If you’ve followed the investing press in recent years, you may be under the impression that GlaxoSmithKline is an underperforming laggard that’s fallen off a patent cliff.

The truth is rather different. Glaxo shares have delivered a total return (dividend plus capital gains) of 52.8% over the last five years. During the same period, I estimate that the FTSE 100 has delivered a total return of about 15%.

Perhaps this is why Glaxo is one of very few big cap stocks to qualify for several of Stockopedia’s more successful value and quality investing screens.

Isn’t it too big?

I can already sense suspicion from Stockopedia’s devoted band of small cap investors! Surely lumbering elephants like GlaxoSmithKline are doomed to underperform their smaller, nimbler siblings?

Apparently not. Here’s a summary of Glaxo’s returns since 2011:

- Closing price 4 Feb 2011: 1,171p

- Capital gain (@1,363p): 16.4%

- Dividends paid: 426p (36.4% return)

- Total return: 52.8%

If nothing else, this is a dramatic reminder of how dividends often form the bulk of investors’ returns. It also suggests that investing in good quality dividend stocks and then doing nothing can be a good way to beat the market.

On the other hand, many small and mid-cap investors have done much better than 52% over the last five years. A fair number of stocks have delivered gains of more than 100%. Ed Croft’s NAPS portfolio returned 43.4% last year alone.

Is GlaxoSmithKline worth considering as a buy, or is it simply too large to deliver market-beating returns?

Deceptively good value

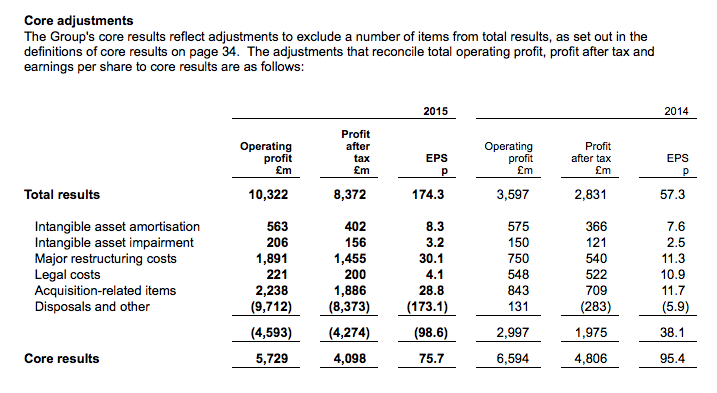

Using Glaxo’s preferred measure of core earnings per share, the stock trades on a trailing P/E of 18. It certainly doesn’t look cheap and a ValueRank of 37 appears to confirm this view.

However, there are two value metrics on which Glaxo scores very highly. The stock has an earnings yield (EBIT/EV) of 13.8% and a trailing dividend yield of 5.9%. These are very attractive figures, without being outlandishly high.

Historically, another of Glaxo’s big strengths has been that its generous dividend has been covered by free cash flow. Last year wasn’t a great year for the firm and free cash flow was poor. The 80p dividend was not covered by adjusted earnings or free cash flow.

However, the Stockopedia figures show that over the last six years,…