Good morning. Lots of results this morning, so I shall crank up a gear and get through as many as I can.

As an aside;

Bitcoin

Is anybody really surprised that things seem to be going badly wrong with Bitcoin? It was only a matter of time before it all went pear-shaped. People who think Bitcoin is a good idea should be sent on a compulsory reading course, to study other financial manias from the tulips, South Sea bubble, technology shares in the 1920's, technology shares in the 1990's, and of course technology shares now! So maybe we should start calling this the Third Technology Shares Boom (& Bust)?

The golden rule in my view is to always remember that anything which creates wealth out of thin air, with nothing of any real value supporting it, is just a speculation that will eventually fail. Some people might flag up fiat currencies, but that's different because they are issued by the State, and hence have the State's revenue raising power behind them. So whilst they can devalue, and become worthless if money printing creates a spiral of hyper-inflation, that's an extreme and rare event, and you can see it coming and get out anyway.

So personally I will always stick to assets where you own something of measurable, and sustainable value - i.e. shares (a part ownership of a business), bonds (a loan), or property (houses, cars, etc.). I will never own Bitcoins.

For people who did want to gamble on Bitcoin, its key selling point was that the whole thing was meant to be secure. It now clearly is not, as an exchange appears to have gone down, along with several hundred million dollars of Bitcoins apparently. That surely will be the death knell of this project? This type of asset is based on confidence, once that's gone you haven't got anything.

Synectics (LON:SNX)

This is a CCTV group that I've been following for years, since the days when it was called Quadnetics, a rather nice name I thought, so it seemed a backward step changing it to the difficult to pronounce Synectics.

Their final results for the year ended 30 Nov 2013 are out today. Whilst the results look OK, the outlook and reduced order book are a concern. The order book was £28.1m at 30 Nov 2013 (2012: £36.9m), which is a material drop of nearly 24%. So the next step is to look for what the current order book is, to see if it has risen in the last (nearly) three months, so I am skim reading the narrative to locate that.

The Chairman's statement gives a pointer;

...We expect the current year to be focused on consolidating these significant organisation and infrastructure investments. Therefore the Board expects results for the current financial year to be at a similar level to 2013. Further details are set out in the Outlook section below.

Unfortunately, the outlook section dodges the issue of what the order book is currently standing at, so I can only assume that there has not been any improvement. If there had, then the company would have mentioned it, surely? They say;

Delays are continuing to some extent, but bid activity for large projects in the oil & gas and gaming sectors remains solid, and an increased pace of sales is anticipated from several new products being launched in the second quarter of 2014...

...The pattern of our current order pipeline suggests that trading will be significantly skewed towards the second half.

Oh dear, there is the dreaded H2-weighted results expected comment. That's not good, as it means a heightened risk of a profit warning if they do not recoup what looks like a gap in the order book.

The market has clearly cottoned on to this, and the shares opened down about 20-30p, but have in the last few minutes really nose-dived down 105p to 435p. Ouch. Nothing to do with me, as I haven't published anything yet, am just about to hit the publish button now.

So this morning's pretty savage market reaction to Synectics wobbly-sounding outlook is a reminder that when shares are priced to perfection, there isn't any scope for disappointment. That's why I am saying no to so many shares which I consider over-priced at the moment - it's all about risk/reward. If you are being asked to pay up-front for good performance over the next year or two, then you have little upside gains to be made, yet you have all the downside risk if something goes wrong. That's just a lousy investment proposition.

What I look for is assymetrical risk/reward the other way around - i.e. where a share is priced with expectations of poor performance, yet there are early signs of them doing well. In that situation you buy at a price where disappointment is already factored in, so you get the upside profit opportunity thrown in for free.

Back to Synectics, it delivered strong underlying diluted EPS of 32.6p for 2013, up 29% on prior year. So if we take the optimistic view, and assume they will deliver the same EPS for 2014, then at the current share price (they've bounced a little to 450p) that puts them on a PER of 13.8. Not exactly a massive bargain, considering that's probably the top end of likely performance for 2014.

