Good morning!

It was a very exciting day yesterday, with the news that J Sainsbury (LON:SBRY) approached Home Retail (LON:HOME) with a mooted takeover deal in Nov 2015, but was rebuffed. As this situation is not really relevant to these small caps reports, let's park that to one side, and I'll write a separate article about it here on Stockopedia a bit later, when time permits.

Check out Ed's NAPS for 2016, selected using the StockRank system, which achieved brilliant results last year - a staggering 43.4% return. As he says, it may not be possible to replicate such a strong performance in future years, but it's a highly impressive first year.

It adds great credence to the idea that "farming" as an investment approach, using StockRanks, is a terrific way for investors to make good returns without having to do a lot of work - ideal for people who have full-time jobs which limit the time available for investment research.

Carr's (LON:CARR)

Share price: 159.2p

No. shares: 89.8m

Market cap: £143.0m

Trading update - this is an agriculture, food, and engineering group. It has an end Aug year end, so yesterday's update covered the 18 weeks to 2 Jan 2016, so 69% of H1, in terms of time.

The key sentence says;

Carr's continues to trade in line with the Board's expectations for the full year.

A lot more detail is given, and it seems impressive that the agriculture division has coped with various issues, including extensive flooding in the North of England, yet still managed to produce an in line performance. Insurance is in place for one feed mill which has been affected by flooding.

The food division was also affected by the flooding (or rather, a major customer was, with a knock-on impact), but this is covered by business interruption insurance.

Margin pressure is noted in the supply chain for bakery category.

There's a good article in today's Questor column in the Telegraph, giving additional useful background on the company.

The engineering division notes a slower than expected start to H1, with the dreaded H2 weighting comment - often a deferred profit warning. Therefore readers would need to check how material the engineering division is to overall profitability.

Net debt was £31.9m at 28 Nov 2015, up £1.5m against prior year. It seems odd that they give us the net debt figure as of 5-6 weeks ago. Why not a current figure? If I were the FD, I would want to have real-time figures available on net debt, and to report those figures to the market.

Outlook - the floods are mentioned again, and market headwinds are noted, which is likely to put a dampener on the shares perhaps?

...As highlighted at our results in November last year, we face a number of headwinds in the markets in which we operate. However, our geographic diversity, investment across our asset base, together with the acquisitions we have made, will continue to set us apart and ensure the Group remains in a robust position over the medium to long term. Additionally our strong balance sheet ensures we remain in a good position to take advantage of any potential acquisition opportunities."

Balance sheet - see my report here on 15 Jul 2015, where I reviewed the balance sheet, which looks sound to me. There is debt, but it looks fine, as the group has freehold property assets, and is decently profitable.

Insurance - going back to the point on insurance, my worry is that, whilst this year's flooding may be covered by insurance, we could see insurance companies imposing more onerous terms, and pricing, in future. Or worse still, declining cover in flood-prone areas.

Therefore, whilst I would normally not fret about, say a one-off disaster (such as a fire), flooding is somewhat different, and this should be something that investors maybe need to think more about, and quiz the company about how they will be mitigating future losses, if/when the floods repeat.

Or, do we treat this year as a one-off freak flooding situation? I don't know the answer to that, but am just flagging the issue for readers to ponder.

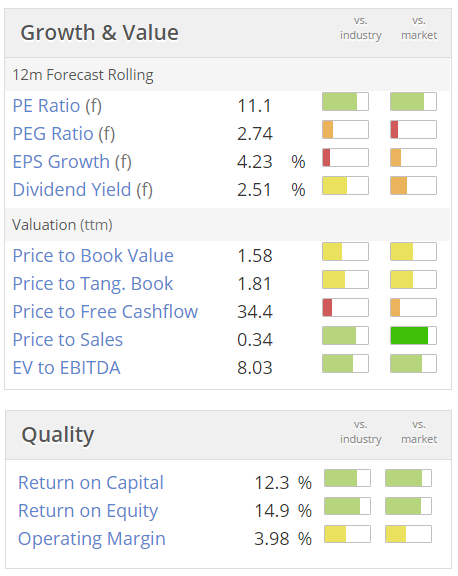

Valuation - given that it's a fairly boring, lowish margin business, these valuation figures look about right to me;

These shares have been an excellent long-term performer, but it's difficult to see much of a catalyst to drive the share price any higher in the short to medium term.

