In the previous article, I looked at what went right and what went wrong for my watchlist in 2025.

So without further ado, here is my watchlist for 2026.

Again, please note I'm not going into detail here - I endeavour to do that in the daily report!

1. PayPoint (LON:PAY)

The worst-performing share in my watchlist in 2025, I’m going to give it another chance.

Don't try this at home! This is a very contrarian pick - and the share is indeed categorised as Contrarian by Stockopedia’s algorithms. But I can’t resist it at this valuation, especially as it's buying its own shares.

However, to demonstrate that I’m not going to be completely pig-headed about the badly-performing shares from my 2025 list, I’m going to remove Impax Asset Management (LON:IPX) (in which I have a long position) from the watchlist.

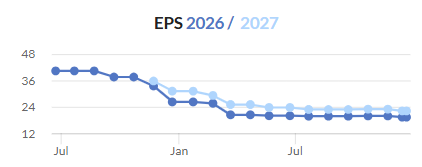

There are at least two good reasons for this. Firstly, the company’s EPS forecasts have genuinely been decimated by falling AUM.

But perhaps more importantly, I already have two other fund managers - Mercia Asset Management (LON:MERC) and Polar Capital Holdings (LON:POLR) - and I think this level of sector concentration is not really necessary for what I’m trying to achieve with this watchlist. So Impax Asset Management (LON:IPX) is out.

2. Nichols (LON:NICL)

This Vimto maker might be the least exciting stock in the watchlist, but I like to have a boring, high-quality anchor. I also don’t want to “sell” it out of the watchlist at a moment when it offers more value than it usually does (it's usually .

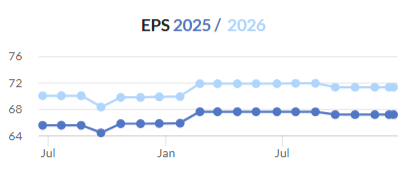

And it’s not as if it has been failing to maintain its earnings forecasts:

3. Peel Hunt (LON:PEEL)

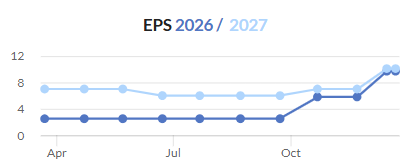

As noted in the 2025 review article, I don’t understand why the market is treating this so suspiciously. Profits in H1 were enormous relative to forecasts (more than 100% of the full-year forecast was already achieved!) and the estimates in the market are struggling to keep up:

I don’t think this one is priced correctly, so it’s staying on my watchlist.

4. Mercia Asset Management (LON:MERC)

Impax is out, but I’m leaving…