Also, by my calculations they are inflating the underlying EPS figure by stripping out amortisation of capitalised development spend, which is not on in my book. So personally I'd feel more comfortable valuing it on the diluted basic EPS of 29.4p, and putting that on a PER of about 10-11, due to the risk of another profit warning.

Note from the cashflow statement that under investing activities, £1m of development costs was capitalised. It's always worth checking for this, as those are cash costs that have by-passed the P&L, hence increasing adjusted profit (which excludes the amortisation charge) by that amount.

On the positive side of things, Synectics passes my Balance Sheet testing, and had net cash of just over £1m at 30 Nov 2013. The total year's dividends are up from 7.5p to 8.5p, so at today's reduced 450p level that gives a dividend yield of 1.9%, which is nothing to get excited about, but better than nothing.

Remember that this type of business is lumpy, as it's project driven, and as far as I'm aware there isn't much in the way of recurring revenue. That makes it higher risk, and shouldn't be on a high PER, unless it has developed some blockbuster product that will drive rapid growth. I'm not aware of that here, so suggest that the rating should be modest. Something like a PER of say 10-12 is about the right price in my view for this type of business.

Therefore I think a price in the 300p ballpark is the sort of level that would get me interested. Even after this morning's drop, it's 50% above that price, so I'm not interested. Risk/reward is still unattractive at the current price, despite the now 16% fall (it's a moving target!) this morning, in my opinion.

Remember that sentiment drives share prices in the short term, but its cashflow & dividends that ultimately determine the long term value. I think sentiment is taking a lot of share prices too high at the moment, and that means heavy losses eventually for people who over-pay.

Molins (LON:MLIN)

I last reported on Molins here on 24 Oct 2013, and was positive about it until I found the pension deficit! Although casting my mind back, I remember almost buying a few as a starting position at 182p, but decided against it due to the pension deficit. Those comments are worth reading, as they cover the background, which I won't repeat now.

After skim-reading this morning's results for the year ended 31 Dec 2013, I've taken the plunge and bought a few at the open. Just a starter size position, as I generally like to start small, and then build a bigger position if and when my confidence grows after doing more in-depth research. Also that way you don't lose much money if it turns out not to be good, after doing more research.

2013 results look good. Sales increased 13% to £105.2m, and underlying profit before tax rose 10% to £5.4m, as did underlying EPS also up 10% to 23.9p. That seems to be comfortably ahead of broker consensus forecast of 21.2p EPS.

Setting aside the pension deficit for the moment, in other respects Molins Balance Sheet looks alright - the working capital position is strong, with current assets at 179% of current liabilities, well above my usual comfort level of around 120-150%.

They had net funds of £5.2m at the year end, and maintained the 5.5p full year dividend (for a useful yield of 3.0% on this morning's higher share price of 183p).

Moreover, the valuation is cheap on a PER basis, at 182p the shares are trading at just 7.6 times the reported EPS for 2013.

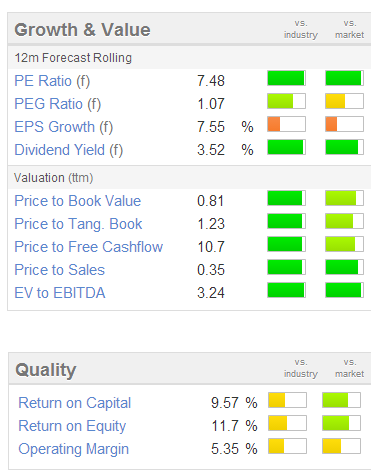

Stockopedia figures are based on 12-months forward PER, so the already cheap PER on the right is likely to get even cheaper, as analysts revise up forecasts for 2014 in the next few days.

At present the 2014 EPS broker consensus is 22.8p, but I would imagine that has scope to rise to say 25-26p shortly?

Some analysis tries to gloss over the issue of the pension deficit, which I think is wrong. All factors should be taken into account, and the pension problem is clearly the biggest reason why the shares are cheap.

