Gold miners are currently popular with investors who want to generate real returns from the yellow metal. But when investing in miners it’s always worth considering what can go wrong. That’s especially true with companies which have just one operating asset.

When I added Egypt-based gold producer Centamin to the SIF Folio in September, I acknowledged this risk, but I didn’t expect things to go wrong quite so quickly.

On Friday, the shares fell 20%+ after the company said it had found signs of instability in one of the pit walls of the open-cast section of its Sukari mine. Fourth-quarter production is expected to fall by around 40% as a result, with an as-yet unknown hit to costs.

This week’s article was scheduled to be my usual month-end review, covering stocks that have been in SIF for at least nine months. Last week’s events mean that I have to add Centamin to the list of stocks under review. The latest news from the firm - and its sharp share price fall - may have triggered one of my sell rules.

Here’s the full list of companies which will be covered in this piece:

Temporary power provider Aggreko (LON: AGK)

Information, education and networking group Wilmington (LON: WIL)

Gold producer Centamin (LON: CEY)

SIF Q3 performance

Let’s start with a quick look at the portfolio’s performance versus the market during the third quarter (the blue link is SIF, the grey line is the FTSE All-Share index):

Here’s how the SIF Folio her performanced against the market so far this year:

Although SIF is still underwater so far this year, it’s stayed comfortably ahead of the market and did not suffer such a severe drawdown in March. I can live with this.

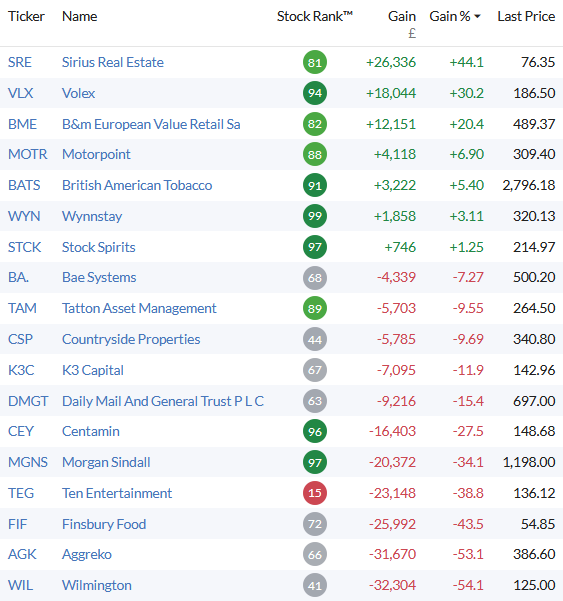

Finally, here’s a list of the portfolio’s current holdings, as they stood during market hours on 5 October:

The two oldest stocks in the portfolio - Aggreko and Wilmington - are also its biggest losers. Perhaps this is unsurprising. Both were bought in December 2019, during the market euphoria which followed the Conservative’s decisive election win.

Centamin (LON: CEY)

(Original coverage: 02-Sept-2020)

What are the likely implications of last week’s operating update from the Sukari gold mine? Centamin says that it’s “detected movement in…