It's remarkable in this day and age of high technology and the millions thrown at polls that nobody called this election right. When it came to the crunch England voted resoundingly against uncertainty and for a continuation of the Conservative economic plan. Unsurprisingly the investment community is looking relieved with sterling and stock markets rallying.

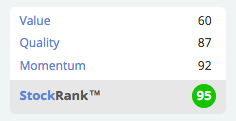

With fuzzy heads after lots of late night channel switching we've had a look at which stocks are winning in the immediate election aftermath. The FTSE 250 mid-caps have stomped to new highs and amongst them are some big moves in high StockRank “conservative" winners.

There are many areas of the market that might continue to prosper in the more stable tax & regulatory environment - we've highlighted a few of the more interesting movers for subscribers below.

Housebuilders

In coalition, the Conservative and Lib Dem government put in place policies that were designed to stimulate the housing market including the original Help to Buy scheme and, latterly, the Help to Buy ISA. These, along with the low interest rate environment and ongoing green belt review, proved to be a massive boost for most of the country's main housebuilders, including Persimmon, Bellway and Barratt Developments, with Barratt seeing its share price rise by 350% over the past five years.

Many housebuilders continue to command high StockRanks, including Persimmon (99), Bellway (91), Bovis Homes (97) and Taylor Wimpey (93). Among the big initial winners in the aftermath of the election result were Berkley Group, up 9.3%, Bellway, up 6.5%, Redrow, up 5.5%, Persimmon, up 5.5% and Crest Nicholson, up 5.1%. You can see Stockopedia's full Homebuilders Sector page here.

At the UK Investor Show Bellway was one of Mark Slater's top picks while Berkeley Group made the cut in Ed Croft's presentation as one of the top five Value & Momentum Ranked stocks in the UK market.

Gambling

Shares in bookies like Ladbrokes and William Hill took a hit earlier this year when Labour announced that it would give councils the freedom to ban high stakes gaming machines. These, of course, are a huge profit source for traditional high street betting shops. So with a…

.JPG)