Sylvania Platinum (LON:SLP) was pitched to the Stockopedia Investment Club on 23 April 2020 when the share price was 38.7p. At the time of writing, approximately five months later, the share price is 76.3p. That is a material rerating and a 97% gain over that timeframe.

And yet even now Sylvania's Value scores are striking, with a forecast PE ratio of 4.4, a forecast PEG of 0.4, and a price to TTM free cash flow of 5.0. You might argue it continues to be cheap, but there are also valid risk reflected in this valuation which we will explore below.

The April pitch to the Club was that Sylvania was priced incorrectly and was due a rerating. Here we revisit that pitch and update it for new information as we explain why we have not sold this Platinum Group Metals (PGM) play quite yet.

Are we right to hold on, or should the Club bank profits while it can?

TL;DR

Sylvania Platinum, a small-cap PGM producer with operations located in the South African Bushveld Igneous Complex, offers striking value and exposure to growing markets such as electric vehicles.

- Bull Points: Low-cost producer, strong PGM demand and spot prices, cash generative, broad factor exposures, qualifies for nine Guru Screens, developing exploration assets

- Bear Points: operational disruption, depressed chrome market, dependence on host mines, profitability driven by PGM spot prices, finite life and lack of scalability of dump operations

Profile

What is the opportunity type?

Sylvania Platinum produces and sells 'Platinum Group Metals' (PGM), which are platinum, palladium and rhodium. It is a small cap Super Stock in the Basic Materials sector and comes with a Speculative RiskRating.

With a market cap of £190m, a share price of 76p, and an EMS of 20,000, liquidity is not so much of an issue as you can buy around £14,000 without moving the market.

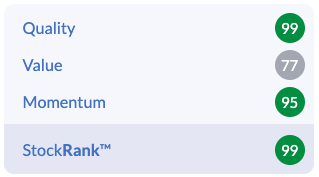

The StockRank is 99 thanks to strong Ranks across the board, with a Quality Rank of 99, a Momentum Rank of 95, and a Value Rank of 78.

Trends/Market/Competition

Competition

Sylvania operates with a natural geographic moat, as PGM metals can only be mined in a few locations. This means both competition and opportunities are relatively scarce.

Competitive advantages

Sylvania has two distinct lines of business: the re-treatment of PGM-rich…

.jpg)