Good morning, Paul & Jack here. Today's report is now finished. I'm heading off to mystery dine Revs again, as it's the last day of their 50% off mains promotion.

Agenda -

Paul's Section:

Saga (LON:SAGA) (I hold) - quick summary (pre 8am) is in the comments section below. I've now written up a full section. It's a small miss against profit forecast for FY 1/2022, but that doesn't really matter, because covid has impacted travel operations so much, as you would expect. The forward bookings info for the 2 cruise ships looks excellent - high level of occupancy already booked for Feb-July 2022, at increased selling prices. So it's got that vital pricing power, needed in a higher inflation environment. I'm very bullish, with a long-term view - as you would expect for my largest personal position.

Cambridge Cognition Holdings (LON:COG) (I hold) - a positive trading update for FY 12/2021. I really like this turnaround under more commercial management, and things are panning out as I hoped. It moved into (small) profit in 2021, has plenty of cash in the bank, and a bulging order book provides good visibility. Valuation still looks reasonable to me, given very good sector tailwinds. Small and illiquid though - so it's one to buy between updates, when people get bored and the price drifts down.

Eagle Eye Solutions (LON:EYE) - another positive trading update, with strong, organic top line growth. EBITDA is shown as the key profit measure, but remember that last year all the £4.2m adj EBITDA disappeared once development spending, and share-based payments, were deducted. Profit after that? Almost nothing! There's no doubt about strong organic growth though, and impressive customer list & wins though. So I like the company. The only question is how to value it?

Cloudcall (CALL) - de-lists today, on completion of the 81.5p cash takeover bid. I rake over the coals, to ponder what I've learned from following and having bouts of owning shares in, this small growth company.

Jack's Section:

Rbg Holdings (LON:RBGP) - I hold - adjusted FY EBITDA to be 10% ahead of market expectations. Wage inflation is a concern, but an industry-wide one and RBG trades at a discount to a few of its peers, even before today’s upgrade. Another dividend takes the total payment to shareholders up to 5p, a c4.5% yield.

Wilmington (LON:WIL) - revenue, adjusted profit before tax, and net debt/cash all ahead of expectations. It looks like the company completed an organisational restructuring last June after a multi-year review of the business, refocusing on global Risk & Compliance markets. The past five years’ performance has been patchy, but no dilution and reduced net debt over the period, so a solid platform for future growth if the company has settled on an appropriate strategy.

Strix (LON:KETL) - Revenue up c30% at constant currency but FX headwinds, as well as ongoing supply chain issues and freight cost inflation. Net debt is higher than expected at £51m as the company invests in inventory. A mixed update unlikely to reverse market sentiment for now, in my view.

Thursday’s Market/General Comments from Paul

People seem to mostly like my early ramblings here, so I'll keep doing them if there's anything interesting to discuss. I'm not saying necessarily my views are right or wrong, but am more just pondering the current situation. As always, please feel free to add your views in the comments, we like discussions, and welcome all rational/polite opinions.

US markets were recovering well yesterday evening, then the Fed Chairman, Jerome Powell opened his mouth again. I listened to his commentary, and obviously I’m not an expert on any of this. However, the stand-out remark to me, was that he said inflation is now more persistent than expected, and has spread into other sectors, beyond the ones initially impacted (used cars have been a surprisingly large element of rising inflation, according to a recent article from the brilliant John Authers - if you don’t follow him, you should! I haven't got time to read all his articles, but when I do, they're most illuminating & interesting).

Yet the Fed is only talking about raising interest rates modestly, by about 0.75 to 1.0% in total this year. Powell doesn’t rule out more aggressive action though. I’m not sure why the market is getting so jittery about this? Last time he tried to raise rates, he backed off. Maybe this time it’s higher inflation that could force him to act? Even then, we’re still looking at historically extremely low interest rates, even after the 4 mooted increases of 0.25% each.

If we end up (UK similar to US) with perhaps 2-3% interest rates, and 6-7% inflation, then where is the best place to invest? I think it's the stock market, in reasonably priced shares, with a good yield.

E.g. a share on a PER of 20, paying a dividend yield of 3% wouldn’t quite do the job. I prefer earnings yield (the inverse of PER) to PERs, because you can compare a share’s earnings yield with other investments. Flipping the PER upside down, converts a PER of 20 into an earnings yield of 5% (1/20 * 100). That means our company with a PER of 20 is not generating enough after tax profit (earnings) to match inflation. Although it may be able to raise selling prices, increase profits, and thereby raise its earnings yield. So it could be worth paying a bit of a premium for companies which can grow earnings well.

