Sainsbury pushed negotiations down to the wire, but on Tuesday the supermarket group finally made public the details of a possible £1.3bn offer for Home Retail Group.

For Home Retail shareholders, I believe this is a good potential offer. If the proposed deal goes ahead, Home Retail investors will walk away with cash and Sainsbury shares worth 161p at the time of writing.

If Sainsbury shares don’t appeal, then Home Retail shareholders can sell into the market for around 150p. This equates to a 53% gain since the start of 2016, and prices Home Retail shares on 17 times 2016 forecast earnings. That seems generous for a low margin retailer with an uncertain outlook.

The big question, of course, is whether this is a deal that will enrich Sainsbury shareholders. The supermarket was one of Stockopedia CEO Ed Croft’s NAPS selections for 2016. It’s also a popular income stock and is the best-performing listed supermarket of recent years.

As a result, I suspect many private investors will be trying to work out whether this is an attractive deal. In this week’s column I’ll try and answer that question. By combining an understanding of how Stockopedia ranks Sainsbury with the details of proposed offer, we’ll hopefully be able to draw a sensible conclusion.

Solid foundations

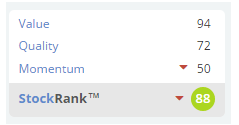

Let’s start with a look at Sainsbury’s quality credentials. The supermarket has a StockRank of 88 and a QualityRank of 72.

The group’s main weakness in terms of quality is its low profitability. A long-term return on capital of 8.1% isn’t too bad, but the 5-year average net margin of 2.1% is uninspiring.

Things seem unlikely to improve soon. During the first half of this year, the supermarket’s sales fell by 2%, despite a 3% rise in transaction numbers and volume growth of 1%. Return on capital employed fell from 11.1% to 9.1%. It’s a tough market.

Despite this, Sainsbury doesn’t seem to have any fundamental problems. The stock has a Piotroski F-Score of eight out of a possible nine. That’s a tribute to effective management, good cash generation and relatively modest debt levels -- net gearing is under 20%.

If I was a shareholder, I’d be keen for management to preserve this low debt advantage. Luckily, the…