This week I’m looking at copper, zinc and lead producer Central Asia Metals. This AIM-listed stock has appeared in my stock screen as a potential buy for my rules-based SIF folio.

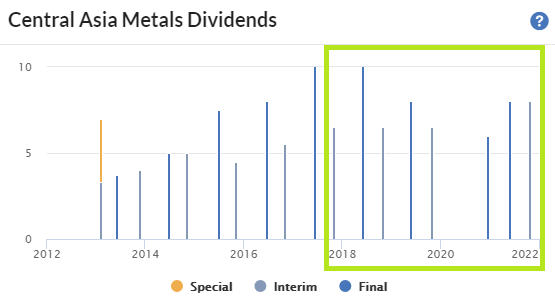

This company owns and operates sites in Kazakhstan and North Macedonia. But it’s a UK-based business that’s been listed since 2010 and has solid institutional ownership. CAML has also paid regular dividends since 2013. It’s a stock I’m happy to consider for SIF.

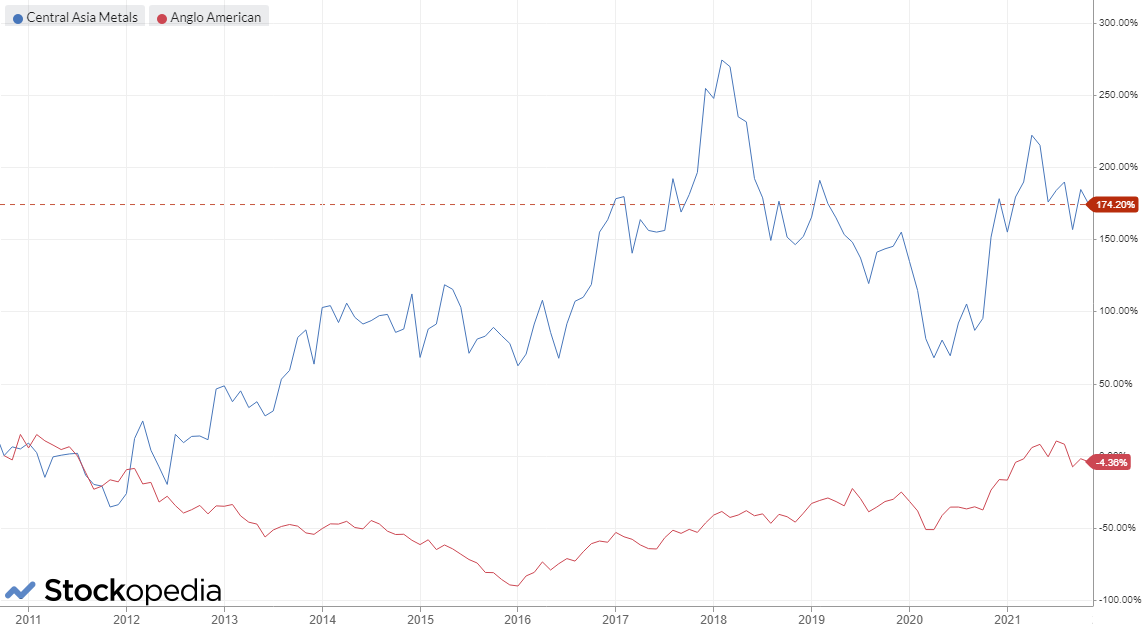

Indeed, I have held CAML in SIF previously, back in 2016/17. You can read my sale review on the stock from September 2017 here.

The shares are now trading slightly ahead of the level at which I sold previously:

CAML stock has also provided a total dividend return of 25% since the end of September 2017:

Overall, I don’t think this has been a bad stock to hold over the last five years.

A low-cost European miner

Central Asia Metal is a profitable and cash generative producer of base metals. Its core business is a copper recovery plant at the former Kounrad mine site near Balkhash, in central Kazakhstan. This facility produces copper cathode from waste dump material that accumulated during open-cast mine operations from 1936 until 2005.

CAML’s Kounrad business has proved to be a low-cost and successful producer of copper. The company estimates that 140,000 tonnes of recoverable copper remain. That’s just over 10 years’ production at current rates.

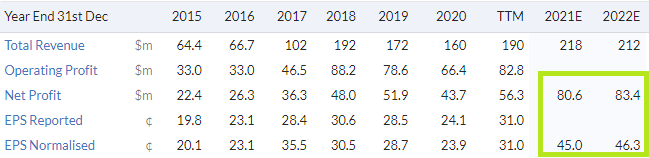

Profits are expected to hit record highs this year:

This is due to the price of copper, which has surged higher since the start of the pandemic:

Source: IG

Group revenue rose by 41% to $106m during the first half of the year, while pre-tax profit rose by 72% to $42m. Free cash flow for the period doubled to $48.9m. This funded a further $20m reduction in net debt, which fell to just $10m.

These are excellent numbers, in my view. But most miners are doing well at the moment. If demand for copper eases, CAML’s profits could fall fast. Given this risk, why am I willing to consider buying CAML stock at what might prove to be a market peak?

One answer to this question is simply that CAML shares…