To match inflation, we need a share with an earnings yield of 7%. Invert that to get to the PER, and it’s 14.3. Therefore I should be very happy buying a share on a PER of 14.3, providing those earnings are sustainable, because the company is earning the same as inflation at 7%. Some of that will get paid out in divis, and some will be retained by the company to fund growth, or build up a cash pile for acquisitions, or any other use (maybe debt reduction, special divis, buybacks), all of which should in theory add to shareholder value.

If I’ve chosen my PER of 14.3 share well, then it should also have pricing power, and hedge me against future inflation.

Hence in my eyes, value/GARP shares are now much more attractive in a higher inflation/low interest rates environment than the other options (cash, and bonds look terrible, with negative real returns, and some capital at risk with longer bonds too, as they re-price downwards when yields rise).

As mentioned yesterday, I do worry about pensioners sitting on cash piles in savings accounts, who are now lined up to lose maybe 15% of their savings purchasing power through inflation over 2022-23, potentially. That seems likely anyway.

The trouble is, how can an adviser tell them to protect themselves from inflation by investing in shares, when share prices are dropping heavily? They could incur a larger loss in the short term anyway, from buying into a falling market. They’ll be better off longer term, but if you’re very old, the time horizon is limited, and maybe erosion of 6-7% p.a. from inflation may not be quite as bad as the stress of volatile markets? Having money in good quality, reasonably priced IHT-qualifying AIM shares is an excellent way to boost returns for people in that situation though, providing they’re held for 2 years. Seek expert advice on that. Obviously, I’m not a tax specialist.

I still see property as attractive too, because interest rates of say 2-3% probably won’t be enough to dent property values much.

Is there a risk of interest rates ballooning to say 5-10%? Very little, in my opinion, because that would trigger an economic meltdown - households and indebted companies just couldn’t afford that level of interest rates, which central banks know. Given that central banks have discovered & used money printing on an almost unbelievable scale, that’s likely to be the tool they reach for in the next crisis - in fact Powell specifically said this in his testimony to Congress recently - “asset purchases” (i.e. buying up Govt bonds, funded by printing money) would be the main response to the next bog standard recession (not even an external crisis, like covid). That’s what Powell said, I noted it down at the time. Maybe we're now in a never-ending cycle of modest tightening & phasing out of QE, then a recession, with the response being interest rates immediately reduced back to zero again through another wave of QE? (that's what they did when covid hit, so it seems to be the go to response now).

US markets sold off heavily last night again, after Powell spoke, so I think he’s in danger of triggering an economic downturn. Shares are very widely held in the US, in people’s savings plans for retirement, which are sometimes self-managed. So there’s much wider interest in the stock market than in the UK. Hence as Americans see their shares tumble, they feel poorer (because on paper, they are), and maybe rein in big purchase decisions.

The destruction of wealth from plunging stock markets may already be scrubbing off the excesses of QE? So maybe it's a good thing to crash the speculative end of the stock market?

As mentioned yesterday, traders do their own thing, and try to profit from these market moves. Whereas long-term investors, which this column is aimed at, just accept market volatility and don’t try to predict, or react to it. Providing we’re in good quality, sensibly priced shares, then we should do fine long-term, even if interest rates do go up a bit.

I think we’re also maybe getting to a point where UK small caps have sold off such a lot since mid-2021, that anyone likely to panic sell has probably already gone. I suppose that if markets do continue falling, there’s likely to be a trickle of people who tip over their maximum pain point, and capitulate. Plus we have prices being constantly messed about with, by traders seeking to benefit from short term movements.

Looking at individual companies, I’m conscious of an ever-growing list of backlog items that I do want to look at, so will see if we can eat into those a bit today & tomorrow.

Anyway, my message remains the same. I’m a long-term investor, holding good quality, reasonably-priced shares, so I just ride out periods of volatility. It’s always worth reviewing portfolios though, and chucking out any speculative or over-priced stuff, which could still have a long way to fall, if these bearish conditions persist. Or wait for a powerful rebound day (common in falling markets), and sell stuff then.

In UK small caps, we’re seeing overwhelmingly positive, or in line trading updates so far. The economy is strong, with full employment (even labour shortages). Higher interest rates don’t seem likely to rise much, so I think that’s a bit of a red herring. That leaves inflation - which could be around for a while, but once supply chains ease, and we lap the tough comparatives, it’s perfectly reasonable to imagine it could begin to ease in 2023. That’s what happened before when we had inflation spikes in recent years.

