My SIF fund is in limbo land again. The SIF screening results contain just four stocks, three of which are already in the portfolio. This is a phenomenon that always follows a sharp market sell off, such as we saw during the final quarter of 2018.

You might wonder why my screening results have dried up when so many decent stocks are cheaper now than they’ve been for a while. The reason is momentum -- specifically my requirement for shares to have positive relative strength:

Disabling the RS 1y rule increase the pool of shares on offer from four to 14. It’s tempting, especially as there are several names on the list I’d be quite happy to own.

However, the SIF’s standard holding period is just nine months. After this time, stocks must continue to pass my screening rules if they are to stay in the portfolio. This relatively short-term approach means I can’t afford to carry stocks with negative momentum. It could take much too long for them to bottom out and turnaround, even if they are good businesses.

Luckily, this isn’t a buying week. It’s the last week of the month, so it’s time for my monthly review of shares that have been in the portfolio for nine months or more.

A good month for SIF

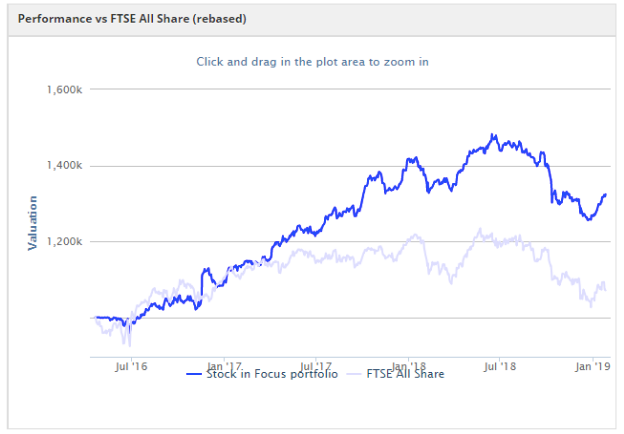

The start of 2019 has delivered a welcome rebound for the SIF folio, which has regained some of the ground lost during the second half of last year:

Although SIF is still down over the last year, the portfolio has bounded back faster than the wider market. At the end of December it was just 2.3% ahead of the benchmark All-Share index on a one-year timeframe. Today the gap has widened to 5.7%. Let’s hope this progress can be maintained.

The companies due for review this month are both down by 20%-25% from highs seen earlier during their time in the portfolio.

Although this might seem like a missed opportunity, I don’t see it that way. Nothing has gone wrong with either firm as an investment, which gives me confidence in my stock selection process. Short-term share price movements are outside my control and can be a bit of a lottery, so I don’t worry too much about them.

…