Big cap mining stocks have been among the biggest fallers in the FTSE 350 so far this year. That’s not entirely surprising after last year’s gains, which saw the value of FTSE 100 giants Rio Tinto and BHP Billiton double in twelve months. Smaller companies delivered even bigger gains.

Some reaction was always likely, especially as the first part of the year has also seen the price of iron ore and coal fall. However, the big miners remain among the top-ranked stocks in the Stockopedia universe.

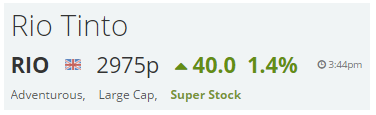

Rio Tinto is a case in point. With a StockRank of 98, Stockopedia’s new rating system classifies it as Adventurous and a Super Stock.

If you haven’t already checked out Stockopedia’s excellent new rating system, then I recommend you do now. There are two parts to the new classifications -- the RiskRatings (e.g. Adventurous) and the StockRank Styles (e.g. Super Stock).

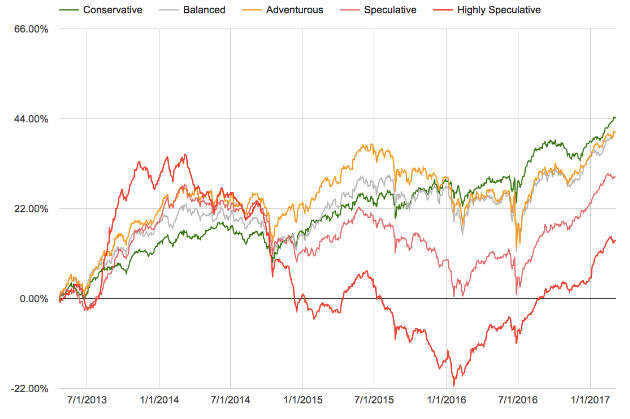

Super Stocks are statistically most likely to outperform, according to Stockopedia’s historic data:

Adventurous stocks also tend to do well:

So in my view, it’s worth paying attention when a stock ranks this highly and falls into your potential buying universe.

This week’s new screen stock

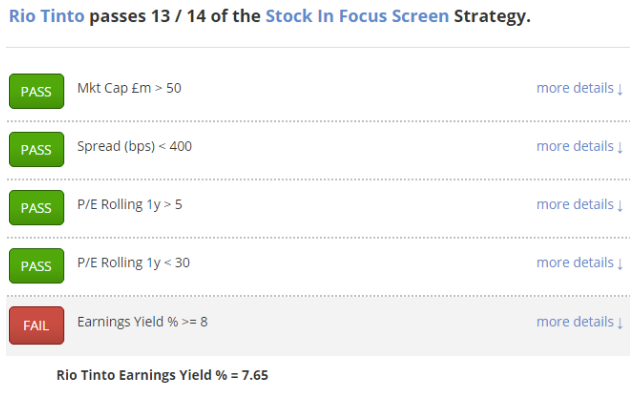

If you pay close attention to the stocks that qualify for the Stock in Focus screen, you may be about to point out that Rio Tinto doesn’t currently qualify for the screen. Technically, you’d be right. Rio fails the screen checklist on one count:

Earnings yield is a metric that was popular with US value investor Joel Greenblatt, who defined it as EBIT/EV in his excellent book, The Little Book That Beats The Market. I like earnings yield a lot because it offers a combined snapshot of profitability and valuation, factoring in both equity and debt capital.

In this case, we can see that Rio Tinto’s earnings yield is tantalisingly close to my screening threshold of 8%. So I decided to take a closer look. I stuck with Stockopedia’s enterprise value of £65.15bn, but I used Rio’s reported operating profit from last year of $6,795m in place of the Thomson Reuters datafeed figure of $6,471m. Doing this gives an earnings yield of 8.1%.

Having tweaked the numbers to allow Rio Tinto to qualify for the SIF portfolio, should I…