I wasn’t expecting to find any new stocks in my screen when markets reopened after the New Year break, but to my surprise there was one new addition. Flowtech Fluidpower is a leading distributor of hydraulic and pneumatic parts to industrial customers in the UK and Benelux. It listed on AIM in May 2014 and has grown steadily since, thanks mainly to six bolt-on acquisitions.

Flowtech shares fell sharply following the EU referendum, but there’s no evidence yet of any meaningful disruption to trading. Although the group did issue a minor profit warning in August, trading appears to have stabilised since then.

Sales rose by 28% to £27.4m during the first half of last year, while underlying operating profit was 19% higher at £4.1m. Small cap editor Paul Scott was impressed by Flowtech’s interim results in September. You can read Paul’s take on these figures here.

Although recently listed AIM companies with acquisitive strategies have a very mixed record of success, I’m comfortable that Flowtech Fluidpower is a credible investment. Debt levels are under control and cash generation appears fairly strong. Stockopedia’s computers also like this share, which has a StockRank of 95.

Should I add Flowtech to the Stock in Focus portfolio? Let’s take a closer look at the numbers.

Tempting value and income

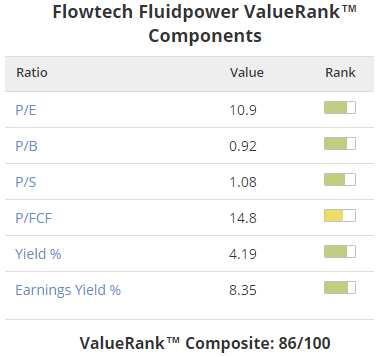

Flowtech Fluidpower certainly looks cheap. The stock trades on 10.9 times trailing earnings and boasts a ValueRank of 86. The group’s trailing dividend yield of 4.2% is also well above the AIM market average of 2.4%.

Here’s the usual snapshot showing the breakdown of Flowtech’s ValueRank (remember that you can access these by clicking on a stock’s Rank numbers on its sector page):

An earnings yield of 8.4% is just above my minimum threshold of 8%. If the shares rise further then this stock could drop out of my screen, but that’s not an issue at the current price.

From the fact that the P/FCF is higher than the P/E ratio, we can tell that free cash flow has fallen significantly below earnings over the last twelve months. What’s happened is that operating cash flow fell to just £0.2m during H1 2016. However, Flowtech’s interims suggest that the shortfall in cash flow during the first half was largely a result of working capital movements related to the purchase of…