This article has been updated to include all the main announcements and analysis following the Chancellor's statement today.

Welcome to our coverage of the Spring Budget.

It’s strange that in a pre-election budget (an election that does not look like it is going to go the way of the incumbent party) the Chancellor does not feel able to be bold.

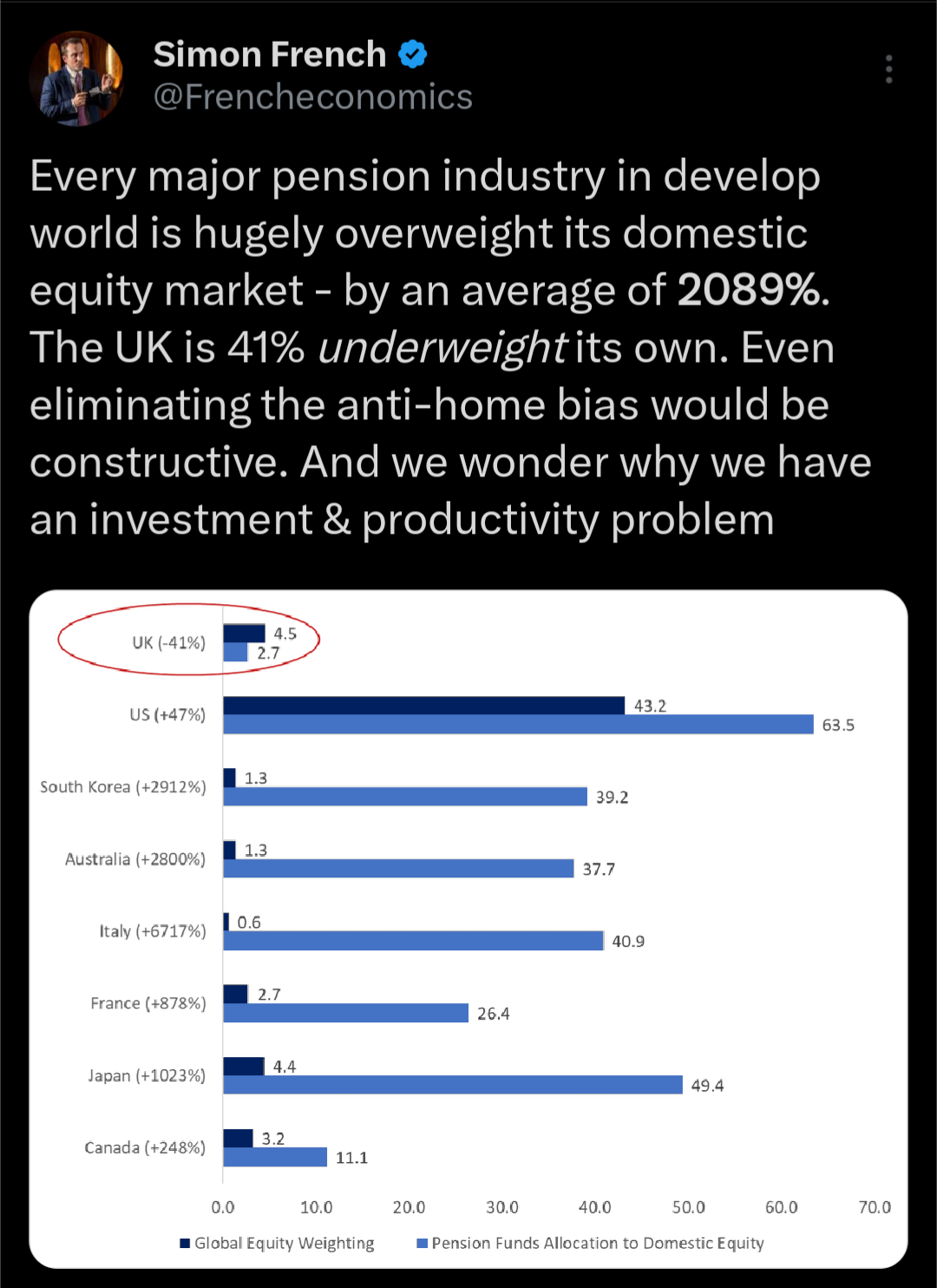

“Growth” is the tagline of choice for Jeremy Hunt but growth opportunities are thin on the ground in the UK and today’s announcements don’t sound like they are going to do much to stimulate change. Key takeaways for investors are the announcement of a British ISA and a handful of minor tax adjustments which will impact certain sectors. But this was an uninspiring announcement, devoid of any measures that will truly stimulate some much needed excitement in the economy.

Updates from the Office for Budget Responsibility (OBR) have confirmed that inflation has fallen to 4% (from 11% when the Chancellor and Prime Minister took office) and will dip below the target 2% in just a few months time (well ahead of the timeline set out in last year's statement). This should give the markets some hope that interest rate cuts will soon be on the cards, providing some much needed stimulus.

But while Britain’s economy goes through what is described as a very ‘mild’ recession, its economic growth lags behind many of its international peers, as can be seen by the OECD GDP growth chart below. The European Union narrowly avoided entering a recession last quarter (Q4), however, the UK has a lot of work to do if it wishes to catch up to the growth rates seen across the pond.

Source: OECD

In this budget, Mr Hunt shied away from any decline in the headline corporate tax rate (a change that many economists suggested could bolster investor sentiment and stimulate investment). Instead, the Chancellor has targeted incentives for investment, including applying full expensing to leased assets - the previous announcement of full expensing has been described (by Mr Hunt) as "the most attractive tax regime in the G7". I am less convinced that it provides more of a growth stimulus than a corporate tax rate cut.

Beyond this minor tweak to expensing and some impressive…