The proposed Republican reduction in the corporate tax rate in the US appears to be reaching its denouement. There are currently 2 tax plans at House and a Senate version

The next step in the legislative process is to reconcile the two versions. The obvious over-riding positive is the reduction in corporate tax rates to 20% from 35%, which directly impacts Somero’s bottom line. When this rate reduction would become effective isn’t clear yet - the House version proposes 2018 while the Senate version proposes 2019. Given budget deficit implications, one would assume the rate reduction wouldn’t be phased in until 2019 although the ever bullish Mr Trump is assuming they come in on 1st Jan 2018.Expect further late night tweets on this subject !

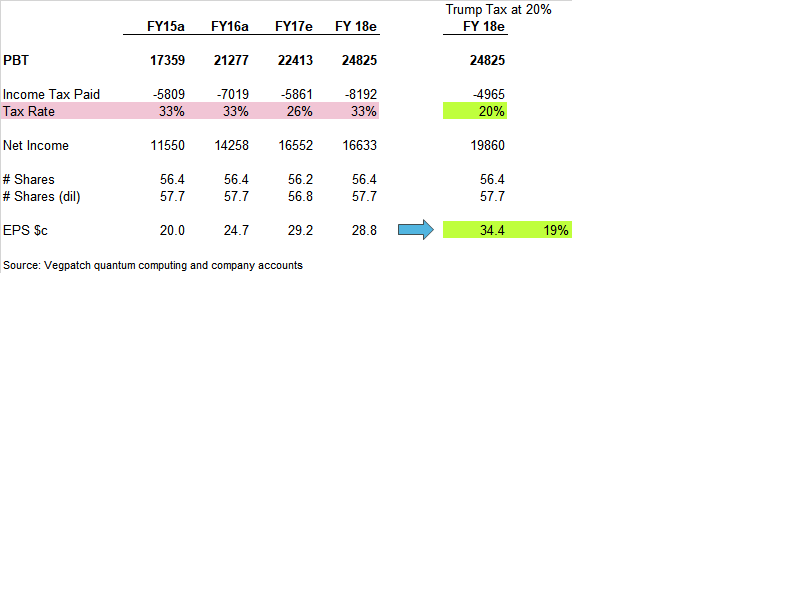

For Somero, using FY18 estimated pre-tax income of $25m (my VegPatch estimate, treat with caution!), the rate reduction equates to over $3m in tax savings, or about $0.06/share. In addition, the more generous capital equipment expensing rules should encourage faster investment in equipment, though primarily impacting the timing of equipment purchases by customers.

Putting the tax saving on a Group rating of c10x PE = 6c or 4p * 10 = 40p of upside.

The reconciliation process is expected to move rapidly so this should become clear soon.

I have emailed the Somero FD John Yuncza his response was "We can’t see any notable negatives from either bill."

I remain a holder.