Everyone’s a stock-picking rockstar in a bull market. It feels a bit like that to me at the moment. SIF is hitting new record highs and shares seem to keep rising for no particular reason.

Of course, what goes up often comes down. As I’ve mentioned before, I’m a little wary about valuations right now. The reason for this is that the main share-buying screen I use for the SIF folio is not finding any stocks that satisfy my affordable growth criteria.

At the time of writing just one share is qualifying - gold miner Polymetal International. This FTSE 100 stock is an existing SIF holding, so I’ve had to broaden my criteria to find a suitable subject for this week’s piece.

As I’ve mentioned previously, widespread disruption to dividend payments last year means that many stocks fall foul of my rules on dividend yield and growth. By suspending my dividend rules I can identify more potential buys. One such company is my subject this week.

A small-cap Super Stock?

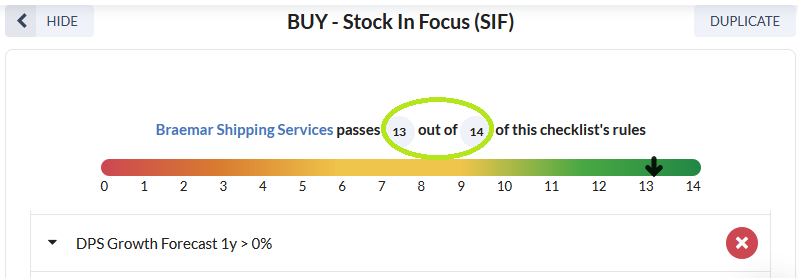

This week I’m going to look at another turnaround situation, small cap Braemar Shipping Services (LON:BMS). This is a stock I’ve owned personally in the past, and have followed intermittently.

Recent newsflow has given me the impression that the worst is finally over for Braemar, after a painful (for shareholders) six-year decline:

The group’s turnaround appears to be coming good under chairman Ron Series, who is also known to UK small-cap investors from his successful turnaround at logistics specialist DX Group.

Although revenue was flat during the first half of the current financial year (which ends on 29 Feb), Braemar’s underlying operating profit rose by 33% to £5.6m during the period.

The recovery was driven by a strong performance from the group’s core shipbroking business. This division generated 70% of revenue and 80% of underlying profit during the year, with an attractive 15% operating margin.

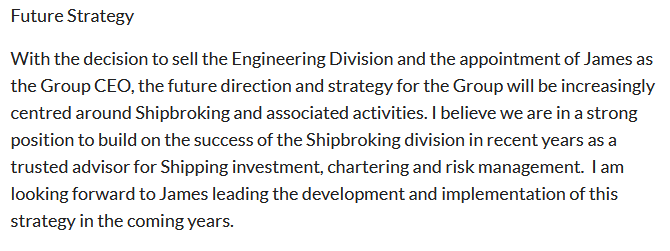

The head of Braemar’s shipbroking business, James Gundy, has recently been appointed group CEO. He’ll retain responsibility for shipbroking, underlining the company’s intention to focus on this area of business:

Braemar Shipping’s share price has doubled from the lows seen in March last year, but the stock still appears to be reasonably…