Investors are turning their eyes towards Europe. As early as April 2014, an article in the Financial Times, titled 'Flying Pigs', noted that 'countries on the edge of Europe have long been out of favour with investors, but interest is reviving in these markets as share prices rise and economic conditions continue to improve.' Indeed, the FTSEurofirst 300 Index has appreciated by nearly 25% over the last year, while the FTSE 100 has risen by just 7%. Investors may be wondering whether there are still good value stocks to be found on the Continent. We covered Greece in a recent article which can be found here. This week we turn our attention to Spain.

Is Spain still cheap?

Investors could use the CAPE ratio to assess where a company is in the economic cycle. The CAPE, or cyclically adjusted P/E ratio, is defined as price divided by the average of ten years of earnings. It therefore seeks to smooth out the economic cycle and allow for better comparisons over time.

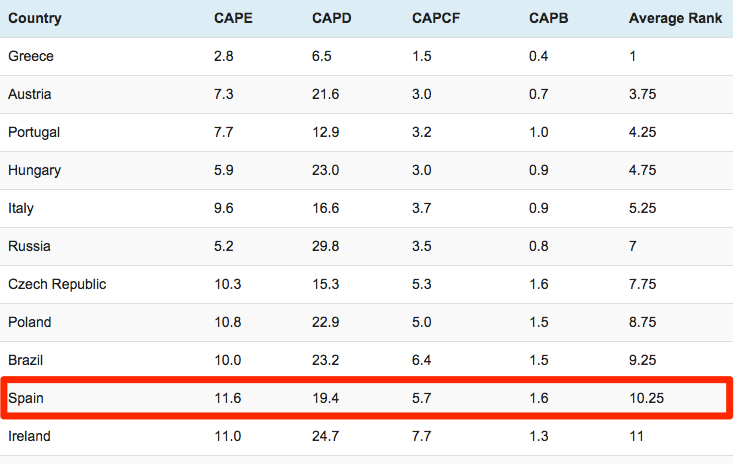

Research by Meb Faber shows that the average CAPE for Spanish stocks is 11.6 - cheaper than the UK (12.1), Germany (15.8) and the United States (23.6).

But there are many ways to skin a cat. Investors can also assess the value of a stock by using the following metrics:

- CAPD: Cyclically-adjusted price/dividend ratio;

- CAPB: Cyclically-adjusted price/book ratio;

- CAPCF: Cyclically-adjusted price/cash flow ratio.

These three data-points are calculated using a similar method to the CAPE, but rather than compare the cyclically-adjusted price against the PE ratio, they compare the price against stocks' respective dividend, cash flow and book values.

Meb Faber has calculated a composite rank based on these cyclically-adjusted metrics. He has analysed over 40 countries and suggests that Spain is the 10th cheapest (see table below).

It is not difficult to understand why Spain is so cheap. Its economy is stuck in first gear and unemployment remains at over 20%. But has the market overreacted to this news? Let's take a closer look by analysing several high

StockRank Spanish stocks.