Despite initial fears of widespread rental defaults, listed commercial property landlords fared relatively well during the pandemic. Only those that were over-leveraged to start with have had serious problems.

Industrial and logistics property has performed best, as tenants have been less affected by the pandemic and in many cases have seen increased demand. The company I’m going to look at today holds 67% of its assets by value in industrial and warehouse property, with the remainder in office and retail units.

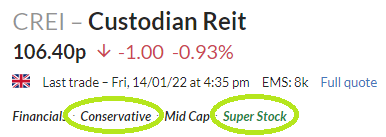

Custodian REIT (LON:CREI) is a recent addition to my buying screen that I’ve not considered before. Founded in 2014, it’s a mid-sized operator with a market cap of £470m and a Main Market listing.

Interestingly, this business comes out of the same stable as AIM-listed asset manager Mattioli Woods (LON:MTW) - Custodian’s investment manager is Custodian Capital, which is owned by Mattioli Woods. The AIM firm also has a 4.8% direct stake in Custodian REIT. As Ian Mattioli still owns 7% of Mattioli Woods, I think this gives Custodian REIT a degree of owner management. That’s no bad thing, in my view.

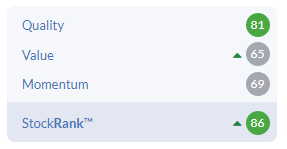

Stockopedia’s algorithms seem to like the stock too. It’s one of a handful of Super Stocks in the REITs sector at the moment and appears to have an attractive profile:

Should I add Custodian REIT to my rules-based SIF portfolio? Let’s start with a brief look at the company’s assets and recent trading. What’s on offer here?

Custodian REIT: a regional landlord

Custodian REIT’s portfolio is spread across the UK regions and largely avoids London. The latest interim results show more than 60% of rental income comes from industrial or retail warehouse property, with the remainder from a mix of other commercial types:

Recent trading has been strong enough for the company to schedule a 10% dividend increase for the final quarter of 2021. Custodian has benefited from “hardening yields in the industrial and logistics sector” and says the valuation of its portfolio rose by £32.3m to £565.3m during the half year to 30 September.

Rent collection rates rose to 95% during the six-month period, compared to 91% for the year to 31 March and…