My Stock in Focus screen has not provided any new candidates for the SIF fund for four weeks. The good news is that despite this, I do have a new stock to consider this week.

For some time, I’ve believed that brickmakers could be a better way to profit from strong demand for UK housing than politically-exposed housebuilders. So I’m interested to learn more about one of the smaller listed players in this sector, AIM-listed firm Michelmersh Brick Holdings (LON:MBH).

But before I get started on this, I should explain how I’ve come to consider a stock that doesn’t qualify for the SIF fund’s stock screen.

A Jim Slater technique

When my main screen hasn’t provided any new stocks for at least four weeks, my rules allow me to switch to a ‘relaxed’ version of this screen.

My inspiration for doing this came from the late Jim Slater, who was known to relax his valuation criteria in strong markets in order to avoid missing out on good buying opportunities. You can my original discussion of this here.

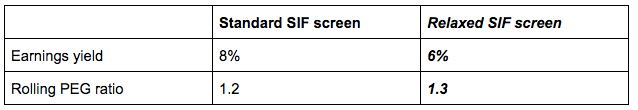

The short version is that I relax my screening requirements by easing two of my valuation criteria, earnings yield and the price/earnings growth (PEG) ratio:

You can see the full relaxed screen here.

I’m sure you’ll agree that these aren’t massive changes. But in the current market, they’re enough to increase my screen’s results from three stocks to seven. Better still, this expanded selection includes two stocks which are eligible for the fund.

The higher-ranked of these two is brickmaker Michelmersh, so this is the business I’m going to consider this week.

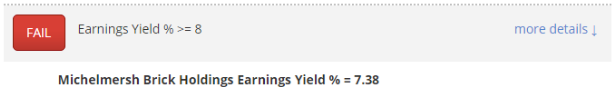

This stock actually passes all but one of my standard screening rules. The only near miss is that the firm’s earnings yield is currently 7.4%, just below my 8% minimum.

Bricks are in short supply

Michelmersh’s corporate tag line is “Britain’s Brick Specialists”. The firm operates at the upper end of the market, with a range of premium brands including Charnwood, Carlton and Blockleys.

These distinctive bricks are used on residential, commercial and public sector developments, but the company’s 2018 output of 106m bricks means its market share is less than 5%. So it’s something of a niche business.

Interestingly,…