I’m writing this on Monday 9 March. Earlier today I saw the price of oil fall 20% and the FTSE 100 open below 6,000 for the first time since February 2016.

Today’s fall has left the FTSE 100 down by 20% so far this year. Already, the coronavirus outbreak has led to the biggest market correction since I launched my rules-based SIF fund. So far, we’re not at 2008 levels of distress, but there’s no doubt this is a serious situation.

Sticking to the rules

Here at Stockopedia, we talk a lot about the importance of overcoming behavioural traits such as overconfidence, loss aversion and recency bias. When times are good, it’s easy to claim mastery over these academic concepts. But when the going gets tough, it gets much harder. As the saying goes, everyone’s a hero in a bull market.

One way to stay disciplined is by running your investment portfolio using a set of rules, rather than subjective judgements.

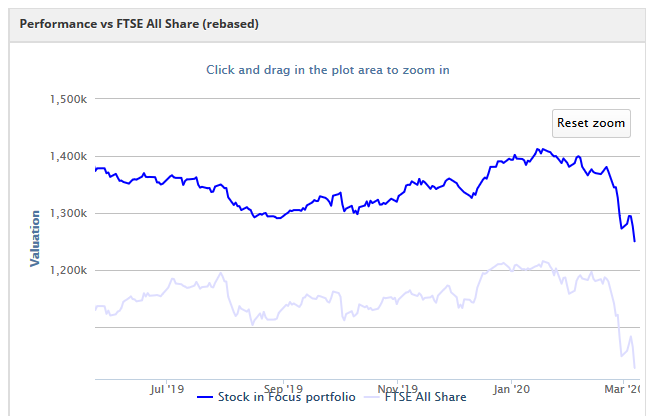

Stockopedia founder Ed Croft has done this since 2015 with the NAPS Portfolio. And I’ve been doing a similar thing since April 2016 with my Stock in Focus fund (archive here). Both portfolios have outperformed the market since their inception.

Naturally, the SIF folio has suffered in the sell-off we’ve seen over the last month. That’s to be expected. When the whole market falls, your portfolio does too. I’m not really too concerned about this.

The only thing that I am watching is for signs that any of the companies I own might be in danger of lasting damage. Among the biggest losers so far are those companies with links to the oil market. The price of a barrel of Brent crude fell by about 20% to $36 on Monday. This is likely to hit three portfolio stocks - Aggreko, BHP and Gulf Keystone Petroleum. Should I be worried? Let’s take a brief look at each.

Aggreko: I suspect the oil price crash will lead to a renewed crackdown on spending by oil producers. This wouldn’t be good news for generator hire firm Aggreko. The group already faces the risk that major event contracts such as the Tokyo Olympics could be cancelled this year. However, the firm’s recent results showed improved profitability, decent cash generation and a reduction in leverage.…