In recent weeks I've noticed a few comments about the applicability of using the StockRanks across sectors on the discussion boards. One subscriber asked the question:

“What we (or at least I) don't know is whether the performance by sector is equal.”

This is a very valid question. As most will know the StockRanks use the same set of quality, value and momentum factors for every stock in the market regardless of sector. This isn’t really at all optimal. There are some ratios and metrics that are more appropriate for certain sectors and others for others. For example there are pre-revenue sectors like mining or E&P which aren’t appropriately valued using P/E ratios or ROCE. There are though some mechanisms rolled into the way we compute the ranks which do counter for these issues - for example the ValueRank only includes the P/E if a company is profitable, otherwise it falls back on using revenue and asset value measures.

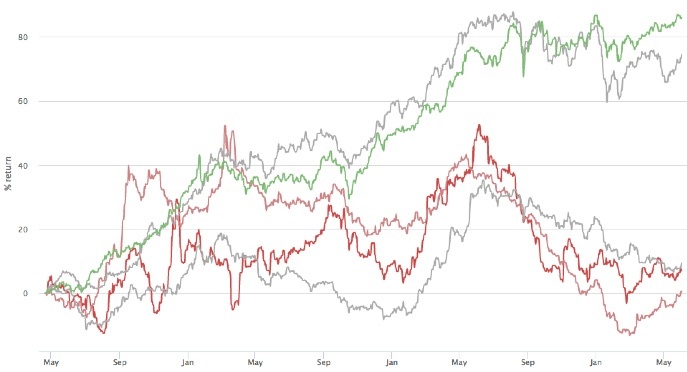

Regardless, I thought it worth having a look at how the 10 economic sectors we track have performed across the board in the UK in the 3 years since inception. I’ve used the StockRank Performance portal and chosen to use “quintile” buckets for each sector. This sorts each sector by StockRank - separating it into five tracked portfolio groupings with stocks ranked 80-100 in the green set, 60-80, 40-60 as ‘grey’ sets, and 0-20 and 20-40 as red and pink sets. Each of these tracked performances uses quarterly rebalancing of stocks above a £10m Market Cap in the UK.

Please note that due to the market cap cutoff, the lower ranking buckets can often have fewer stocks in them, thus being more volatile.

Let’s look at each sector in turn.

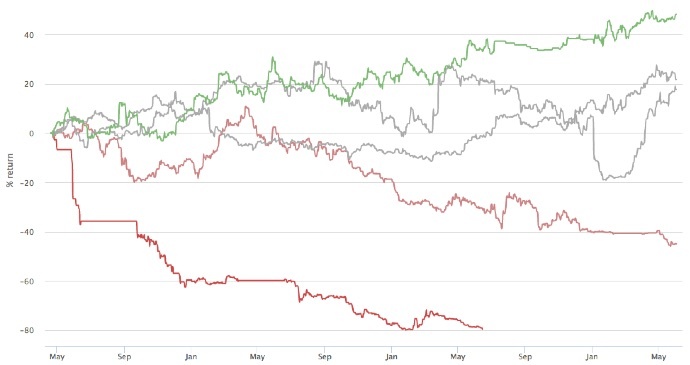

Energy Sector

Let's get the bad news out of the way first... it’s been a dismal run for the UK Energy Sector over the last 3 years. Even the top ranked set of shares has fallen about 38% in that time period. There’s not been much in it across the board. The lowest ranking shares haven’t done much worse. If there’s one sector where the StockRanks aren’t yet adding value - it’s in Energy. I’ll be interested to see what happens when the cycle turns.

Basic Materials Sector

The Basic Materials sector is quite a bit broader than the energy sector in scope. While some think of it as just…