I’m not mentioning Ukraine, because that’s political, and uncertain. To my mind, a major war between NATO and Russia looks highly improbable. But you never can tell, as the West rarely understands Russian thinking, and history shows Russia has a very high pain threshold. There could be a standoff there for a while, so I think we have to deal with the uncertainty. It could cause a spike down in markets, if war kicks off, but does it affect the value of Tescos in the long run? No. Or if the worst case plays out, the value of Tesco’s won’t matter.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Saga (LON:SAGA) (I hold)

286p (up 1.6% at 08:37) - mkt cap £401m

I should add that this is now my largest personal holding, so clearly I view this share very positively. That remains the case after today’s update. It’s a classic half full/ half empty update - sceptics might focus on the guidance for a small underlying loss for FY 1/2022.( forecast was for a small profit). Bulls like me, are focusing on the upside from travel restrictions lifting, and the indications there look good - with strong bookings for the new financial year starting imminently.

Summarising today’s update, with my opinions added -

Insurance division performing in line with expectations. I won't go into the detail, because everything sounds fine. This is the reliable cash cow of the group, and has proven a tremendous asset during the pandemic - generating the profit & cashflow to subsidise the losses from the travel division which was mothballed during most of the pandemic, although has restarted on a limited basis in H2 of 2021/22.

Cruise ships - remember SAGA owns 2 new ships, which have barely been used, as they were anchored in Tilbury Docks when covid restrictions prevented them operating. Then limited use (and higher costs) when travel restrictions eased. It surprised me how many over-50’s wanted to go on cruise ships at all, especially during omicron, but they did. Don’t under-estimate the huge pent-up demand for cruising that has built up during the pandemic. I think SAGA, and other cruise ship operators, look set for a multi-year bonanza, assuming no more travel restrictions.

SAGA targets the over-50s, who’ve got most of the money, so they don’t buy on price, they buy on service. Good cruise lines seem to generate amazing brand loyalty, so I think there’s hidden potential value in this brand/company/share, once things normalise. Like lots of other businesses, restructuring has taken place under newish management (including the former long-serving CEO Sir Roger de Haan [the founder’s son], who headed the rescue refinancing during the pandemic). The strategy is to run the business for customer service first. Whereas previous management teams (including a period of private equity ownership) just ran it as a cash cow - sowing the seeds of decline of course, as so often happens with private equity.

Cruise division - positive EBITDA in H2, but an underlying loss of £45-50m after the big costs of depreciation (non-cash) and finance charges on the hefty ship loans. It’s not clear from the RNS whether that loss is for H2, or FY? It's mopped up by insurance division profits anyway.

The load factor in H2 is called “strong”, but is only 68%. I suppose they mean strong in the circumstances of continued travel restrictions & covid anxiety/risk? You might think older customers would stay at home, but it seems they’re raring to go cruising again, and have to be triple vaxxed to get on the ship in the first place.

Cruise bookings - far more important, as this share (like the whole travel sector) is all about anticipating what recovery & eventual normality looks like, post covid.

Even if covid returns in some new form, we already know that SAGA can mothball operations, and won’t need any more cash, because the insurance division holds things up. So a very much better business model than all-or-nothing travel sector shares. I don’t think the market gives SAGA shares credit for this.

I’m really impressed with bookings info for H1 22/2023 (i.e. Feb-July 2022), which are 86% load factor - not far off fully booked then, given that more bookings are likely to happen in the coming months.

Pricing power - SAGA uses a silly term, per diem, which is just daily rate per customer. This was £299 in H2 of 21/22, but has risen 6.4% to £318 for forward bookings in H1 22/23. That demonstrates clear pricing power - almost fully booked, and prices up 6.4% - what’s not to like! So this is certainly one share where we don’t have to worry about the company’s ability to pass on costs to its affluent customers - SAGA is demonstrating that it can raise prices and still see strong demand - that's exactly what I'm looking for in my current investments.

Also remember SAGA faces fairly limited direct competition - its ships are over-50s adults only. Clearly then mainstream, larger cruise ships which dominate the cruise market, like Royal Caribbean, which target families & younger couples, are not competing directly anyway. I'm sure SAGA clients dearly love their grandchildren, but don't want to be on a cruise ship with other peoples' grandchildren screaming & darting about.

Hence a big tick in the box for not having to worry about higher costs - extra revenues are needed, and are being achieved, which should more than cover things like increased cost of fuel, food & drink, etc. Also hopefully some pay rises for the usually Filipino or similar geographies staff. I remember once feeling sorry for the immensely hard-working staff on a cruise ship, and asked several about their views. They told me they were very grateful for the job, which allowed them to support their families back home. It’s hard work, but they didn’t seem to mind. That was only a small sample of staff though. And of course customers can always tip the staff too, if they're feeling guilty. I’m only airing that to see if there’s any negative ESG type angle on cruise ships, but I don’t think there is, if the company is run ethically, which SAGA very much seems to be now.

