Vodafone.

However, that’s all for the future. Right now, what matters for me is to understand how Airtel Africa’s numbers shape up against my SIF buying rules.

The initial omens are promising. Airtel scores a StockRank of 96 and Super Stock status.

As usual, what…