This year has forced most of us to accept massive drawdowns in the valuations of our stock portfolios. Although some of these losses have now been reversed, I feel that we’re currently in a holding pattern. Until we see how the COVID-19 pandemic evolves and how much damage has been done to the real economy, it’s hard to know where the market might go next.

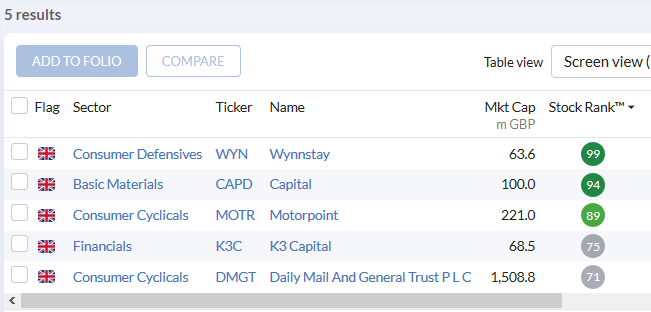

There are no new stocks for me to consider in my Stock in Focus (SIF) screen results this week. All five of the companies that qualify for the screen are already in the portfolio:

Instead, I’ve decided to grasp the thorny topic of how to limit my losses on losing positions in my rules-based SIF portfolio.

During the stock market crash earlier this year, I suspended my usual rules on selling and allowed positions to run. I saw no point in selling anything when the market was pricing in armageddon.

That moment has passed and I returned to business as usual in May. But I’m painfully aware of the adage that we should look after the losers and let the winners look after themselves. Have I accepted drawdowns on individual stocks too readily in the past?

The story so far

When I launched the portfolio in April 2016, I didn’t have any rules for selling other than at the end of a predefined holding period.

In April 2019 I modified my rules to add a requirement to sell any stock that issued a profit warning. Stockopedia’s excellent Profit Warning Survival Guide makes it clear that the weight of statistical evidence supports a quick exit from stocks which warn on profits. This reflects my own experiences, too. As Warren Buffett says, there’s rarely just one cockroach in the kitchen.

In 2019, I dismissed the idea of adding a stop-loss rule to sell on price action alone. I’ve always been against stop-losses, for two reasons:

Personal experience - when I’ve tried to use stop-losses, I’ve usually found that they’re triggered too easily or not soon enough.

Although the SIF Folio is a fairly short-term portfolio (typical holding nine months), most of my personal investments are over much longer periods. Selling based on price action alone doesn’t make sense for long-term investments, in my opinion.

I think that it’s fair to say my…