As it’s the last working week of May, it’s time for my monthly review of stocks that have been in SIF for at least nine months.

This month there are two stocks under consideration, including Nat Rothschild vehicle Volex, which has already been a double bagger for SIF:

- Volex (LON:VLX) - this cabling manufacturer is starting to generate significant revenues from electric vehicles, in addition to its more established activities. The valuation doesn’t look outrageous to me.

- Tatton Asset Management (LON:TAM) - the firm’s platform provides a range of services to financial advisers. Trading has been strong through the pandemic and so far there’s no evidence of any slowdown.

I’ll look at each of these in more detail in a moment. But let’s start with a look at the performance of the portfolio over the last month.

SIF Folio: May performance

It’s been a relatively quiet month so far for UK equity markets. Both SIF and its benchmark the FTSE All-Share have eked out a 1% gain since my last review:

(SIF = blue line)

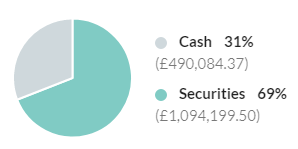

I’ve added two stocks and sold one over the last month. This means the cash weighting of my virtual portfolio remains high, at 31%:

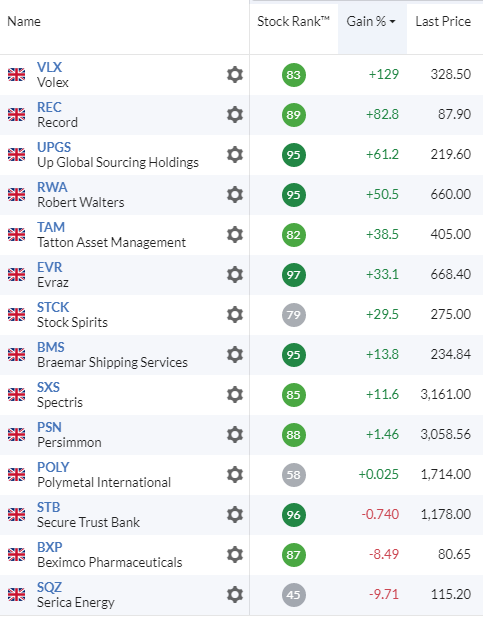

Finally, here’s a full list of the portfolio’s holdings on 24 May 2021, before any transactions that might result from this review:

Let’s move on to the individual stock reviews.

Volex (LON:VLX)

Volex makes power cords and electrical wiring assemblies used in consumer electronics, data centres, electric cars and other applications. This stock has been one of SIF’s best ever performers, rising by around 130% in just nine months.

When I added Volex to SIF in August last year, I noted that although the company’s market share was only 7%, it was one of the top two suppliers in the market. This suggested to me that it is quite a fragmented market, potentially ripe for consolidation.

Consolidation certainly seems to be part of executive chairman Nat Rothschild’s vision for this business, in which he has a near-25% holding. Volex has reported six acquisitions in just over three years, the latest of which was a sizeable €62m deal last November.

Unfortunately, Volex does not seem to split out the contribution from acquisitions in its reporting.…