The never-ending quest for online eyeballs means that there’s sometimes a temptation to favour popular stocks when writing this weekly column.

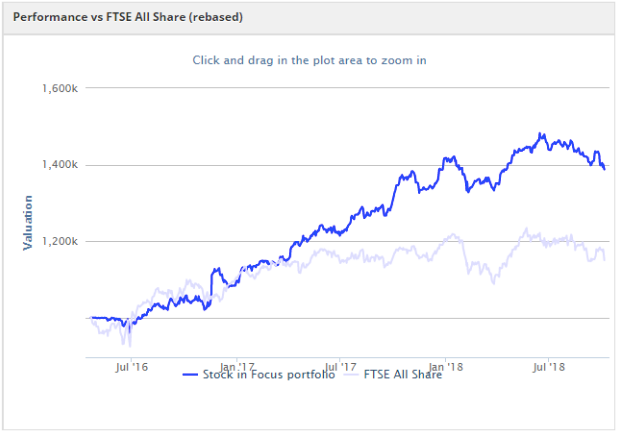

It’s a temptation I do my best to resist. My focus is on analysing and writing about the stocks highlighted by the rules in my Stock in Focus screen. By ignoring sentiment and rigidly following my system, I hope to extend the folio’s track record of market-beating performance.

Despite this resolve, it’s clear that last week’s stock - small cap recruitment group Staffline - wasn’t a particularly popular choice, despite regular coverage by Paul Scott and Graham Neary.

I’m afraid I may be about to drop another clanger this week.

For several weeks, my screen has persistently flagged up investment group Renewables Infrastructure. I’ve now decided that it’s time to take a closer look at this financial-cum-energy business.

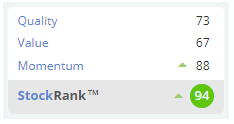

With a StockRank of 94 and a StockRank Style of Super Stock, at least Stockopedia’s algorithms are on my side.

Should this stock be finding more love among private investors? Or will it prove to be fully priced and about as profitable as a wind turbine on a still day?

What you need to know

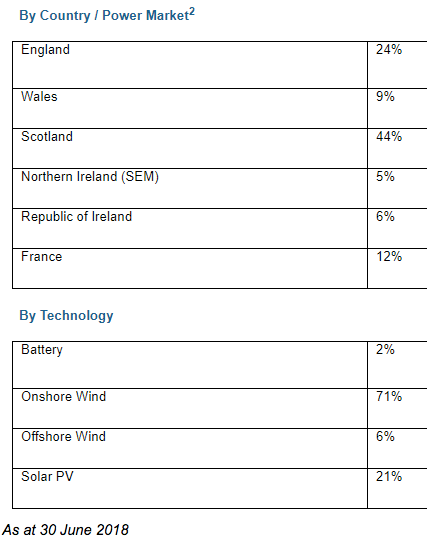

The Renewables Infrastructure Group (TRIG) is an investment trust that owns a portfolio of investments in renewable energy project companies. The majority of the firm’s investments are in UK onshore wind. However, it is diversifying, as you can see from this portfolio breakdown, which I’ve taken from the group’s half-year results:

TRIG floated in 2013 and is currently a FTSE 250 member, with a market cap of about £1.2bn.

The group’s modus operandi is generally to raise cash by issuing new equity at group level to finances acquisitions. Short-term finance may be used, but this is normally repaid within a year.

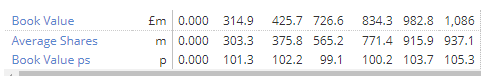

Non-recourse debt is used at project level, subject to a 50% limit on gearing. What this equity-led approach means is that net asset value per share is fairly stable. Returns come mostly from income.

According to the firm, total shareholder return since flotation has averaged 7.7% per year. The vast majority of this has been income as the dividend yield has mostly hovered between 5.5% and 6%. Net asset value (NAV) has risen from…