Good morning!

CMC Markets (LON:CMCX)

- Share price: 163.75p (+6%)

- No. of shares: 288 million

- Market cap: £472 million

This stock is of particular interest to me because I follow the sector, and currently have a long position in IG Group (LON:IGG).

This sounds good:

Profitability in H1 2018 is significantly higher than the same period in 2017 with both net operating income and revenue per client higher (and marginally higher than H2 2017), driven by increased client volumes.

Interestingly, the statement says there has been a small decline in active clients and that therefore, the improved financial performance helps to prove that CMC is focusing on higher-value, experienced clients.

This would be essentially the same as the IG strategy for the past several years. IG has had no interest in increasing active clients in the UK, instead only wanting to find and keep the most profitable ones.

It was a sound strategy but then it became very relevant when the FSA last December threatened to put leverage caps on retail traders in leveraged products. Along with other regulations, these rules would have had a particular focus on restricting how these firms are allowed to cater to inexperienced clients.

The regulatory threat smashed the share prices of all the stocks in the sector, although they have been recovering since then. CMC is up more than 50% from the low of 95p.

The threat hasn't gone away, but the FSA is certainly taking its time to figure out what to do next. It received more than 2,500 submissions in relation to the proposals, and has doubtless been wading through them.

On this subject, CMC says:

Regulation remains a key focus for the firm, and despite profitability in H1 2018 being significantly higher than the same period in 2017, the firm remains cautious about the future outlook given the ongoing regulatory uncertainty and the impact, if any, potential changes could have on Group performance.

I'm happy continuing to hold IG, which has the best international diversification and which I think would experience a strong boost to its competitive position in the UK from the new rules. I'm not sure if CMC would experience any competitive boost.

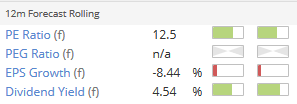

But CMC shares remain pretty decent value, still on a discount to compensate for this issue:

Harvey Nash (LON:HVN)

- Share price: 87.75p (-0.4%)

- No. of shares: 73.5 million

- Market cap: £64 million

After a lacklustre operating profit result for the previous financial year, these interim results are an opportunity for Harvey Nash to show it's back on the front foot.

It's a tech recruiter and provider of outsourced services, and its shares tend to trade on a discount against its peers. The PE multiple is currently a mere 7x.

A few of the H1 highlights:

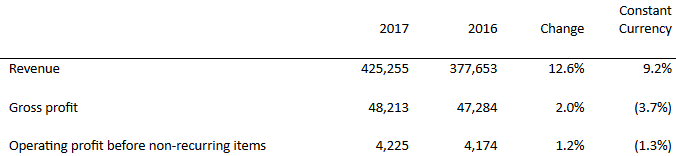

- Revenue and gross profit up 12.6% and 2.0% respectively

- Profit before tax before non-recurring items up 4.4%

- Interim dividend of 1.643p per share, up 5.0%

Scrolling further down the statement, the constant currency performance is again a bit softer versus the prior year:

Even though net income increased, arguably the operating profit before non-recurring items, at constant currency, is the most important measurement of group performance. And on that front, it recorded a 1.3% decline.

The reduction in gross profit at constant FX is explained as follows:

This was mainly due to changes in revenue mix with the strongest growth in profitable but lower-margin managed services, coupled with a slowdown in permanent hiring in the UK during the election period.

The financial performance as a whole is becoming substantially lower-margin.

On the positive side, Harvey Nash is implementing a cost-saving transformation programme, has moved to AIM where costs are lower, and has made a couple of acquisitions which sound interesting.

Net debt might be worth keeping an eye on, as it jumped up to £10 million by the end of the period and then a £6m cash acquisition was made.

My opinion

Harvey Nash says that it grew market share in the UK & Ireland region, which accounted for 38% of its net fee income.

The results are probably quite reasonable then, in the sense that Harvey Nash grew market share in the more difficult region, and did fine in Mainland Europe where conditions are presumably easier.

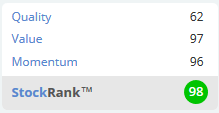

It offers a 5% dividend yield and is probably much safer than the typical AIM stock. And yes, the StockRank is 98.

Moss Bros (LON:MOSB)

- Share price: 97.5p (-2.5%)

- No. of shares: 100.8 million

- Market cap: £98 million

Trading at this suit retailer is in line with the Board's expectations.

I've selected these from the highlights as the most important:

- Total Group revenue, excluding VAT, was up 4.3% on the previous year to £66.6m.

- Group like-for-like* sales increased 2.8%

- Like-for-like* retail sales, including e-commerce were up 5.1%

- Like for like* hire sales, which represent 12.8% of total sales in the half on a cash taken basis were -8.4% down.

The problem area is clearly suit hire. Under current trading, this trend has persisted in the first 8 weeks of H2, although not quite so poor: minus 4.7% (again on a "cash taken" basis).

Reading through the statement, the company says that customers are choosing to buy rather than hire. So in other words, if hire sales hadn't fallen, then retail sales would have fallen instead.

Our store teams are increasingly focussed on offering solutions to customers for whatever their occasion or need, whether they choose to buy, hire or 'Tailor Me'. Whilst we cannot know for sure the original intention of customers coming to our stores, more customers are ultimately choosing to buy rather than hire their suits. This is in part reflected in the reduction in hire sales on a like-for-like* basis versus the previous year.

It's a difficult environment:

We remain acutely aware that market conditions remain tough, with a highly competitive retail landscape set to continue alongside an unpredictable economic back-drop. There are significant cost headwinds, driven by National Living Wage, the Apprenticeship Levy and weaker sterling.

Paul has pointed out before that like-for-like sales at Moss include refitted stores, making the comparison somewhat debatable.

Last year, Moss refitted 11 stores and opened 7 new ones. In H1, it refitted 4 stores, and opened 4 new ones. The total number of stores is 129, and at least the 15 refitted ones will be included in the like-for-like calculation. I still think the company's reported like-for-likes are important number, but it's worth bearing this in mind. The numbers would have been worse without the 15 refitted stores.

Moss still managed to grow operating profit from £3.6 million to £4.2 million, and cash was stable at £21 million despite £4 million in dividend payments.

My opinion

I quite like the proposition here. It seems conservatively run, not just in terms of the cash balance but also in terms of the store portfolio. It had 124 stores in January 2016, so the net increase is just 5 stores in 18 months.

Tactically, I don't think I'd buy the shares just yet. The company's USD requirements are hedged out to Spring/Summer 2018 and when those hedges expire, I wonder if margins might take a hit. So I think we might get cheaper opportunities to buy into the story here..

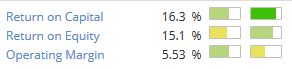

All that being said, the StockRank remains very high at 92, including some above-average quality metrics:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.