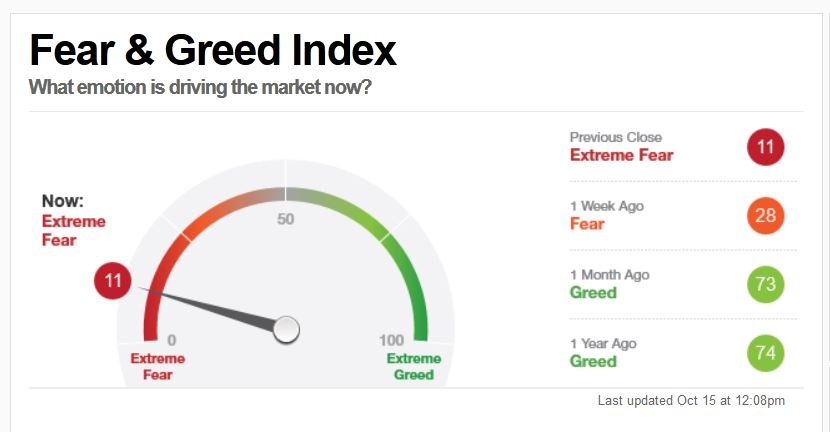

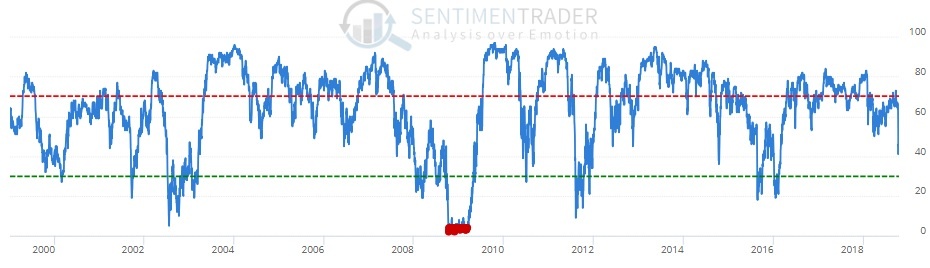

What you see above is the Fear&Greed Index you find on CNN. The index indicates whether investors are currently very optimistic - or if they are afraid. It is easy to see that they have become very anxious. The index is only 11 out of 100 possible points, last week it was even at 6. This is the result of the correction we are currently experiencing on the world's stock exchanges.

What am I gonna do now? I am back in the game since I stood on the sideline with cash since the beginning of the year. The reason why I get back in the market is simple – there is a rule: If the Fear&Greed index falls below 18 then stocks are especially cheap. It is worthwhile to buy now. Or as Warren Buffett once said: „Be greedy when others are fearfull.“

So today I opened up some positions. I am a long-term investor and I follow an approach that I would call QARP (quality at reasonable price). It is inspired by investors like David Dreman or Warren Buffett and the tools for screening for those stocks are here at Stockopedia. Dreman and Buffett are both pursuing an approach that makes sense to me. They are looking for good quality companies that are financially stable and for which they do not pay too much. In a correction as we are experiencing, in my opinion this strategy is ideal.

How about you? Are you in the process of rebuilding positions? Or do you still wait? Are you expecting a real bear market? Or do you believe it is “just” a correction and share prices will recover again soon?

Looking forward to hearing your opinion.