The ludicrous accounting treatment under IAS19 of pension deficits means that a liability of only £5.6m is disclosed on the Balance Sheet. When the actuarial deficit was last calculated on 30 Jun 2012, and showed a huge £53m deficit! That's more than the entire market cap of the company.

The litmus test is how much cash is the company required to put into the pension fund, to deal with the deficit? In this case it is £1.7m p.a. from July 2013, rising by 2.1% p.a. (or more, if dividends are increased more), for seventeen years!

Therefore it's utter nonsense to only disclose a Balance Sheet liability of £5.6m, when the true liability in cash payments terms is actually nearer £27m, and that's before adding on the 2.1% p.a. increases. It's not the fault of Molins, as they are just reporting as required to under IAS19. Of all the accounting standards though, IAS19 has to be one most urgently in need of being scrapped, as it's just presenting wildly inaccurate financial positions of companies that use it.

In this case it also effectively puts a cap on the dividend too.

The way I look at things, any additional pension payments which are not put through the P&L need to be adjusted for, as if they were a cost. In this case I need to do a bit more digging to work out exactly how the pension costs are treated through the P&L. I can see the £1.8m pension cost on the cashflow statement, near the top. The way it's presented, it looks as if that IS going through the P&L, which is good news, Although I need to double check whether that is the whole of the pension cash payments, or whether it's just part of it?

Another quick way of looking at it, is that you adjust the PER by whatever you think is reasonable, to allow for the pension deficit recovery payments. More work on this is needed, so I shall report back later in the comments section below. Any readers who are clear on the pension situation here, please feel free to comment.

The counter-argument is that as corporate bond yields rise, as QE ends & the economy recovers, then pension deficits should fall, since the bond rate is used to calculate the present value of scheme liabilities. The higher the bond rate, the lower the liabilities become, so pension liabilities have been exaggerated in one of the unintended consequences of QE.

Anyway, nothing has changed today in respect of the pension fund, but what has changed today is that the company reported EPS nearly 13% ahead of forecast, so that probably deserves a re-rating of say 15-25% (since it will also flow through to improved forecasts for this year & beyond).

The outlook statement lacks specifics, and sounds a bit hesitant, so probably not one to get too excited about in the short term. They say;

We remain mindful of the uncertain economic and regulatory environment, but are cautiously optimistic the Group will continue to demonstrate progress.

Equity Development have today put out an excellent commissioned research note on the company, written by a superb analyst who I know & very much admire, Paul Hill. It's well worth a read. People sometimes disparage commissioned notes, but they can be very good research, as the analyst has more time to spend on them, and contain excellent background information. Paul Hill's notes usually also contain very informative sector analysis, as this does too. Highly recommended, especially as he is also an accomplished investor, not just an analyst.

Idox (LON:IDOX)

My good friend David Stredder has asked me to point out that the Board of IDOX have agreed to do an investor presentation at their AGM tomorrow. David is tirelessly campaigning to get companies to broaden their AGMs into an opportunity to communicate with private investors in the same way they do with institutions, so if more companies do this too, then AGMs will become a lot more worthwhile and more people will attend.

Also, companies holding AGMs, please schedule them for around lunchtime, so that people can travel to them from further afield, and avoiding rush hour traffic. Little things like that differentiate companies that have consideration for their shareholders, and all too often other companies that treat us with haughty contempt.

The game is changing. With the internet, and private investors now dominating the small caps space, creating the liquidity, narrowing the spreads, etc, we are the key audience that companies need to communicate with, and it's easy in the internet age. Hence why I am supportive of companies like BRR Media, who put out regular CEO audio & video interviews, which all helps disseminate the information that private investors need to make better informed decisions.

Quarto Inc (LON:QRT)

Normally I don't cover overseas companies Listed in the UK, as so many of them turn out to be disasters. However, if they've been around for a few years, and pay dividends, then I will look at them.

Quarto is a book publishing group in the US, but operating internationally. They supply coffee table books, with long lifespans.