As you can see from the 5-year chart below, Carr's has out-performed the small caps index very nicely over 5-years. Whether there is much upside from here, who knows? It would have been a nice share to hold in 2012 & 2013, but beyond that, the risk is that it's dead money, which has an opportunity cost of course. So it's not for me.

Johnson Service (LON:JSG)

Share price: 88p

No. shares: 330.6m

Market cap: £290.9m

Treading update - a reassuring update today from this dry cleaning and textile renting group. Trading is in line;

Group trading results for the year ended 31 December 2015 are expected to be in line with market forecasts, which already reflect the positive performance reported in our Interim Results, and significantly ahead of the previous year following our successful acquisitions during the year.

Net debt - the group says;

Notwithstanding the acquisition of Ashbon Services Limited, announced on 30 November 2015, net debt at the year end is expected to be slightly lower than the £72.4 million reported at June 2015.

National Living Wage - is factored into forecasts, so there shouldn't be any surprises here hopefully. Although it's an incremental rise, each year until 2020, so the cumulative effect needs to be factored in by investors (at all companies, not just this one);

The National Living Wage will be implemented across the Group in April 2016. We believe that the effect of this, including the benefits of our mitigation plans, is already reflected in current market expectations.

My opinion - I feel that the level of net debt is starting to cause concern again. Groups which grow by acquisition, funded by debt, are doing well at the moment. However, management can sometimes be sowing the seeds for future disaster, when the next recession and/or credit crunch hits.

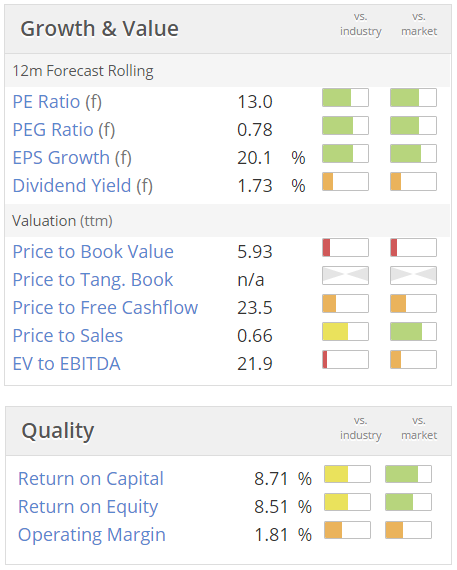

The balance sheet here certainly looked stretched to me, at 30 Jun 2015, with negative NTAV, and too much debt. Taking that into account, the fwd PER of 13.8 shown on the StockReport is not a bargain in my view, as that would rise into the high teens if you were to sort out the balance sheet with an equity fundraising.

Still, investors don't worry about such things in the good times, so maybe the shares have further to run? I feel it's fully, or a little over-priced, and a bit too high risk, given the weak balance sheet, for my personal preference.

Topps Tiles (LON:TPT)

Share price: 158.75p (up 1.1% today)

No. shares: 194.6m

Market cap: £308.9m

Q1 trading statement - as it has an early-Oct Year end, today's update covers Q1 - the 13 weeks to 2 Jan 2016.

LFL sales of +4.4% is reported, coming on top of a 5.2% increase last year. That's a good performance, assuming that gross margins are unchanged (no mention is made of margins or profits).

A brief strategic overview is given, on various initiatives to develop the business further - e.g. improved displays, 17 new product ranges (delivering 8.9% of total sales), consolidation of support functions into one H.O. in Leicester, etc.

Outlook - non-specific, but confident-sounding;

Our strategy of 'Out-Specialising the Specialists' continues to be very effective and we are confident that our plan for 2016 will see us deliver additional profitable sales growth as we further extend the appeal of the Topps brand."