Travel division - has been restructured, to make it more efficient. This is the bit where SAGA is a middleman for specialist holidays. Quite lucrative in the past, but the cruise ships should be the big money spinner (something like £80m EBITDA was talked about pre-pandemic for the 2 cruise ships combined - although it might take some time to get to that level, as they’re rebuilding the business from standstill).

Cash - plenty of it, following several refinancings. £151m (gross) cash pile, plus an undrawn £100m RCF, is clearly very healthy liquidity - more than adequate.

The way I see it, the £125m cash pile almost exactly nets off against the old bond (2024 I think from memory) which was £250m originally, then £100m was repaid when the new £250m bond was issued last year, 5 year duration I think.

Hence I would say the only structural net debt is the new £250m bond.

The ship loans are bigger, but they are asset-funding loans, so I just offset them against the value of the ships.

There’s no financial strain at all - the group looks fine to me, and has plenty of liquidity.

The plan is to reduce debt as a priority over divis in the coming years, so shareholders will need to be patient, but divis should recommence in future - fine, because I’m more interested in the share price quadrupling over a number of years (upside scenario, may not happen), than getting an income.

Overall profit guidance - small underlying loss for FY 1/2022 - that’s fine. It might be a small miss against broker consensus, but it really doesn’t matter in the exceptional circumstances of covid. It’s remarkable that SAGA has got through the pandemic with only modest losses, which shows the strength of its business model.

More important, is the future profitability. We’re not given any numbers (fair enough, it’s early days, and covid isn’t over yet) - the company says -

Although we are mindful that disruption from the pandemic could continue into the first half of 2022/23, we are well-positioned as customer confidence rebuilds and we move to a new Tour Operations proposition. This, paired with strong Cruise bookings and a strengthened Insurance business, place us in good stead for the future.

We will continue to take an agile, proactive approach to navigate any challenges but are confident that the strength of our proposition, management team and the brand will create sustainable long-term value for our stakeholders.

My opinion - very positive. I think SAGA now looks set up for a future where profits should come strongly back, providing travel can operate as normal. Even if restrictions return, we know SAGA can cope, and won’t need to dilute shareholders again, due to the cashflows from its successful insurance business covering any potential travel losses, as has been demonstrated in 2020-22.

What I like best about this share, is that the brand, and customer service are being rebuilt. That will take years, but everything they’re doing is music to my ears. I tested the customer service myself, and was delighted with it - a completely no quibble full cash refund was given, despite me cancelling my cruise on the morning of departure. That tells me this is a trusted brand again, and the upside on valuation from the brand value being restored, could be large. Remember this company was valued at something like £2bn when it was perceived more positively by investors.

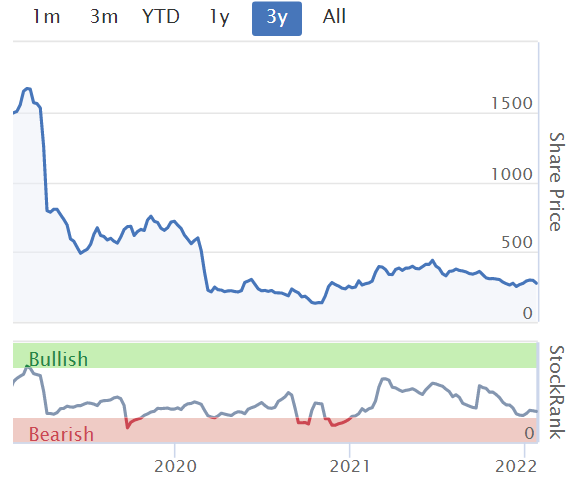

On the downside, the shares are very volatile indeed, and nobody really seems sure how to value it. If you use EV/EBITDA then you won’t come up with such a bullish valuation as me (I use PER on future possible earnings of maybe 100p, possible upside to 1200-1500p per share, long-term).

Anyway, so far so good, things are panning out as I hoped. Just have to be patient now, and tuck it away for a couple of years.

.

.

The StockRank system obviously doesn't know anything about covid, or travel restrictions easing, so it remains staunchly negative, as I would expect at this stage. It's a useful reminder that the upside hasn't yet happened.

.

Cambridge Cognition Holdings (LON:COG) (I hold)

131p (up 17% today, at 10:14) - mkt cap £41m

Many thanks to Michael Tee, who has posted in the comments below an excellent bull/bear review of COG’s trading update today, thanks Michael! I don’t really have a lot add, but here are my notes anyway -

Positive update for FY 12/2021

Revenues up a very impressive +50% to £10.1m (all organic growth too)

H1: £4.5m revenues (up 50% on LY H1), so H2: £5.6m (which must also be up 50% vs LY)

Gross margin was 80% in H1, so assuming that’s the same in future (it’s not mentioned today), COG has outstanding operational gearing.

