I have a new stock to consider for the portfolio this week, but first I’m going to take a quick look at the latest news regarding portfolio stock GKN.

Melrose Industries’ hostile bid for FTSE 100 engineering group GKN has grabbed a lot of attention in recent weeks. I added GKN shares to the SIF portfolio when they qualified for my screen in the wake of Melrose’s original offer in January. The stock has been in a holding position since then, awaiting further events.

The final straight?

This process now seems to have entered its final phase. Melrose made a final offer for GKN on Monday morning, with an acceptance deadline of 29 March. The offer document valued this offer at 467p per share. However, this calculation appears to have included last year’s dividend and to have been based on a higher Melrose share price.

The offer is made up of 1.69 Melrose shares and 81p for each GKN share. Based on Monday’s closing price I estimate this is worth around 442p of new money to GKN shareholders. That’s a 30% premium to GKN’s pre-offer price, but is 61p less than the sum-of-the-parts valuation of 503p suggested by GKN management in their latest defence document.

GKN’s board only took a few hours to reject Melrose’s final offer, but at least one major fund manager has now come out in favour of the Melrose bid. The final outcome seems likely to be based on management credibility, as both teams are suggesting similar measures to turnaround the engineering group.

If Melrose is successful, I’ll sell the portfolio’s virtual shares before the takeover completes. This is because Melrose doesn’t pass my screening tests, so it isn’t eligible for the portfolio.

New screening results

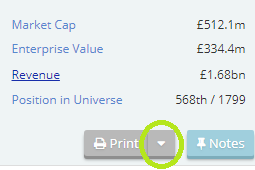

The SIF screen has offered up a number of tempting stocks this week. However, the rules require me to rank the results by StockRank. The top-ranked eligible stock is FTSE SmallCap infrastructure and engineering group Costain.

I came close to ruling out this firm because the portfolio already owns shares of groundworks specialist Keller. However, in the end I decided that Costain’s UK focus meant that its fortunes wouldn’t overlap too heavily with Keller’s global operations.

These diversification decisions are inevitably quite subjective and often…