Building the world brain

Global investment opportunities abound and yet investors rarely leave their home market. Is it possible to conquer home bias and invest profitably in overseas companies?

Pooling our experiences can be a great time (and pain)-saver in terms of learning lessons. A lot can be gained from reading the conversations in the comments section of this recent home bias article, for example, where contributors discuss a variety of (equally valid) overseas investing strategies and pitfalls. There is useful information here for anybody interested in looking at different stock markets.

Stockopedia is an amazing platform for investors to share successful strategies. We should take advantage of this more.

We are now able to compare a broad array of portfolio strategies and stock screens instantly thanks to the internet. It’s quite a marvel if you stop to think about it. In the 1930’s, HG Wells wrote about the ‘World Brain’ - a sort of central repository for the sum of all human knowledge. Once, we might have called that fanciful. Today, we call it the internet.

What’s more, ‘linking up to the world brain’ does a better job of describing what we do when we go on Google or Wikipedia than ‘connecting to the internet’ ever could.

In this article, I’d like to riff a little on those previous conversations. If you have any insight or experience in this area please do share with others in the comments - help build this small corner of the world brain.

Exchanging currencies and dastardly broker fees

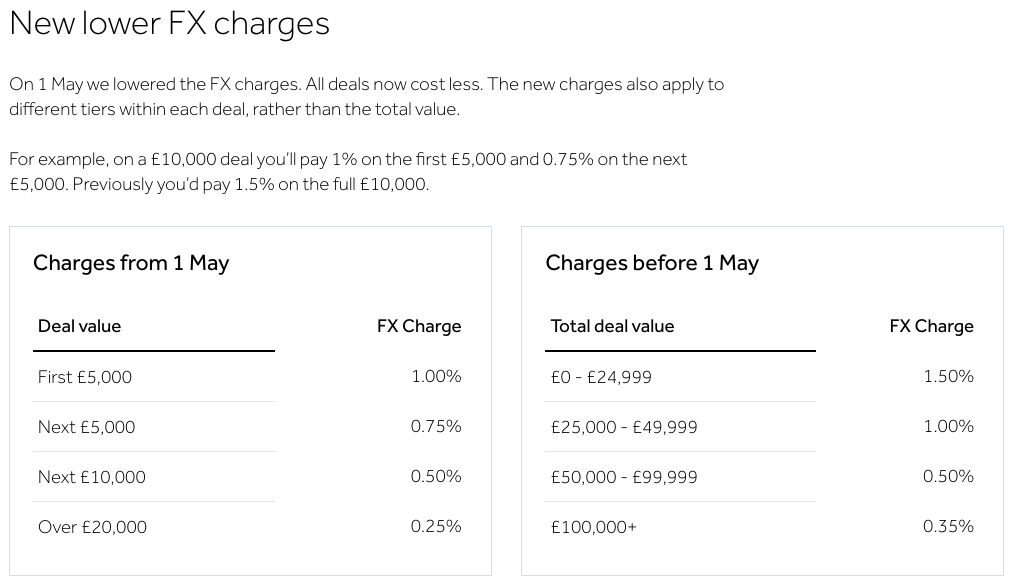

One recurring gripe investors have is the often excessive foreign exchange conversion costs levied by brokers on overseas trades in which they have to either convert domestic currency into foreign or vice versa.

These charges are currently at around 1-1.5% per overseas trade. What's more, many brokers convert the cash back into your home currency once you sell those shares, doubling the fee. Ouch. This makes short-term trades and rebalancing strategies tricky. For those seeking longer-term buy-and-hold investments, it might be less of a big deal.

Some brokers do allow you to hold foreign currencies. This is one thing to ask for if you intend to start dealing in different markets.

As one contributor pointed out, it can make more sense to convert money and transfer it overseas to a local broker. This does add another layer of…

.jpg)