Does limiting your investment to companies with high StockRanks mean you miss out on some profitable buying opportunities?

The answer to this is almost certainly yes. But I think it’s the wrong question.

The right question is whether the StockRank system can help you avoid bad investments. After all, you don’t need to invest in every good stock. It’s often much more profitable to simply avoid investing in bad stocks.

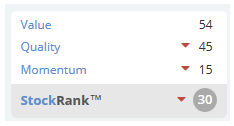

Utilitywise is a case in point. Is it an attractive investment at current levels? There are strong arguments on both sides, but a StockRank of just 30 suggests it may not be.

In this week’s column, I’m going to take a look at why Utilitywise scores comparatively poorly against Stockopedia’s StockRanks.

I’ll also look at the arguments in favour of this company. After all, with top fund manager Neil Woodford on the shareholder register holding a 26% stake, Utilitywise must have something in its favour.

What’s the big deal?

The controversy starts with the Utilitywise business model. The firm essentially acts as a bulk-buying middleman for business customers. It claims to be able to offer customers cheaper rates for utilities than if they go direct to the big energy and telecoms firms.

According to the firm’s website, it manages over 20TWh of power for more than 27,000 businesses across the UK. Utilitywise makes money by receiving commission payments from energy and water utilities, in return for providing them with new customers.

These commission payments have historically been generous enough for Utilitywise to generate operating margins of more than 20%. This gives rise to an obvious question. With such high profit margins, will the energy suppliers one day decide that they are paying companies such as Utilitywise too much for each new customer?

We don’t know. But in my opinion, there are several potential risks here:

- Utilitywise salespeople might find themselves in a position where they have to choose between maximising commission payments and maximising customer savings;

- Regulatory changes could result in a dramatic fall in commission payments;

- Utility companies might decide to spend more on marketing in-house and reduce payments to middlemen like Utilitywise.

All of these risks could one day result in a dramatic fall in the profitability of Utilitywise’s business model.

Is it cheap?

Does Utilitywise’s valuation reflect investor uncertainty about the firm’s long-term profitability? A ValueRank of 54 suggests not.