As I write this on Monday, the market is falling as investors price in another lockdown. But who knows. Perhaps we’ll have a circuit breaker instead. And maybe Chancellor ‘Dishi’ Rishi Sunak will decide to extend the furlough scheme.

The pandemic has brought these words into everyday use in contexts that none of us have ever known before.

It’s been a similar story for the hospitality industry, and for those companies which service it. Who could have imagined that almost every pub and restaurant in the UK would close for three months? I don’t think any of us would, before February.

These closures have shone a harsh light on the defensive qualities of many firms in the food and drink sector. Previously, we could gloss over the exact mix of sales channels which generated a company’s revenue. Supermarkets or restaurants - it didn’t always matter too much. Now, this mix has become much more important.

My rules-based SIF folio currently has two companies which sell food and drink:

Stock Spirits: Eastern Europe-focused drinks producer (see my review last week)

Finsbury Food - Bread and cake producer

Both firms generate the majority of their revenue (85% and 80% respectively) from retail channels. The remainder comes from foodservice - bars, cafes and restaurants.

This revenue mix was one of the reasons why I decided to add Stock Spirits to the portfolio last week.

But with Finsbury Food, it was more a question of dumb luck. When I added Finsbury to SIF in January, I didn’t have any idea what would happen next.

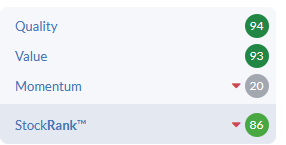

I still don’t. But we do have some new information - Finsbury Food has published its preliminary results for the year to 27 June. This week, I’m going to take a closer look at these numbers and consider how they might affect this highly-ranked firm’s QVM metrics.

Finsbury Food (LON: FIF) - “resilient”

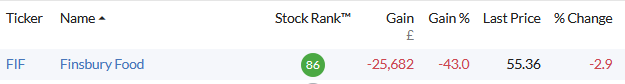

Buying shares in January was generally a poor trade. Finsbury is no exception and SIF’s holding is down by 43% at the time of writing:

However, my feeling since March has been that this firm’s dismal valuation is a little harsh. Stockopedia’s algorithms seem to share this view. Ahead of Monday’s results they awarded Finsbury a StockRank of 86 and Contrarian status -- a winning style,…