Contracted order book up 51% to £17.0m, which gives excellent visibility, and proves that 2021 wasn’t just a one-off good year (which has happened before under old mgt).

Profitable now, PAT is £0.5m - nothing to write home about, but this is a breakthrough after years of losses. I’m not sure why the company references PAT, not PBT. Maybe it gets an R&D tax credit? Tax should be negligible in future anyway, due to brought forward losses.

Cash looks very healthy at £6.8m, no doubt helped by getting roughly 20% on contract signings. So I don’t think we need to worry about any more dilution.

My opinion - this looks excellent, and is playing out exactly as I hoped.

The 17% rise today looks justified, and bear in mind that’s only added about £6m to the market cap. It’s still cheap in my view, given the positive industry tailwinds, and COG’s expertise in a niche with barriers to entry.

Although we should remember that we’re in a much more sceptical stock market, that is reducing valuations on growth companies. Although COG never reached a lofty valuation in the first place, so that doesn’t worry me.

I regard COG as a classic turnaround, of a company with considerable expertise, now being enhanced from the introduction of a much more commercial CEO, Matthew Stork. That combined with lovely industry tailwinds. And a reasonable valuation still, I must top up when funds permit, and it remains a core long-term holding of mine. So far, so good!

Tailwinds - although partially offset by delays - could that be a longer term opportunity as delays reduce in future? Maybe, I don't know -

The pandemic has provided a catalyst for the growth in adoption of virtual clinical trials as pharmaceutical companies shift to measuring patients at home more1, which has been of benefit to the Company, but this has been offset to a certain extent by some delays to trials, mostly due to more cautious, slower patient recruitment. These trends are expected to continue in 2022.

The underlying market for the measurement of electronic outcomes in clinical trials was reported to be growing at 17% in 2021. The Company results were ahead of this underlying market growth. The 2021 performance provides a strong platform for further growth as the Company continues to develop and commercialise its innovative digital assessments, primarily for clinical trials.

.

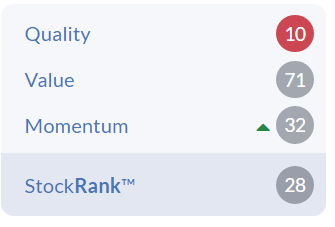

The 1-year chart shows a nice rebound from recent indiscriminate sell-off -

.

The StockRank is currently low, but I would expect this to improve. COG does look expensive on a PER basis though, so it's not well suited to the StockRank system!

.

Eagle Eye Solutions (LON:EYE)

Up 5% at 605p

H1 Trading Update (and US customer win)

Eagle Eye ( LSE: "EYE"), a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, is pleased to provide an update on the Group's trading for the six months ended 31 December 2021 ("the Period") and announce the signing of its fourth U.S. customer, Giant Eagle.

“Continuing strong growth, high profile wins and customer expansions, plus record sales pipeline and growing recurring revenue, provide confidence for a successful year”

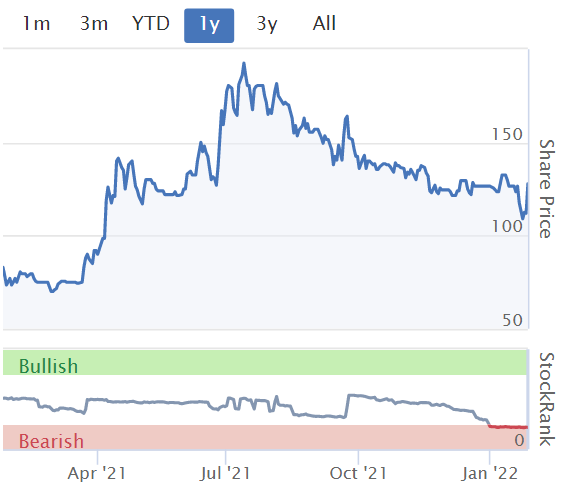

I like the very strong organic growth here, but not the focus on EBITDA - it’s not real profit here, because the company capitalises a lot of costs. For example, last year FY 6/2021, adj EBITDA of £4.2m turned into just £0.1m profit before tax! It wasn’t just the heavy amortisation charge of development spending, but also management swiped £877k last year in share-based payments. Leaving shareholders with no profits at all after tax.

Here’s the H1 trading update highlights -

.

Cash has been tight for a while, but is better than a year earlier.

Commentary - as always, this is upbeat. It mentions the growing new business pipeline. There’s a substantial new US client win, Giant Eagle.

