When you strip back all the political and economic turmoil of Brexit, 2019 turned out to be a solid year for UK shares.

That said, things got off to a shaky start. Markets were trading close to new lows as January 2019 got started. But that proved to be the bottom, and the mood turned bullish almost straight away. In fact, this time last year the market was risk-on with investors flooding back into shares.

In the end, it wasn’t quite a vintage year for PIs, but positive momentum was the prevailing trend. A last gasp, post-election rally in the final weeks took the small and large-cap indices up to between 11 and 14 percent for the year. That wasn’t a bad result given the economic unease that still hangs in the air.

But for many savvy investors in the Stockopedia community, 2019 proved to be much more profitable than that.

In recent years we’ve been keen to take the pulse of Stockopedia users. We’ve wanted to find out how confident they are feeling, and of course, how they’ve performed. Last summer, this routine check-up discovered some aches and pains. Markets were labouring and equities were under pressure. Stockopedia’s StockRanks were only moderately outperforming. But in our latest survey, covering nearly 1,200 subscribers, we’ve found things are much healthier...

Stock markets bounce back

In the 2018 Subscriber Performance Survey, published last year, it was clear that the going was pretty tough. Falling markets and moderate StockRank outperformance had combined to put pressure on subscriber portfolios. Back then, just over 50% said they’d outperformed or significantly outperformed the market since subscribing to the service, while 18% had underperformed or significantly underperformed.

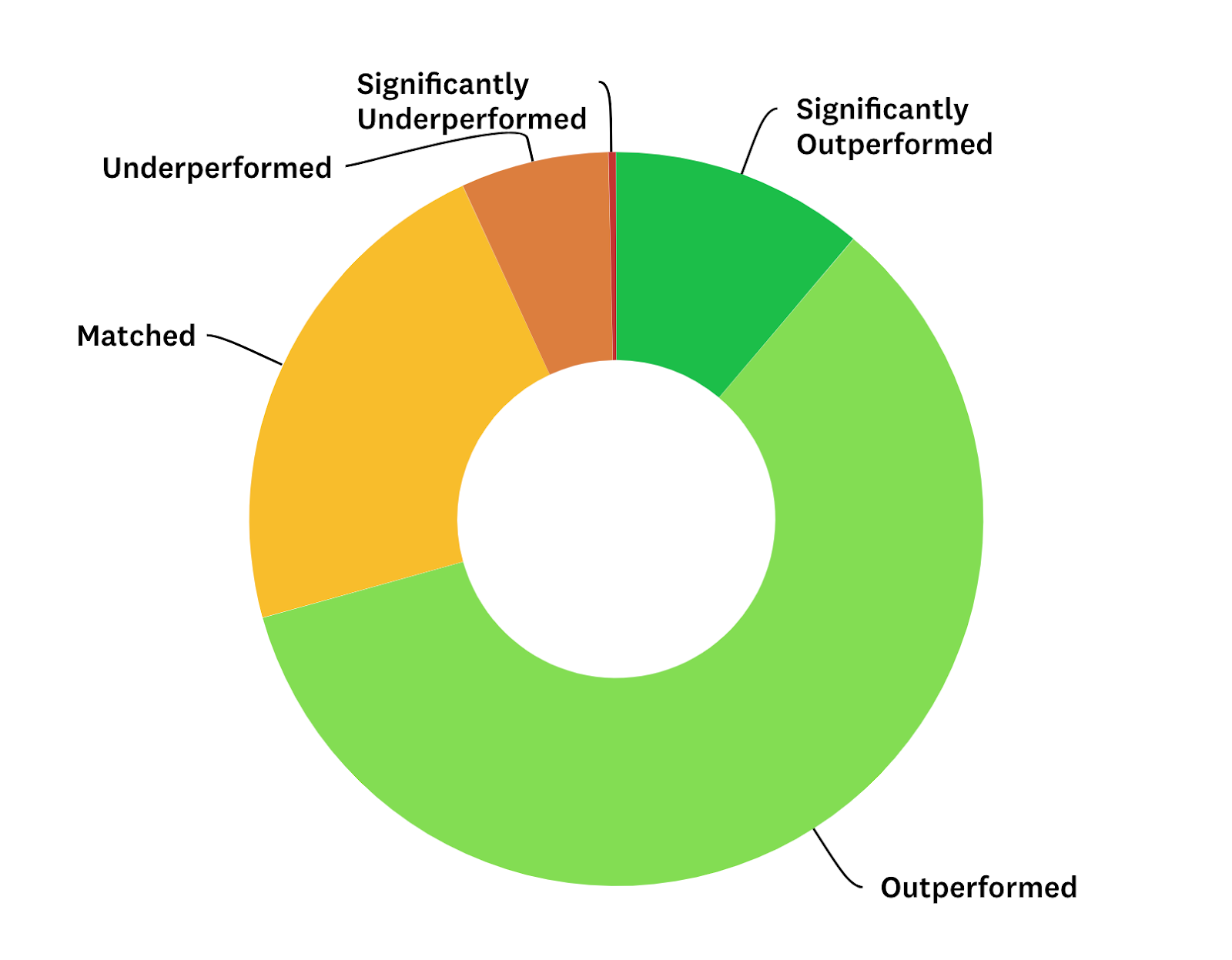

In 2019, the results were much more upbeat. Seventy percent of respondents said they’d outperformed or significantly outperformed the market since joining Stockopedia, with 22% matching the index and just 8% underperforming it.

Since subscribing to Stockopedia has your performance outperformed, matched or underperformed the market?

Another big change between 2018 and 2019 was the scale of the average outperformance. In 2018, 45% of respondents said their portfolios had fallen in value by up to 20%, but only around 4% said the same in 2019. As you’d expect, it looks like it was harder to lose money in last year’s buoyant conditions.

In terms of winners, just over…

.png)

.JPG)