Wincanton is one of the more controversial stocks in Stockopedia's discussion stream. This logistics company sparked an intense debate between Ed Croft and Paul Scott earlier in the year, mainly because the company has "one of the worst balance sheets" that Paul has ever seen; however, it retains a very high StockRank (97) and has returned about 150% since it first entered the 90+ StockRank bucket. The price trend appeared to support Paul's argument between early February and late April, when Wincanton's share price dropped by around 9%.

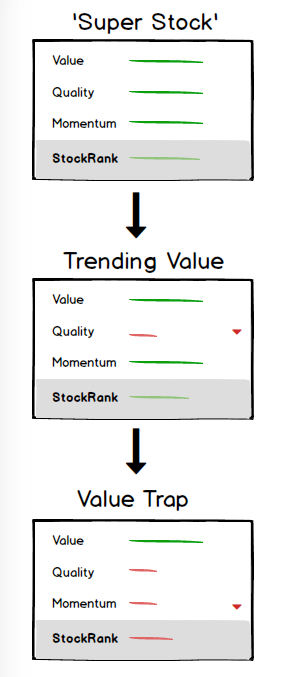

Nevertheless, the share price has rebounded in recent weeks, appreciating by 18% since 1st May. Prices have a tendency to follow a random walk over the short-run, but over the long-term good, cheap and improving stocks have had a tendency to beat the market. Is Wincanton really a super stock or is it a false positive ?

Do balance sheets matter?

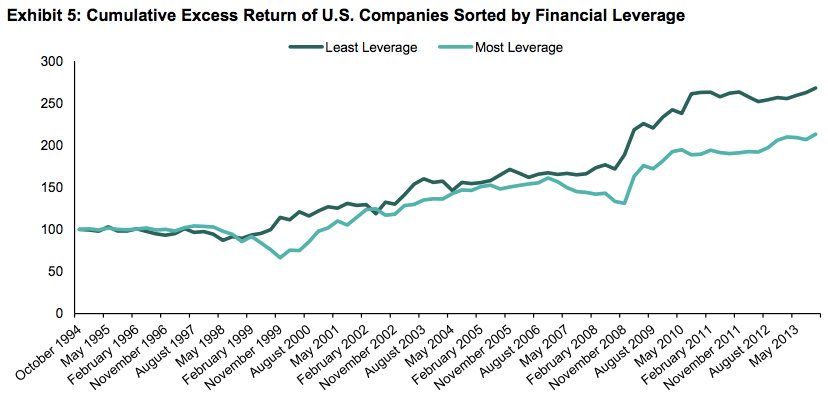

Financial health is an important aspect of quality. Poor quality companies tend to have deteriorating fundamentals and face higher bankruptcy risks. Is Wincanton a risky stock? According to the Altman Z-Score, Wincanton does have a high risk of bankruptcy. Is this a problem? Research by S&P suggests that 'lowly-geared companies beat highly geared ones by about 1% per annum'. Indeed, the chart below suggests that lower indebtedness offers greater downside protection during recessions, when weaker companies could go to the wall. For example, notice how companies with the most leverage fell harder during the bear market of 2007-08.

Falling Quality

Wincanton may have a poor Z-Score, but around twelve months ago, investors who were bullish about the company may have pointed to Wincanton’s F-Score. The Piotroski F-Score was designed to identify companies with improving fundamentals - for example, an improving balance sheet. In July 2014, Wincanton had a strong F-Score (8 out of 9), so the bulls may have argued that Wincanton had a weak balance sheet, but was nevertheless improving its capacity to service debt. However, the F-Score has now fallen from 8 to 6, and the firm's ability to pay short term debts has decreased. Wincanton's current ratio improved between September 2013 and July 2014. But since then the current ratio has fallen from 0.75 to 0.66.

This is part of a wider trend whereby…