.

Hi Shine,

That £70 is average, some are £150 some £40 (for example)

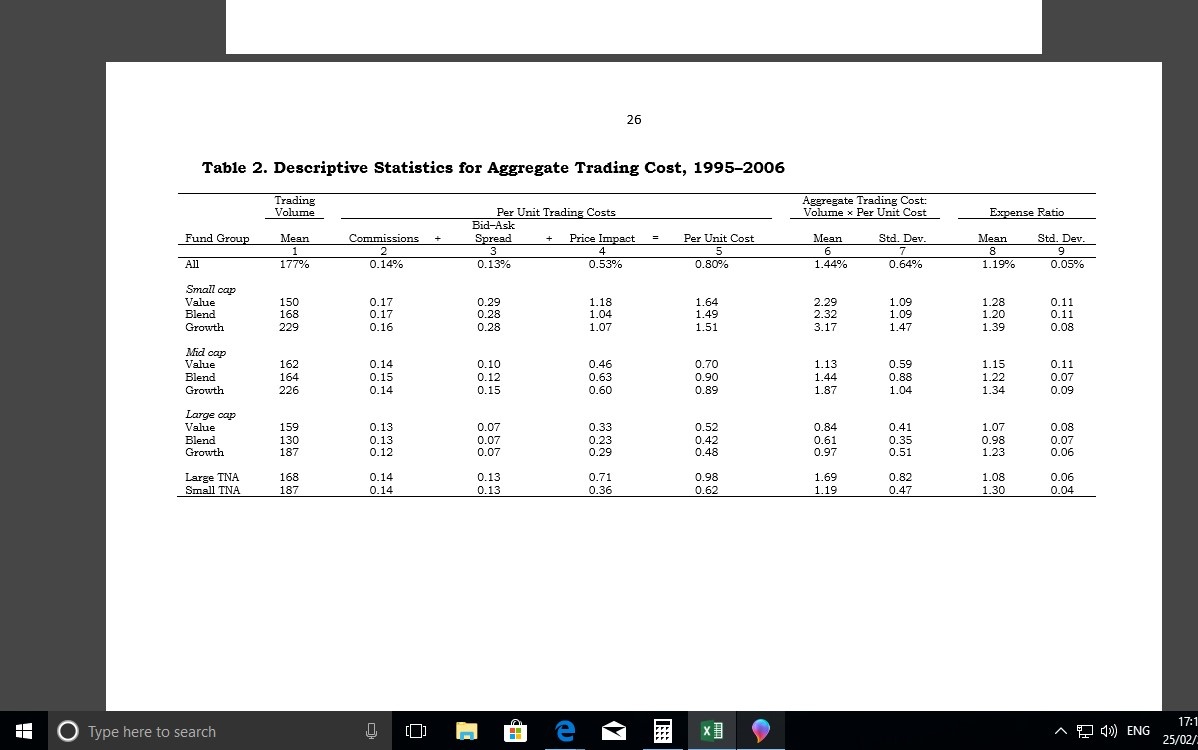

Commission is 0.10% which is £10 each trade - So £20 Open & Close.

The spreads as disclosed by the stocko reports range from 0.02% upto 1% for the smaller caps.

Does that make sense?

The UK spreads are however more, but the volume lies with the US market.

.jpg)