The shares appear cheap, on a low PER and with a good dividend yield, but after reading their last Annual Report last weekend, I was unconvinced. There are two problems here. Firstly debt is very high. Today's results show some progress on that front, with net debt reduced from $81m to $71m. Although I suspect from looking at the Balance Sheet, this has been achieved by squeezing other things down, such as reduced stock, and some property appears to have been sold (therefore a one-off benefit in reducing debt, but increasing costs as at least one transaction seems to have been a sale & leaseback).

I think debt is still much too high here - just look at the large proportion (nearly half) of operating profit that is consumed by interest payments.

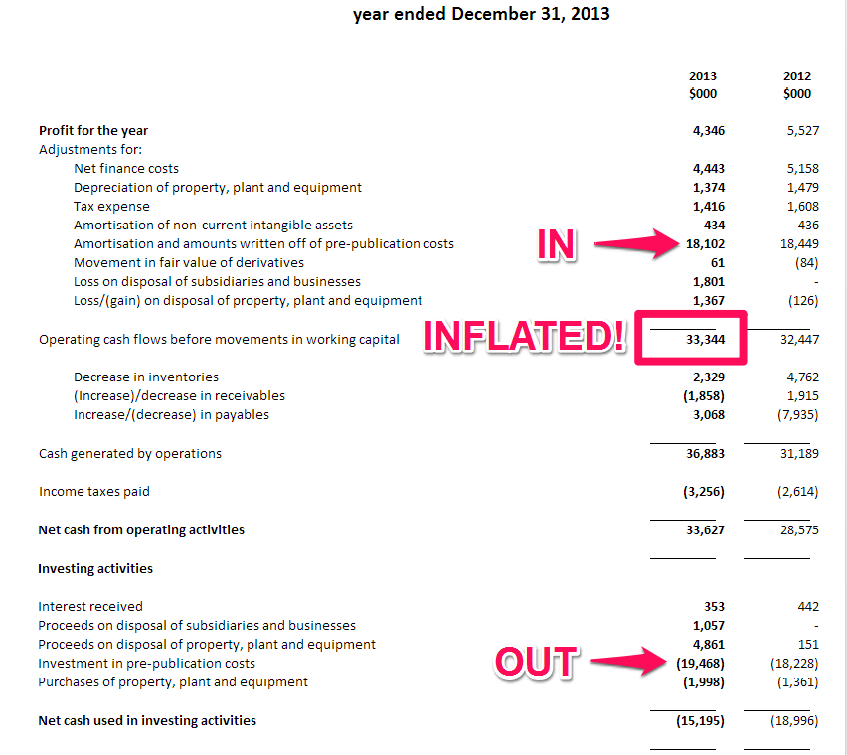

Your attention is also drawn to the Balance Sheet, where a very large debit of $56.2m is sitting in current assets, being pre-publication costs. So these are cash costs that have left the business, but are being temporarily delayed on the Balance Sheet before being reflected as a cost in next year's profit & loss account. That's very different to an asset with a resale value, and arguably should be adjusted out & written off by investors in my view.

This accounting treatment of pre-publication costs also means that cashflow is wildly exaggerated. So the $33.6m net cashflow from operating activities reported in the financial highlights is just nonsense, and does not in any way reflect the real performance of the business, in my opinion.

It may be a perfectly allowable accounting treatment, but it greatly exaggerates the real cashflow in my opinion, as shown on the excerpt below of their cashflow statement, which I have annotated;

So overall I think the high level of debt puts me off investing in Quarto.

Although the counter-argument is that they have valuable titles in the books themselves, which are not reflected on the Balance Sheet. So it's a question of how you see it really.

Personally I don't like chasing dividend yield at companies with high levels of debt, as the dividend could easily be cut at any point. If they make progress though, then the low PER could rise over time, who knows? It's risky, but might be of interest to people who like low PER stocks, and are prepared to take a sanguine view on the debt.

Run out of time today, so I'll stop now.

Thank you for reading, and your comments, which are usually very interesting.

Back tomorrow at the usual time, around 8am.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in MLIN, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.