I last looked at bathroom fittings firm Norcros in September last year. At the time I flagged up the stock’s apparent combination of strong value and momentum. I suggested this could deliver good results.

Nine months is a short timeframe, but the markets have not turned in my favour so far. Norcros shares are worth 11% less today than they were when I last wrote about them. So why am I planning to add Norcros to the Stock in Focus portfolio?

Firstly, I should point out that like my other SIF portfolio buys, Norcros qualifies for my Stock in Focus screen. In fact, this stock has been a constant presence in the screen since day one. With a StockRank of 91, the numbers suggest that there is a lot to like.

A second reason is that Norcros results in the period since I last wrote about the firm have been fairly decent. Paul Scott has reviewed November’s interim results and the more recent year-end trading update in detail. But in brief, trading appears to be solid. Norcros has made several attractive small acquisitions in line with its buy and build strategy. The firm’s figures haven’t flagged up any new problems and have included a welcome 10-year settlement relating to pension deficit overpayments. There’s no obvious reason why the shares should be worth less.

Institutional support is also pretty solid. Highly-regarded small cap specialist Miton Group is the biggest shareholder, with a 14.96% stake. Other big shareholders include Hargreave Hale and Fidelity. Chief executive Nick Kelsall has a 1.3% stake that’s currently worth about £1.4m.

A final temptation is that Norcros is the most recent stock to qualify for the Winning Growth & Income screen. Over the last three years, this has been the third-most successful Stockopedia Guru Screen, returning an impressive 80.9% plus dividends. Could Norcros be the screen’s next big winner?

Value in detail

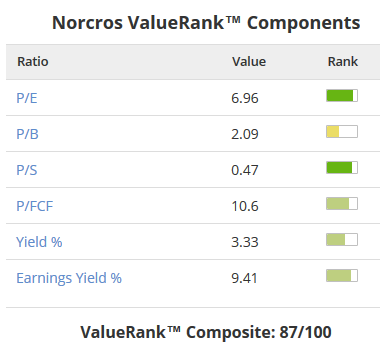

At the time of writing, Norcros has a ValueRank of 87. Drilling down into this as I always like to do, we can see that the stock looks cheap across the board:

The only exception is the price/book ratio, which is not obviously cheap. I’m not too concerned by this. Norcros…