European stock markets have been on a tear since the turn of 2015. With central bank bond-buying under way and a strengthening dollar putting pressure on US companies, European shares have become la coqueluche du moment. But with apparently rich pickings for investors prepared to look beyond their home borders, where do you start looking for opportunities?

One answer could lie in some of the patterns we’re seeing in our European screening strategies this year. With the FTSEurofirst 300 index up by a blistering 18% over the past 12 months, it’s the Growth strategies have generally got closest to matching those gains performance.

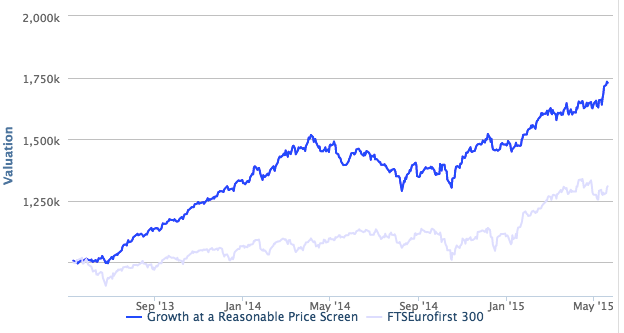

Together they’ve generated an aggregate return of 13.8% - but there have been some standout performances. Among them are Charles Kirkpatrick Growth, up 25.7%, Growth at a Reasonable Price (GARP), up 24%, and the Robbie Burns-inspired Naked Trader screen, up 19.3%. As this chart shows, the GARP screen has delivered some strong returns in Europe since we began tracking it two years ago - and the chart has broken out again in May.

Chasing European growth shares

Another way of studying growth in Europe is to consider the GrowthRank. This is Stockopedia’s scoring and ranking system for companies based largely on their historic and forecast sales and earnings growth (you can read more about it here).

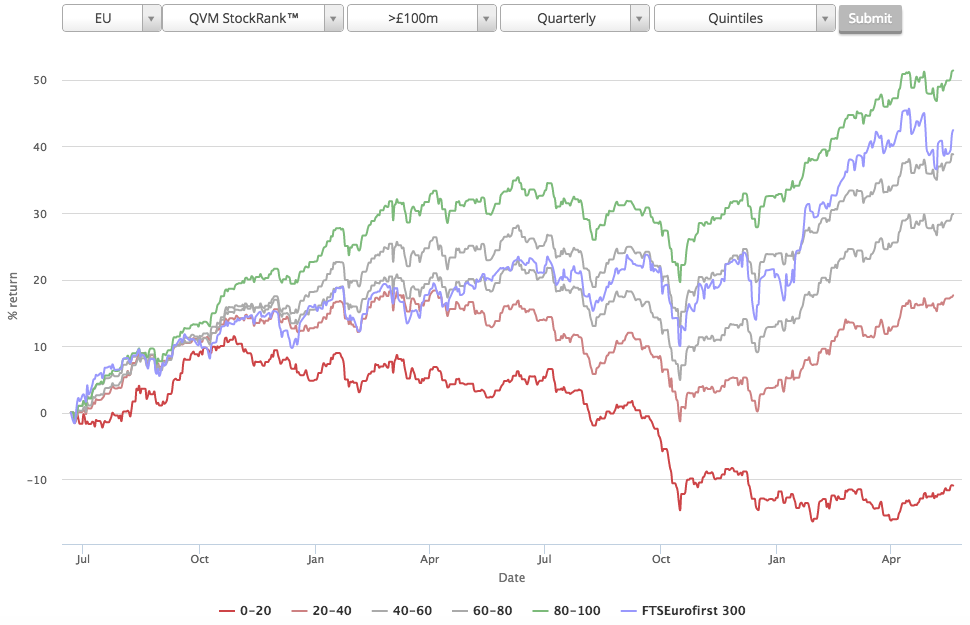

In a little under two years, a quarterly rebalanced portfolio of £100m+ European stocks with a GrowthRank of more than 80 out of 100 has produced a 38.5% return. That’s not a bad performance. But it does fall short of the same basket equivalent of top ranking StockRank shares, which returned 51% over the same period. While the StockRanks do of course, focus on quality, value and momentum and exclude the Growth Rank, Ed has shown that the top QVM stocks have extremely high growth rates.

With all this in mind we set up a screen to look for the very highest GrowthRank shares in Europe to pick out those with the best historic and forecast growth rates. For added detail, we sorted that list for those with the highest StockRanks. Subscribers can see the screen here.

| Name | Mkt Cap £m | Growth Rank | Stock Rank™ |

Unlock the rest of this article with a 14 day trialAlready have an account? 0 comments |