Another week, another second chance. Last week Carr’s Group rejoined the SIF folio and I explained why I’m hoping for a better result this time.

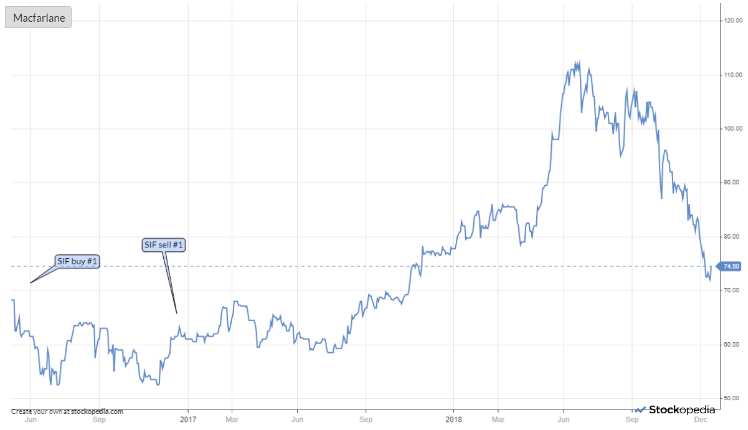

This week, another stock has reappeared in my screening results. Packaging firm Macfarlane (LON:MACF) was a SIF stock from May - November 2016. It wasn’t an especially successful trade, closing with a 10% loss. But as I commented at the time, the company did deliver “a solid operating performance” during the period.

Macfarlane shares went on to double bag between November 2016 and June this year. But the firm’s share price has since fallen by 35% to 75p from this summer’s 52-week high of 114p.

At this level the shares look quite reasonably priced to me, so I’m keen to see if they qualify for a repeat investment.

How I selected this stock

I know that a number of you like to follow my screening results. So I’ll start with a quick word about how I selected Macfarlane, even though it’s not the highest-ranked new stock in my SIF screen results:

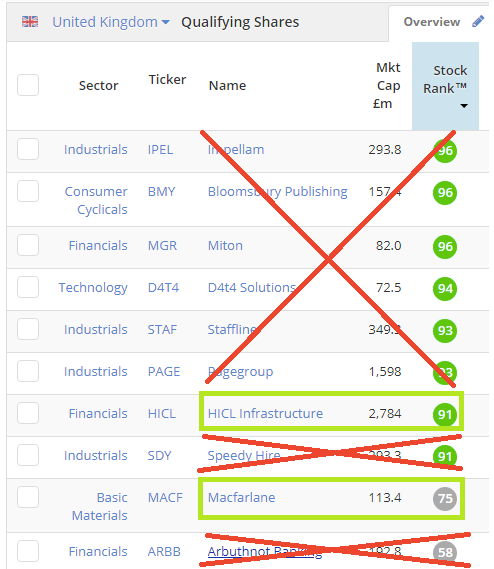

I’ve crossed out in red all of the companies that are already in the portfolio, or which duplicate those which are. That left two choices:

FTSE 250 infrastructure investment company HICL Infrastructure (LON:HICL)

Small-cap packaging group Macfarlane (LON:MACF)

I was tempted by HICL, as this is a stock I quite like from an income point of view. This group owns stakes in a wide range of infrastructure investments in developed markets around the world.

HICL doesn’t specifically invest in renewables. But it is run by the same investment manager (InfraRed Capital Partners) as portfolio holding The Renewables Infrastructure Group. I also felt that there was some potential overlap with Costain and Sirius Real Estate, both of which are already in the portfolio.

On balance, I decided that packaging firm Macfarlane might be a better choice in terms of diversification.

An under-appreciated business?

It’s not just Macfarlane that’s been falling recently in the packaging sector. I’ve noticed that peers of all sizes have taken a battering. FTSE 100 firms Mondi and DS Smith have also fallen heavily in recent months.

I guess these businesses do carry a…

.JPG)