To read the introduction, see July’s article here. Aug monthly update here.

Do leave me a comment with your thoughts; I'd love to hear your views on any overlap holdings, or your views on the market and interesting shares!

(Part Time) Fund Manager’s Report

Another slightly negative month, although this time both portfolios have done better than the FTSE All-Share benchmark (-2%). And when compared to AIM100 (-5%), my ISA has done pretty well, despite all the shares in there being AIM listed.

Still, two negative months in a row is frustrating. I know I shouldn’t feel that way and instead feel relief that at least in September I’ve outperformed the benchmarks. But a red number still has this primal psychological effect on me, that I have lost.

In the ISA, I have been disappointed that it hasn’t done better, despite positive statements from Appreciate, Begbies Traynor, and the announcement of a potential bid for French Connection. Still, I have been reassured by the positive updates and decided to continue to hold for further upside Sosandar and System1 have been the performance drags; but I’m looking forward to a positive trading update from Sosandar soon. And on System1, the price is now low enough that I am looking to top up if it gets any lower. My continuing monitoring of both businesses show they are still in rude health, so I see no reason they will not announce positive trading updates shortly.

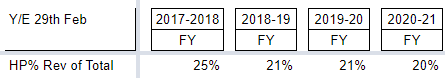

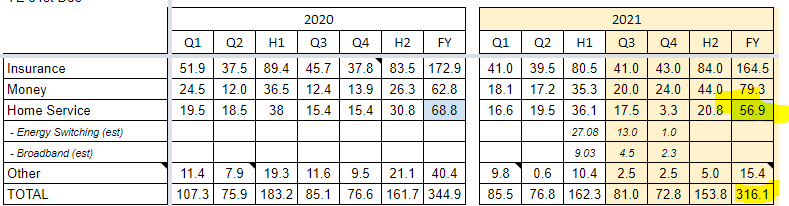

Looking at Appreciate (LON:APP) , it seems like the business is accelerating and in rude health compared to pre-COVID. "Billings" (which are sales of gift cards and vouchers) are up +14.6% in Q2 (Jul-Sep) compared to the same period in FY20 (Jul-Sep 2019, pre-COVID). Appreciate only recognise revenues when the cards/vouchers are redeemed, so this is like an "order book" that will translate to revenues and profits in the next 6-12 months. There are tough comparatives in Q3 coming ahead, as last December, companies replaced xmas parties with gift vouchers. But IMO, as outlined in my July Report, I think there are some key structural drivers that will see increased revenues and profits in the next 3 months. In addition, there is likely to be a shortage of all kinds of in-demand Christmas gifts (toys, electronics, etc) and a lot of people might then give a gift card instead, so the…