Outlook - sounds positive -

Board confident in achieving results for the full financial year ahead of management expectations

My opinion - it’s a very interesting company, and has such an impressive, growing client list of large retailers, worldwide.

The only difficulty, is how to value the shares? Since valuation is detached from any traditional metrics (as it doesn’t really make any real profits yet), I’m completely at a loss as to how to value this share.

At around 600p currently, the market cap is about £156m. Is that too high, or too low? Nobody knows, because it ultimately depends on how the business develops in the next few years.

Speculative tech is exactly the area that’s de-rating the most in valuation at the moment, and has been in the US for almost a year now. So I’m worried about touching anything right now which relies on hopes of future growth to support pretty much the entire market cap, which seems to be the case here.

So I’m positive on the company & its prospects, but it looks far too expensive to get involved at this stage, for me personally. I know some investors will say that’s the wrong way to look at it, and I can see that point of view - if you find a company that is doing something special, sometimes ignoring valuation can be the right approach long-term. But sometimes it's a ruinous way to destroy your portfolio, chasing growth at any price, when euphoric conditions come to an end.

It's incredibly difficult to know what to do - run a winner, or bank the profits after a great run, reflecting deteriorating market conditions for growth shares. It's exactly this type of situation where I find that top-slicing a bit, and hold onto the rest, can be a nice compromise. That's for each individual investor to decide of course - your money, your choice. I like top-slicing, because then whatever happens, you can claim victory!

.

.

Cloudcall (CALL)

That’s it, the shares have now de-listed, due to the takeover bid from Xplorer Capital Growth I, LLC having completed. We get 81.5p in cash, in what is actually not a terrible outcome, considering how the company missed targets every year, and repeatedly raised & burned cash in its life as a listed company.

In the most recent update, no doubt in order to give us a kick to vote for the takeover, management said it would burn through the existing cash pile, and need more funding. As a fellow shareholder quipped to me on WhatsApp, “That’s the first time in its history the company has been honest about its cash burn!”

Looking back, I’m amazed to see that Cloudcall (previously called Synety) has been on AIM for almost 10 years! It might be helpful to post some thoughts on what I’ve learned from this experience since 2012.

Synety was little more than a startup when it reversed into a cash shell in 2012 (H1 revenues only £194k)

The product has always been quite good - web telephony integrated into CRM systems, I use it myself.

Cash burn has been unrelenting since day 1, and never declined as forecast - the fundamental flaw being that management kept adding to overheads, so the operational gearing from growth never fed through into profitability.

Growth was never fast enough to reach critical mass and become cash generative, constantly missing ambitious targets.

Ludicrously over-confident management, Simon Cleaver, repeatedly given the benefit of the doubt (and more money) by me & other investors, despite constantly missing targets.

Repeatedly (over years) claimed to have enough cash to reach breakeven. This was not true. A placing usually followed shortly after these reassurances, always justified by increased development spending - I see this as a big warning sign now.

I definitely got too close to management, so need to keep my distance in future.

Reporting focused on KPIs, which always told a good story, obscuring the reality of unrelenting losses & cash burn.

So if I see characteristics like the above again, I try to avoid small, loss-making companies. The only exceptions now, are those that are poised to reach profitability soon, and growing very strongly (e.g. Sosandar (LON:SOS) [I hold]).

Rather than buying the interesting-sounding small growth shares, I now just monitor a few of the most convincing-sounding, waiting for a realistic tipping point, where success looks assured. That avoids the horrendous losses that usually occur as these shares burn cash, disappointing, and repeatedly fundraising.

There are so many investment ideas that sound such good concepts, but actually scaling up a startup into a viable business, takes a long time, and is incredibly difficult. Entrepreneurs almost always under-estimate the costs & difficulty, and they never factor in enough overheads or support staff, to cope with a larger business. Hence why the early forecasts are almost always wildly inaccurate, especially on growth rates, and costs.

Having said all the above, if we look at the 10-year chart (below) for Cloudcall/Synety’s time on AIM, it’s certainly not been a disaster. Considering we’ve had 10 years of placings, dilution, and missed targets!

The share count is now 48m, which has risen 10-fold from the 4.9m shares shown in the interim results for FY 12/2013. Taken in that context, the share price below (current price shown as a dotted line) is actually not that shabby!

In conclusion then, I’ve learned a lot from this share over the last 10 years, and the final outcome is not a disaster by any means. So I’m happy to move on, with no hard feelings towards the company or management.

.

