I suspect March is a month that none of us will forget in a hurry. I know I won’t. I hope you’re all as safe and well as possible in these difficult circumstances.

For my rules-based SIF fantasy fund, March has been a very interesting time. As it’s now the last week of the month, it’s time for my usual month-end review.

However, for various reasons the format will be a little different to usual. There are three areas I want to cover this week:

Portfolio performance review

My plan for selling stocks

Buying activity and further plans for SIF

SIF performance review

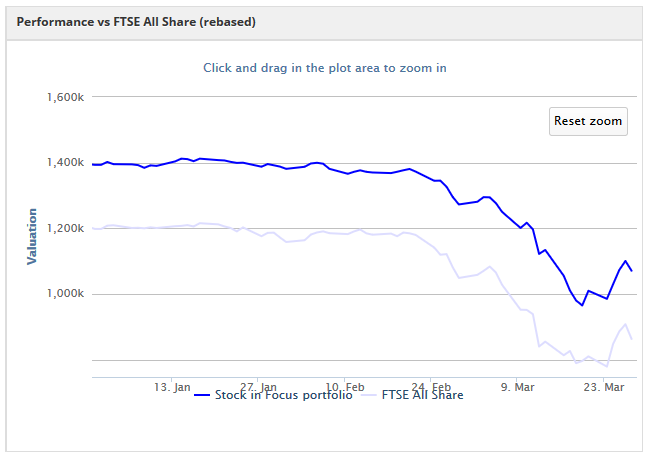

Just as a rising tide lifts all ships, a true stock market crash will hit most stocks. The SIF folio has broadly tracked the market fall over the last month, but has delivered an encouraging rebound over the last week:

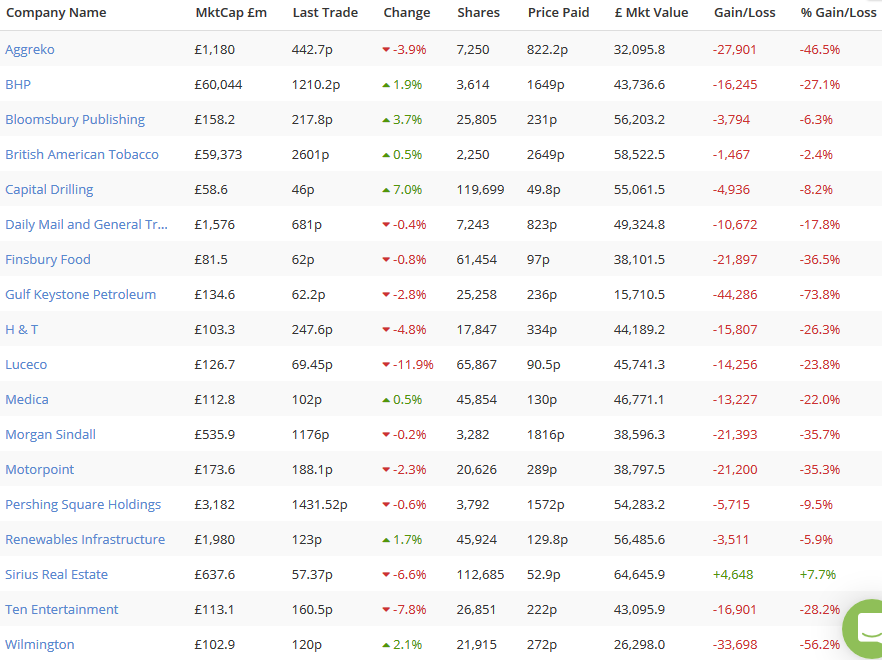

Of course, many of the folio’s holdings are deep in the red:

Still, things could be worse. So far, none of the companies in the folio appear to be in any immediate risk of financial distress.

Although bowling alley operator Ten Entertainment raised £5m through a placing last week, I don’t see this as a concern. The cash was described as a precaution to bolster existing liquidity of c.£25m. That seems fair to me. The new shares were sold without any further discount to the market price and the company has pledged to return the cash if it’s not needed.

Dividend carnage: The unprecedented uncertainty facing companies has prompted many to draw down unused lending facilities and suspend their dividends. In some cases, even payouts that have gone ex-dividend have been cancelled.

I don’t have a problem with this cautious attitude. If the economy recovers more quickly than expected, then dividends can be resumed sooner. In any case, I’d expect at least some of these payouts to be reinstated within 18 months.

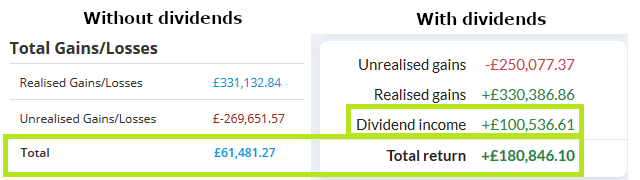

However, now seems a good time to highlight the significant boost dividends have provided to the SIF folio’s returns since 2016:

Including dividend income, the total return since April 2016 is 18%.

Excluding dividends, the total return at the time of writing is about 6%.

Of course, we’re now seeing dividend cuts on a scale…