I remember looking at Computacenter’s results back in 2012. For some reason, I didn’t buy any shares at the time, despite the fact that the stock had survived the credit crunch without a dividend cut and looked very reasonably priced.

I don’t remember why I didn’t buy any Computacenter shares, but I am certain I was wrong. That’s why I now keep a written record of my investment decisions.

You see, Computacenter is a highly successful ‘picks and shovels’ investment. It provides the data centres needed for large companies to operate their IT infrastructures. Customers include John Lewis, Nationwide Building Society and Morrisons, according to the firm’s website. Computacenter also has significant operations in France and Germany.

The firm’s performance has been impressive. According to Stockopedia’s figures, over the last ten years, Computacenter has delivered an average total return of over 10% per year (share price return plus dividends).

The firm’s performance has been impressive. According to Stockopedia’s figures, over the last ten years, Computacenter has delivered an average total return of over 10% per year (share price return plus dividends).

The value of quality

With the benefit of hindsight, the aftermath of the financial crisis presented investors with the chance to pick up some bargain stocks. Shares in Computacenter dropped as low as 84p in 2009 - they now trade at around 756p.

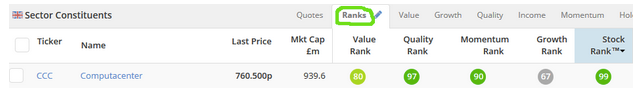

That kind of value isn’t on offer today, but Computacenter shares still don’t look especially expensive. Stockopedia assigns the firm a ValueRank of 80. This is the lowest of the three ranks which make up Computacenter’s StockRank of 99, suggesting the firm could be a genuine Super Stock.

As always, it pays to look at the values of the individual factors which make up each rank. You can do this by clicking on any of the individual rank numbers on the ‘Ranks’ tab on any page with a list of companies, such as the Technology sector page:

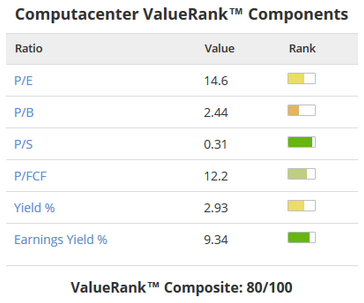

Computacenter has no obvious weak points:

The nature of Computacenter’s business is to add value to the hardware and software assets it owns. This means a high price-to-book ratio is acceptable.

A trailing P/E of 14.6 looks reasonable and is below the FTSE 350 average of 17.2. A price-to-free cash flow ratio of 12.2 makes the valuation seem even more appealing. Relatively few companies can deliver solid earnings growth and generate this much free cash flow.

Although Computacenter’s yield is an unremarkable 2.8%,…