Jack’s section

Rbg Holdings (LON:RBGP)

Share price: 115p (+3.6%)

Shares in issue: 95,331,236

Market cap: £109.6m

(I hold)

Trading update for the year to 31 December 2021

The Board is pleased to announce that having completed a strong final quarter, it now expects adjusted EBITDA for 2021 to be approximately 10% ahead of current market expectations.

The board intends to pay a second interim dividend of 3p per share in respect of the six months to 31 December 2021 on 25 February 2022, bringing the total FY21 dividend to 5p (2020: 3p). That’s a 4.5% yield based on yesterday’s closing price of 111p.

Balance sheet ‘remains satisfactory’. Net debt of £14.2m (2020:net cash of £3.5m) following the acquisition of Memery Crystal in May 2021. RBG has paid back £1m of the £10m term loan used to fund the acquisition, with the remainder to be paid down over five years.

Furthermore, the Group has used £5.2m of the £15m revolving credit facility announced in April 2021.

RBG Legal Services - the group has combined the recently acquired Memery Crystal with its Rosenblatt law firm to create a new legal services entity (RBGLS). This entity now has two client-facing brands: Rosenblatt, which specialises in contentious legal services, and Memery Crystal, which focuses on non-contentious. RBGLS has performed well, benefitting from increased corporate and commercial transactions and greater breadth and depth of expertise.

The integration of the two support functions is largely complete and the business will now move to a new practice management software system. The move has so far resulted in a ‘sustained improvement in net margins of 29%, expected to rise towards 35% over the medium-term’.

Litigation Finance - there are two types of litigation assets here: RBGLS’s own client matters, and the third-party litigation matters funded by LionFish. Both have ‘significant return potential’.

In FY21, LionFish completed a further four investments bringing the total investments made by LionFish since its inception in May 2020 to 10, with a total capital commitment of £10.5m of which £3.6m has been deployed. Disposals since inception total £6.4m.

Convex Capital - the specialist sell-side corporate finance boutique has successfully rebuilt its transaction pipeline in 2021. A total of 14 deals generating revenue of £9.4m (2020: 2 deals, revenue of £1.6m) were completed in FY21, a strong recovery. This business can presumably be a bit feast and famine but the group says the pipeline remains strong, with 22 deals at various stages of completion.

Conclusion

I think the shares look quite cheap at these levels. RBG has performed well over Covid and is paying out nearly 5% in dividends in a period that has seen many payments to shareholders halted and equity significantly diluted.

The valuation remains modest - 10.1x forecast rolling earnings (pre-upgrades) compared to 15.9x for KGH and 14.5x for Gateley Holdings (LON:GTLY) . If you take the average of 15.2x and bring RBG in line with its peers, that suggests a share price of around 160p is achievable on a rerating alone.

There is a question of scalability, given that the acquisition strategy revolves around picking up companies whose quality is derived in part from the people that work there. It definitely has key person risk. Additionally, this part of the market may be more at risk than others from wage inflation.

Perhaps these concerns are weighing on the shares? Or perhaps the recent downturn in small caps presents an opportunity here. There’s an investormeetcompany presentation this morning, at 10am, which will be a good opportunity to hear from the CEO.

Wilmington (LON:WIL)

Share price: 238.65p ( +9.47%)

Shares in issue: 87,591,559

Market cap: £209m

Wilmington is a provider of data, information, education and training services in the global Governance, Risk and Compliance (GRC) markets.

Trading update for H1 to 31 December 2021

Wilmington ended the first half of the current financial year ahead of expectations for revenue, adjusted PBT and net cash/debt.

Double-digit organic revenue growth and adjusted PBT significantly up on the same period last year.

Net cash (excluding lease liabilities) was £11.0m with strong trading being augmented by the sale of the AMT Training business in December for £23.4m. All bank debt has been repaid.

Both divisions traded well in the first half, with events revenues returning to pre-pandemic levels. Strong first half trading and the return to face-to-face events means that profit for the financial year is expected to be comfortably ahead of expectations.

Diary date - full results for the six months to 31 December 2021 to be released on Monday 21 February 2022.

Mark Milner, Chief Executive Officer, commented:

Our divisions and teams are performing strongly. The resilient nature of our digital business delivery, the return of face-to-face events and our investment in new products and capabilities means we now expect profits to be materially higher this financial year.

Conclusion

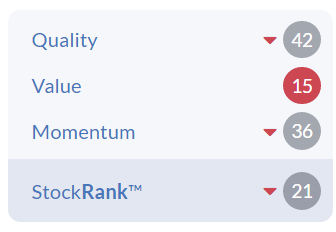

The recovery to pre-Covid share price levels is complete, but it’s worth noting that the group appears to have disappointed the market pre-Covid, back in 2018.

