Successful trading is about helping yourself and putting the ‘odds’ on your side. In part 23 we looked at strategy, design and implementation. This week, we’re going to take a brief look at an often forgotten and overlooked use of technical analysis: Risk & Trade Management. If you are a raw fundamentalist, or don’t want to use technical analysis to make trading execution decisions, that’s fine, but I think you’re being foolish if you don’t consider using technical analysis to improve your risk & trade management processes.

As we’ve learnt over the previous 23 articles, technical analysis is great as it can:

Make and save you money

Save you lots of time

Help you deal with the psychological aspects of trading

Create discipline

Be simple to understand and apply

We now know how technical analysis could help you with strategy design, but is is also a very strong tool to help you in the world of risk. It gives you a set of rules, ie. fixed and objective parameters around which to trade, which in turn, creates the psychological discipline you need in your trading.

Many people go into trading blind – no rules, plans, strategy and especially no risk & trade management concepts to deploy. That’s why so many lose at trading.

Money management & Risk reward

On top of developing a strategy with a mathematical edge, you also need to address money management – this is as important as your trading system. You can use technical analysis to control the risks in your portfolio and individual trades. For example, you can use moving averages or an oscillator as a tool to get you ‘automatically’ out of a losing trade. This takes away a lot of the psychological pressure of trading. You can also use technical analysis tools to calculate the risk reward on any potential trade idea you have:

Risk Reward

Is it worth executing a trade?

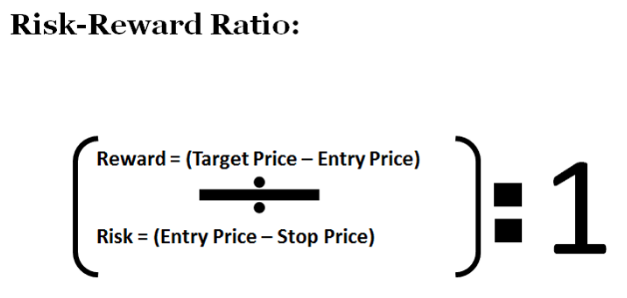

Only if the risk reward is in your favour. How do you calculate?

The risk/reward inputs can be defined much more simply and clearly by using technical analysis.

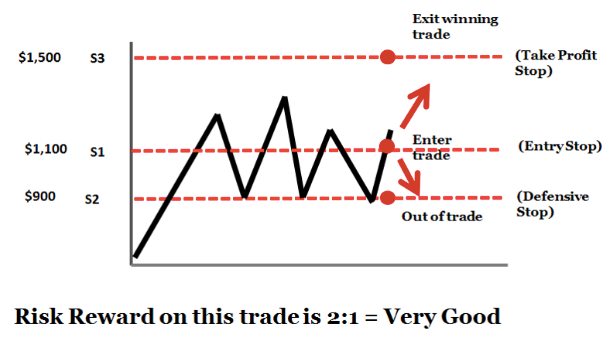

Gold Example

A risk reward > 2:1 is very good. Mathematically you’d need an edge >50% to your strategy if your ratio was 1:1.

From the example you can see that technical analysis can help define the inputs:

Let’s take a look at a real world…