It’s the last week of January, which means that it’s time for the regular monthly review of my systematic SIF folio. There’s a lot to get through this week, so I’ll cut the preamble and get straight into the stock reviews.

As per my newish selling rules, I will be checking stocks held for nine months or longer to see if they qualify for my selling screen. If a stock passes all the rules, then I can continue to hold the stock for another month. If there are any failures, then it’s out.

I’ve rolled over quite a few stocks in recent months. This means that there are five shares to consider this week:

Used car supermarket chain Motorpoint Group (LON:MOTR)

Construction and infrastructure firm Morgan Sindall Group (LON:MGNS)

FTSE 100 high yielder British American Tobacco (LON:BATS)

German commercial property firm Sirius Real Estate (LON:SRE)

Defence giant BAE Systems (LON:BA)

Note: I must emphasise that the trading decisions I make here are taken in the context of the rules I use to run the (virtual) SIF folio, plus a subset of my personal portfolio.

My decisions are not tips or advice. They won’t necessarily make sense for other strategies. As I’ve said many times before, SIF is an ongoing experiment. Please DYOR.

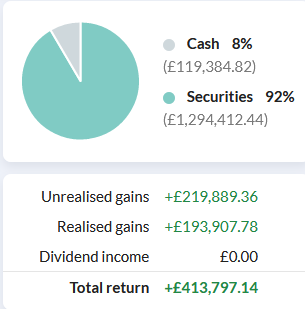

SIF Folio: January performance

The SIF folio (blue line) has delivered a satisfactory 5% gain since my last monthly review in December, narrowly beating its FTSE All-Share Index benchmark:

(Return on £1m virtual fund since inception April 2016. Dividend income is logged elsewhere to monitor true total returns)

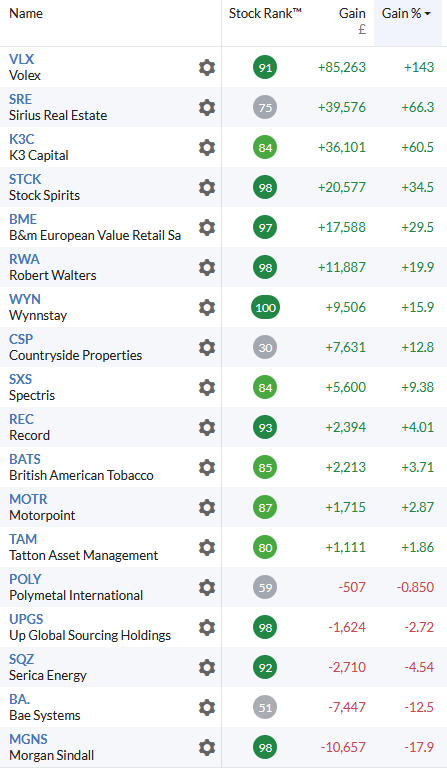

Here’s how the portfolio’s holdings look as of 25 January 2021:

Motorpoint Group (LON:MOTR)

I’m a long-term fan of this used car supermarket group, which generated a return on equity of 65% last year and benefits from strong insider ownership.

The business appears to have adapted well to online selling, with more than 40% of cars sold this way between April and September last year.

I covered the Motorpoint’s interim results in November, so you can look back for more detail on recent trading.

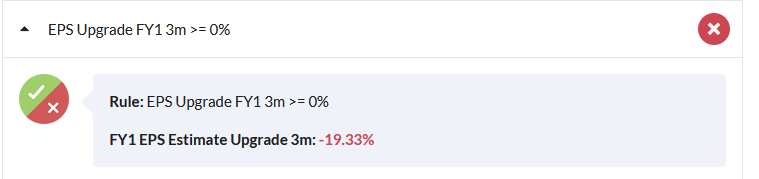

Right now, this stock passes all of my screening rules with one exception:

However, as I explained