Wilmington has been on a bit of a journey over the past few years and has restructured, with a clear focus now on regulatory and compliance markets that offer structural growth opportunities. The group structure was simplified into two main divisions back in June 2021: Information & Data and Education & Training.

Results have been choppy over the past five years but Wilmington has remained cash generative, with no equity dilution and falling levels of net debt. So if it has got its house in order then this could be an interesting opportunity. It seems like a decent business at a decent price, with signs of improving operational momentum.

There could be additional upgrades as the year progresses. The StockRanks are weighed down by previous results, but if the company has changed then so too have its prospects. The liquidity scores are poor though, and the balance sheet is not the strongest. On balance, it’s probably worth taking this one a bit further.

Strix (LON:KETL)

Share price: 248.25p (-1.49%)

Shares in issue: 206,671,946

Market cap: £513m

Strix is back in SCVR territory, having given up most of its 1Y share price gains over the past six months.

This is a leader in the design, manufacture and supply of kettle safety controls and other water temperature management components.

Trading update for the six months to 31 December 2021

The Group has achieved circa 30% revenue growth on a constant currency basis and profit after tax in line with market expectations for 2021.

Market expectations are for profit after tax of £31.4m according to FactSet. Well done to Strix for including this, it’s a small but important detail that many others gloss over for some reason. Clearly, it’s an important reference point to include.

The performance underpins management’s medium-term target of doubling revenue by the end of 2025, primarily through organic growth in its Water and Appliances categories. An important driver will be new product development initiatives. That’s something the newly appointed chief technology officer will no doubt help with.

An example of this new product development:

Strix also continues to work closely with its key partners and own brands to bring technological innovation to the markets delivering core benefits in usability and sustainability to the consumer. The launch of the Induction kettle in December 2021 was an example of that which also won a highly prestigious German award for excellent product design.

On managing well-known pressures:

Strix continues to proactively manage and mostly offset the impact of a number of headwinds which continue to persist including supply chain, freight cost inflation and adverse foreign exchange rates. This is being achieved effectively through price increases on some of its legacy products, implementing hedging strategies as well as a range of other efficiency measures and strategic initiatives. Additionally, the Company crystallised a tax benefit in relation to the factory opening which is expected to result in a lower effective tax rate in 2021.

Kettle Safety Controls, Water and Appliance Categories

Continued positive volume growth here as Strix increases the number of specifications using its latest platform ranges and regions.

With the combined contribution of LAICA and HaloPure technology, the Water category has made solid progress. The trading performance of LAICA has been particularly strong, while HaloPure has now secured 14 contracts.

Within the Appliance category, Aurora (Instant Flow Heater/Chiller) is starting to show signs of penetrating consumer markets across the world and is performing ahead of budget.

Corporate and Operational Review

The new manufacturing operations within Zengcheng district in Guangzhou, China are now fully operational.This has doubled the group's manufacturing capacity enabling it to grow the business, increase efficiencies and implement further in-sourcing opportunities which are expected to have a positive effect on margins over the medium-term.

Financial Position

Net debt (excluding the impact of IFRS 16 lease liabilities) as at 31 December 2021 was £51m which is higher than previous guidance as Strix has invested to minimise the future impact of continued commodity price inflation.

The group says it has enough to continue with its capital allocation priorities and pursue the purchase of niche companies or technologies. I would want to investigate the financial position a little further, personally. It’s not too much in the context of a £500m+ market cap, but given the backdrop more of a cash buffer would be reassuring.

Diary date - The group will be announcing its preliminary results for the year ended 31 December 2021 on Wednesday 30 March 2022. We should see the balance sheet then.

Conclusion

An interesting company with growth potential, but there’s not enough in today’s update to tempt me away from the sidelines. Sentiment is poor and the market currently unforgiving, so I’m minded to just keep tabs on the share price for now.

There have been some chunky director sales recently, as well as an increase in short interest.

The share price has suffered more than most over the past six months. There are headwinds, and I note that Zeus is taking the opportunity to trim its forecasts (which were at the top end of consensus) not just for FY21, but for FY22 and FY23 as well.

The group needs to prove to the market that it can grow. This is what analysts anticipate, and what the company itself is guiding to with its ‘doubling of revenue’ ambition.

I think you can take this update either way. Revenue is up by 30% at constant currency and the group has been able to mitigate some of the pressure with selective price increases. And the new factory is a major positive moving forward. Free cash flows should increase in the years ahead as related capex spend falls away.

Ultimately though, I don’t think there’s enough here to redirect market sentiment. There’s a bit too much for sellers to hold onto, namely net debt higher than expected (albeit as a result of increased inventories) and ongoing headwinds. So I’ll continue to watch from the sidelines for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.