Last week’s article about the top 20 clearest trending small caps generated a great deal of discussion. Buying strong momentum stocks is just so hard to do. It goes against our fibre. But what is great about this community is that we all learn from each other. Reading a comment like this perhaps gives others courage.

From a behavioural point of view it’s just so hard to jump in after a strong run, yet every time I’ve summoned up the courage to do so it has seemed to work out.

More than this, I discovered several research papers from you all that have inspired me to push some of my research deeper. I am going to run a webinar in a few weeks, and it’s likely these momentum investigations will feature prominently. So thanks for all the feedback and do look out for the invitation.

Several of you asked if I could create a similar list of smooth trending mid-caps. While small-caps are so often the focus of private investors, as they are so under-researched, mid-caps have been the powerhouse of UK markets for decades. While Brexit put a stall on the FTSE 250 more recently, it’s still returned 5.6% annualised since 1996 with a yield (currently) of 3.4% on top. Mid-caps have lower volatility, and often more consistent returns.

The performance of smooth-trending mid-caps

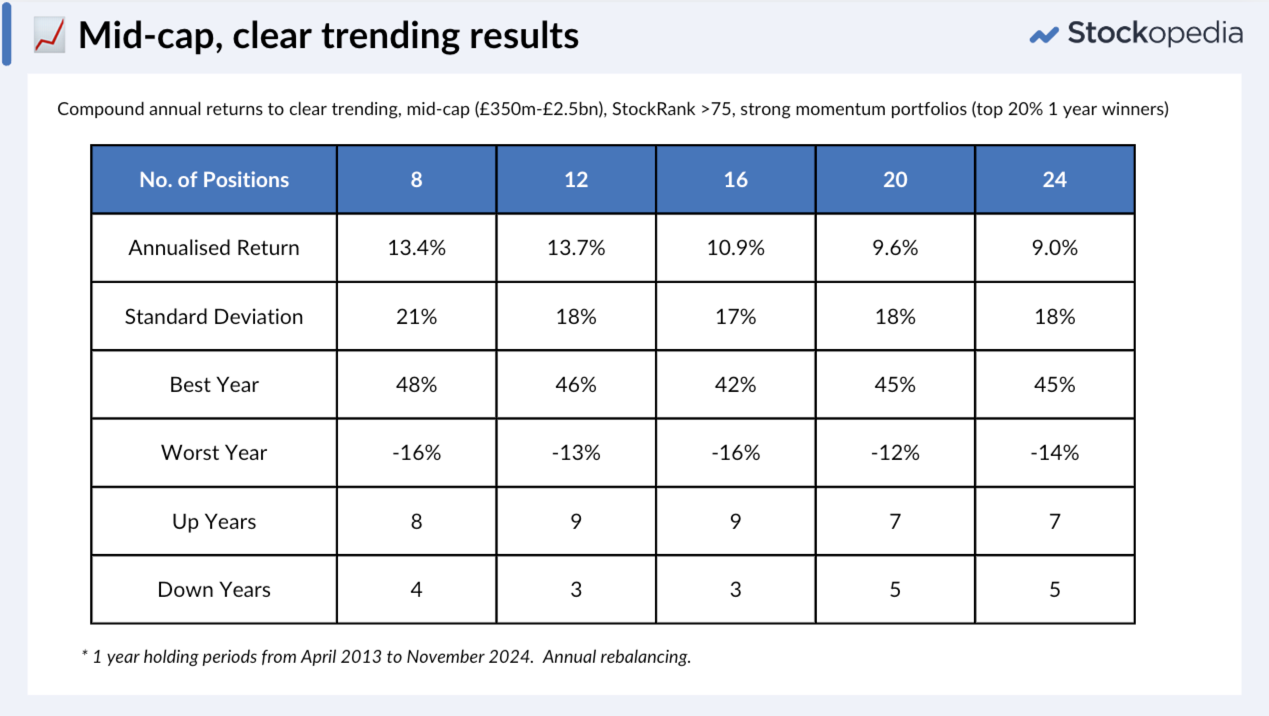

To analyse the performance of mid-caps, I’m using the same approach as last week. We’ve a growing archive of financial data that goes back to 2013 in the UK, which is proving more and more useful for research. So I’ve interrogated it for the following criteria:

- Market Cap - between £350m and £2,500m - which is our “Mid-Cap” Size Group.

- StockRank at least 75.

- Stocks among the top 20% price risers over previous 12 months.

- Sorted by trend clarity. (using the r-squared as before)

I tested these rules on a range of portfolio sizes since April 2013. You can see the results below.

These results are quite startling from a few angles.

- Firstly, the best returns came from the more concentrated portfolios without much additional risk.

- If you compare the risk to the small cap backtests, one has to wonder if chasing small-cap trends is worth it. The standard deviation averages about 18% in this set, while the small-cap list was at…