Valuation - the fwd PER is 17.0 times this year's earnings, and 14.6 times next year's, which looks about right to me. Bear in mind the company has some net debt (£28.4m as at 3 Oct 2015), so that needs factoring into the valuation. Although this was more than half covered by freehold property (of £16.5m), so it's not a concern.

My opinion - I like it. This looks a good, well-run business. The valuation seems about right to me, so there's no compelling reason to buy now in my view. However, as a long-term hold, I can see the attraction, and it's the sort of stock that I would happily have on my "buy the dips" list.

Note that the company has been a little accident-prone in the past, and sailed too close to the wind with excessive debt, and at times erratic trading, although the problems appear to have been gradually sorted out. For this reason I'd be reluctant to pay top whack for the shares, in case problems resurface. It would have made a smashing purchase if you'd caught the spike down in Oct 2014.

Staffline (LON:STAF)

Share price: 1393p (down 0.8% today)

No. shares: 27.7m

Market cap: £385.9m

Trading update - this "staffing and employability organisation" updates today for the year ended 31 Dec 2015, as follows;

The Board today confirms that earnings for the full year will be in line with market expectations and both of the business' divisions have performed well in the year.

The Staffing business has secured a record number of Onsite wins in the period, also supported by two strategic bolt-on acquisitions completed in the second half. In PeoplePlus, the Employability, Skills and Justice Division, the integration of A4e, acquired in April 2015, remains on track and PeoplePlus continues to build on its reputation for quality and performance.

The record performance in winning new business in the Staffing Division has led to a short-term increase to working capital requirements, which, in conjunction with the acquisitions completed, means that net debt peaked at the year end at around £64m. Net debt remains on track to fall quickly over coming periods.

This announcement seems to have spooked some investors, probably the bit about debt spiking, with the shares down about 8% in the first hour of trading - probably on a "sell first, and ask questions later" type of basis. Buyers brought the price back up again, and it ended the day almost flat.

A short term spike in debt shouldn't really matter, when the company specifically says that it is "on track to fall quickly" thereafter. Having said that, I've just had a look at the last published balance sheet (at 30 Jun 2015), and it looks stretched to me - it's now dominated by intangible assets, as the group has grown at least partly through acquisitions, so NTAV is now negative, at -£37.9m.

Valuation - the valuation doesn't look particularly cheap once you adjust for a notional equity fundraising to straighten out the balance sheet, which would push the fwd PER up to about 15, the way I look at things. That's high enough, for this type of business, maybe a bit too high?

My opinion - the group has made two further debt-financed acquisitions in H2 (although the price of neither was stated in the RNSs). Forecast net profit for 2015 is £19.8m, so I feel that a net debt burden of £64m is too high.

Why does that matter? In the good times, it doesn't matter, but if something goes wrong, then highly indebted companies/groups can end up in a real pickle. You also tend to get poor dividends at highly indebted companies, and the divi yield here is only about 1.5%. I'm not keen on indebted companies paying divis at all really - the money would be better retained within the business, to shore up its finances.

Perhaps I'm too conservative about balance sheets, but a strong balance sheet buys you safety. Sure a share will still fall on bad news, but it gives management time to sort out the problems, and the share usually recovers, with patience. Whereas highly indebted companies can implode when things go wrong, and shareholders can end up badly diluted if fresh equity has to be raised when the company has its back against the wall.

My other reservation about Staffline, and staffing companies generally, is the risk of legislative changes. These companies basically exist to allow employers to circumvent regulations on giving full employment rights to people who work for them, and to provide a ready supply of cheap labour. I'm not comfortable with that, and at some point the EU for example could drop a bombshell on this sector.

Therefore, whilst Staffline looks superficially attractive, it's not a share I want to revisit for my portfolio, as I see too much latent risk here. I note that the CEO cashed in £4.3m worth of shares at 1400p in Jul 2015.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.