Hi there,

for those who listened into my pitch last night (Wednesday 8 Sept.) for uranium miners' closed-end fund Geiger Counter (LON:GCL), here are my bullet points to recap my version of the investment case...

- Closed-end fund, run by CQS/New City Inv Mgmt. YES I own it!

- Market Cap £50m, price 50p

- Focused on CAD, AUD, USD, other quoted and unquoted uranium miners, thus very high risk.

Fund page can be found here - Only 2 main UK-listed uranium plays, Geiger Counter (LON:GCL) and Yellow Cake (LON:YCA) (not counting Berkeley Energia). US-listed ETFs include URA and URNM.

- Drivers for uranium:

- net zero carbon drive by US/EU/COP26,

- electric vehicle energy demand growth,

- utilities’ stockpiles running down,

- big geopolitical risk with Kazatomprom (in Kazakhstan) the biggest single world producer (21%),

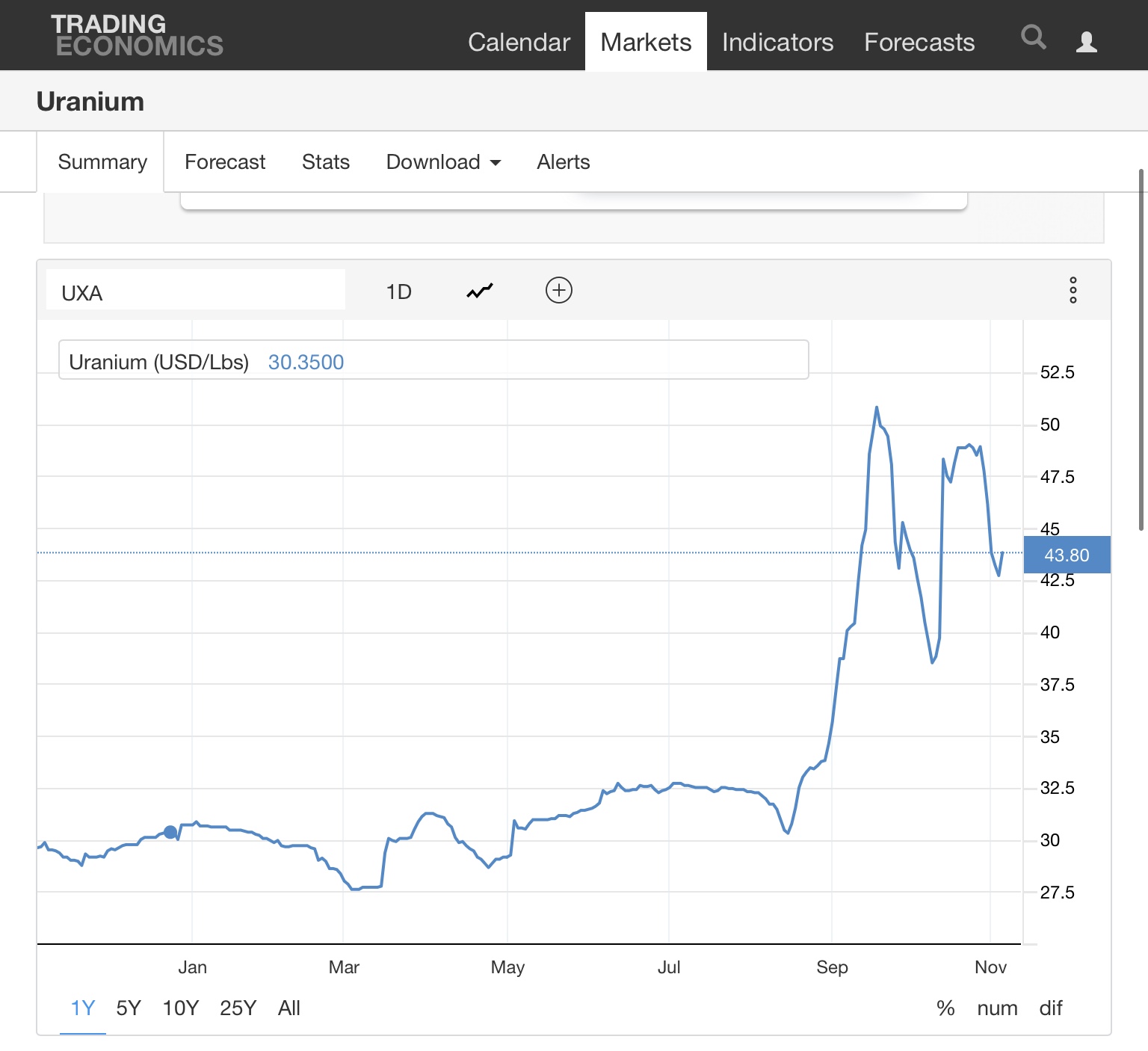

- Uranium oxide price at < $40/lb, v break even mining cost closer to $50/lb,

- supply from decommissioned warheads disappearing,

- new reactors coming online e.g. in India, China to satisfy growing electricity demand. Even Japan gradually bringing nuclear reactors back online - Catalyst = Demand/supply imbalance: YCA, Sporott Physical Uranium Trust (in Canada, up to $300m buying pressure), uranium miners all stockpiling uranium, creating a short squeeze for electric utilities

- GCL largest holdings:

- Nexgen Energy 23.5%,

- UR-Energy 7.6%,

- Sprott Physical Uranium Trust 7.6%,

- Isoenergy 6.9%. See factsheet for more details, or interim report for detailed breakdown.

- NAV driven by (mostly) quoted and unquoted uranium mining exposures; operational leverage to uranium spot price (early 2020 = $25/lb, now $40). Current premium to NAV c 5%

- Chart: recent breakout to 9-year high, next resistance 70p

Geiger Counter (in blue) v Uranium price (yellow) last 10 years