The end of the month is normally a bit of a relief. Carrying out my monthly SIF portfolio review means that I don’t need to find an interesting new stock to write about. Instead, I’m able to review the folio’s performance and revisit some familiar stocks to see how they’re doing.

I think there’s also a psychological trait at work here. There’s a part of me that’s always keen to take profits on successful positions, even if logic suggests they should be held. Fortunately, my rules prevent such emotional responses. And as I discussed in my stop-loss piece last week, I’m taking steps to try and eliminate losers more effectively so as to maximise the benefit from successful positions.

Incidentally, last week’s piece attracted many excellent comments - thank you for your contributions, I do read them all.

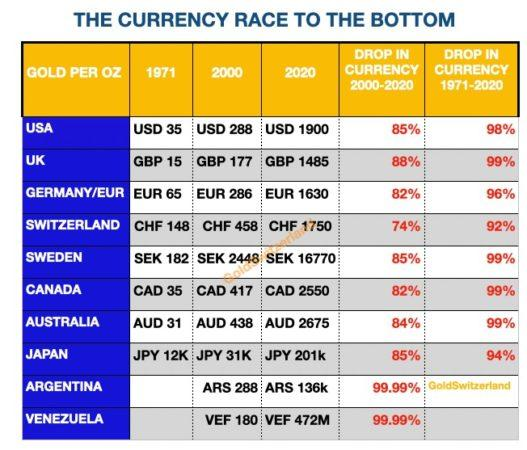

This month doesn’t feel quite as relaxed as usual. I’m blaming this on the gold price, which hit a record high of more than $1,900/oz at the end of last week. The SIF Folio includes two stocks with exposure to gold, so naturally my instinct is that it’s time to sell them. However, as we’ll see, my rules suggest otherwise.

The case for selling seems logical enough to me. The last time gold rose above $1,800 was in 2011, during the previous gold investment boom. You may remember that this coincided with the eurozone crisis.

But despite the existential threat to the EU, the gold price soon started to fall as investors remembered that it’s an unproductive asset that never grows or generates any income (tin hat on).

Source: IG Index

For a gold cynic like me, what we’re seeing now is likely to be a repeat of the 2011 boom. I see that gold is now overbought on RSI for the first time since 2011. However, even if I’m right, there’s no way to predict when the gold price might start to head south.

In any case, momentum is a powerful force. Gold bugs have done very well this year and concerns about the medium-term impact of COVID-19 remain high. As Ed commented in his latest SNAPS review, “there could be a long way to run in precious metal stocks yet”.

SIF folio review

The portfolio currently contains three shares that have been in SIF for at least nine months,…